Warren Buffett,1 the Oracle of Omaha has done a lot of things right. When he makes a move, many investors follow the smart money.For example, he turned $230 million into $8 billion with BYD,2 China’s EV powerhouse.

In January 2023, his company made a bold move. Berkshire Hathaway closed an $8.2 billion acquisition 3 in another EV related deal.

Come December 2023, the spotlight’s now on California’s Salton Sea. A lucrative discovery beneath its waters – a lithium deposit worth $540 billion4.

The real challenge, however, lies in the extraction.

But of course, Buffett’s Berkshire Hathaway Energy Co. is right there, with ten geothermal facilities5 looking to find a way to extract the lithium from the sea.

His approach is clear – he’s a first mover, always ahead in the race to where the money will be. And in this case, now it’s all about lithium extraction, the heart of the EV boom.

No lithium extraction = No batteries = No EVs.

And thanks to a recent discovery at the University of Liverpool that has the ability to significantly speed up EV battery charging, EV adoption could hit high speed.

In short, we need more lithium ASAP.

This is where Direct Lithium Extraction technology (DLE) comes into play. It’s a revolutionary method that outperforms the traditional salt brine process, both in efficiency and time.

Breaking News

Now, gaze north to Alberta, Canada. Here, a company named E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is quietly revolutionizing lithium extraction.

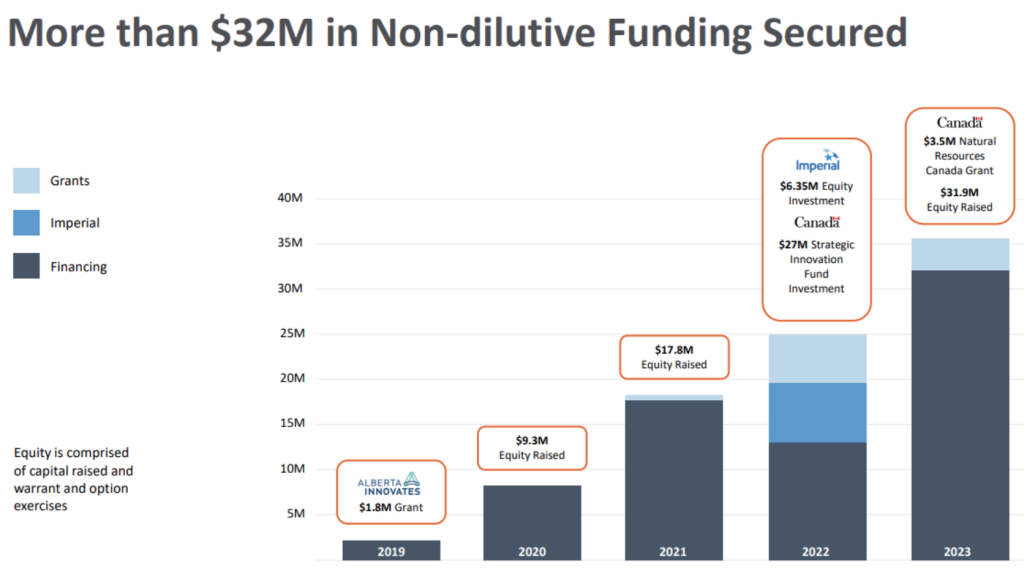

Their pilot plant’s results are turning heads. With more thanC$32 million in government support, including a C$1.8 million grant from Alberta Innovates and over C$30 million in additional funding raised in 2023, E3 Lithium is primed to make major waves in the space in 2024.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is quickly becoming a company to watch, as it moves closer to full production capability.

What No One Told You About Lithium Extraction

Lithium. It’s the heart of the electric vehicle (EV) revolution.

But there’s a problem…

North America. It’s rich in lithium deposits, but poor in production. Right now, the United States produces less than 2% of the world’s annual supply.6

The only producing mine in the country, Nevada’s Silver Peak is only producing a modest 5,000 tons a year7. A drop in the global demand ocean.

New mines? They face hurdles. Environmental lawsuits.8 Bankruptcies.9 No clear path to production. Several states, from California to North Carolina, are stuck.

But the biggest challenge of all is extracting this white gold.

Take the Salton Sea discovery in Lithium Valley. It’s so significant it could meet all of America’s lithium needs and 40% of the world’s demand.10

But environmental concerns and water usage questions are being raised, particularly their potential effects on the Colorado River’s supply. 11

The fact is, whether being mined in an open pit or evaporation ponds, lithium extraction can take a major toll on surrounding agriculture.

Fortunately, Lithium Valley has become an attractive location for major energy companies exploring advanced mining techniques to solve these problems, especially a process known as Direct Lithium Extraction (DLE).

DLE offers a much more eco-friendly approach to lithium mining, eliminating the need for resource-intensive practices that produce chemical waste and worsen climate change.

There’s a reason Goldman Sachs is calling DLE a “game-changing technology” that could accelerate lithium extraction and increase recovery rates. 12

Up North in Canada, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is spearheading this revolutionary advancement in lithium extraction and is on the fast track to commercial production following impressive results from its field pilot plant.

North America faces a pressing need for more lithium refineries to compete with China’s current market dominance if it hopes to increase domestic battery supply.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has emerged as a hopeful contender in changing this landscape and is on track to become one of Canada’s first producers utilizing groundbreaking DLE technology to extract lithium from brine.

Recognizing lithium’s pivotal role in the booming EV market, the Biden administration has committed over $135 billion to foster EV technologies,13

That includes a $90 million agreement with the Department of Defense to expand domestic lithium mining for US Battery Supply Chains.14

This investment aligns with burgeoning demand for EVs and positions the US as a significant player in lithium production.

Canada just increased its EV commitment, announcing new regulations that require all new vehicles to be zero emissions by 2035.15

The Canadian and provincial governments are also putting money into securing domestic supply, including over C$32 million into E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) and its massive resource.16,17

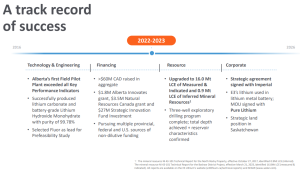

E3 Lithium had an epic year, knocking down milestone after milestone in 2023 on its accelerated path to commercialization, and 2024 is shaping up to be another big year.

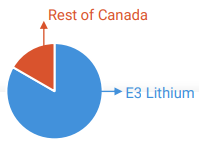

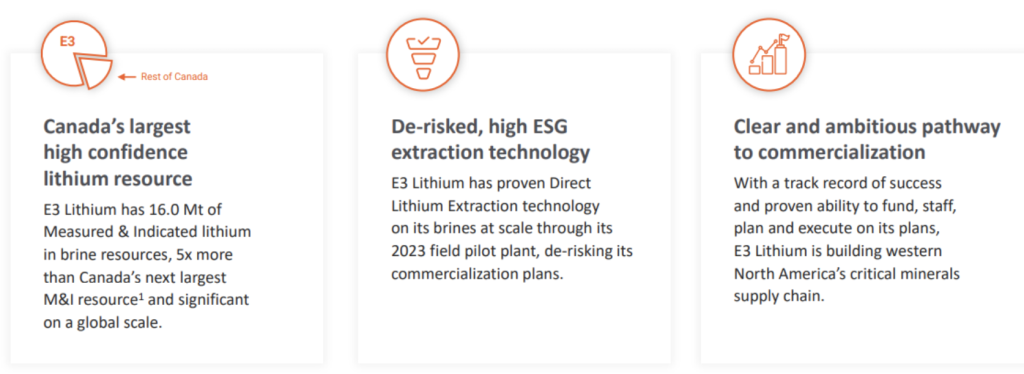

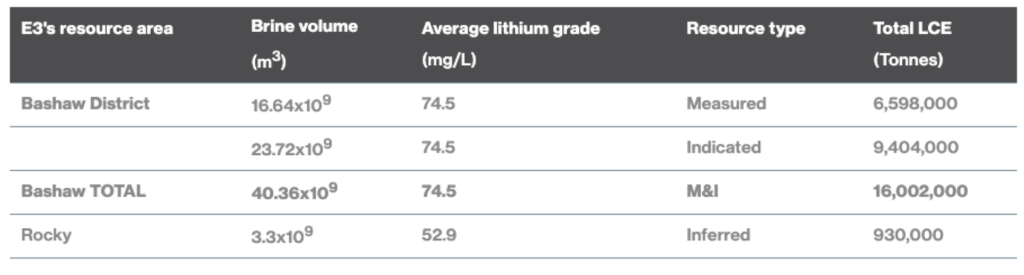

First the company upgraded its Alberta-based lithium resource to an impressive 16.0 million tonnes (Mt) of Measured and Indicated (M&I) lithium carbonate equivalent (LCE).This upgrade makes E3’s property the largest M&I lithium resource in all of Canada,18 5X more than Canada’s other M&I resource.

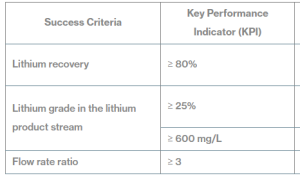

Next, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) built and operated its Direct Lithium Extraction field pilot plant, exceeding all KPIs for lithium concentration, contaminant rejection and flow rates.

Then, E3 successfully produced battery-quality lithium hydroxide monohydrate (LHM) with a purity level of 99.78%.19

In short, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has been on a serious roll and is showing no signs of slowing.

The company just rolled out its 2024 plan to advance the Clearwater Project towards commercial operations which includes huge milestones like progressing engineering studies, advancing commercial permitting, completing a Pre-Feasibility Study (PFS) and releasing the NI 43-101 report.

Now, let’s take a look at some of the reasons why E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has garnered so much attention.

7 Reasons

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) May Be a Lithium Production Game Changer

1

Lithium Market is Booming: Thanks to surging demand for EVs and lithium-ion batteries for tech, the world is scrambling for lithium supply, with structural shortages in the lithium market for years to come.

2

Major Inflection Point Reached: E3 Lithium successfully produced 99.78% pure battery quality Lithium Hydroxide Monohydrate (LHM).

3

Flagship Asset with Globally Significant Resource: With 16 Mt of Measured and Indicated (M&I) LCE on the books, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has the largest M&I LCE resource in Canada. This only entails about 70% of the company’s entire permit area.

4

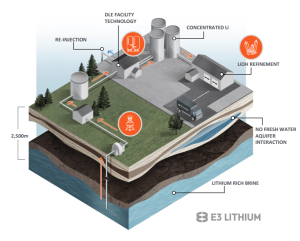

ESG-Friendly Process: 100% brine aquifer reinjection and a small land footprint makes the company’s DLE process a potential monumental game changer in the lithium space.

5

Well-Funded: E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has received over C$32 million in non-dilutive investments from the Province of Alberta and the Government of Canada,21,22 The company has also raised close to C$30 million in the capital markets in 2023 alone.

6

World-Class Jurisdiction: Within industry-friendly Alberta, E3 Lithium is capitalizing on the famous “Alberta Advantage”, with over 600,000 hectares of brine permits in an area where 4,000 oil and gas wells have already been drilled to date.23

7

Strong Leadership Team: Proven team with over 150 years of combined experience in emerging technologies, finance, mining, petroleum and unconventional resource plays, including Peter Ratzlaff, who has 30 years of experience in engineering and production/operations at companies like ConocoPhillips and Independent director Kevin Stashin, a 40-year oil and gas industry vet with experience at companies like Devon Canada Corp, Anderson Exploration, and Petro-Canada.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) Gearing Up For Commercial Production in 2026

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is setting a new standard in the lithium production landscape as it targets commercial production in 2026.

Diverging from traditional methods like evaporation ponds or hard rock mining used by companies like Albemarle and Lithium Americas, E3 Lithium leverages Direct Lithium Extraction (DLE) technology.

According to a 2023 report from Goldman Sachs:

“Direct Lithium Extraction (DLE) has the potential to significantly impact the lithium industry, with implementation on the extraction of lithium brines potentially revolutionary to production/capacity, timing, and environmental impacts/permitting.”24

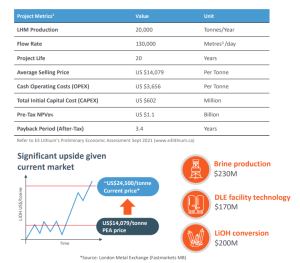

This technology, along with E3’s large resource base and strategic location, is highlighted in their Preliminary Economic Assessment (PEA)25 for its Clearwater Project area in Alberta, suggesting an advantageous position for lithium development.

Not to mention, E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) resource is among the Top 4 LCE Resources in the World.26

In total, E3’s Resources cover just 69% of the Company’s permit area in south-central Alberta.

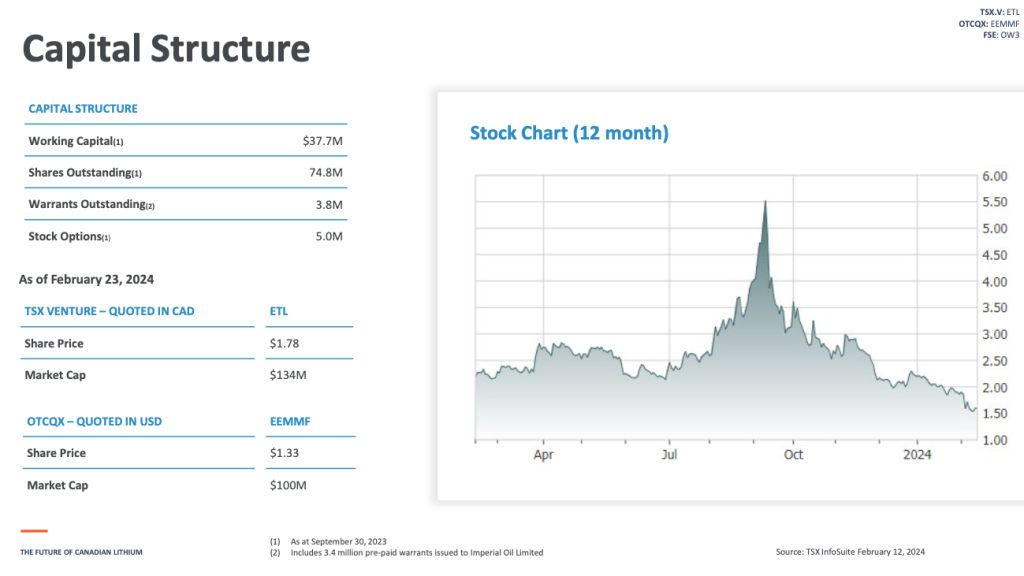

But what makes their Resource really stand out, is how it’s somehow flying under the radar of the market.

How so?

Well, for starters, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is aiming for production as soon as 2026. That puts it on the same schedule as Lithium America’s Thacker Pass chemical processing plant’s go-live date.27

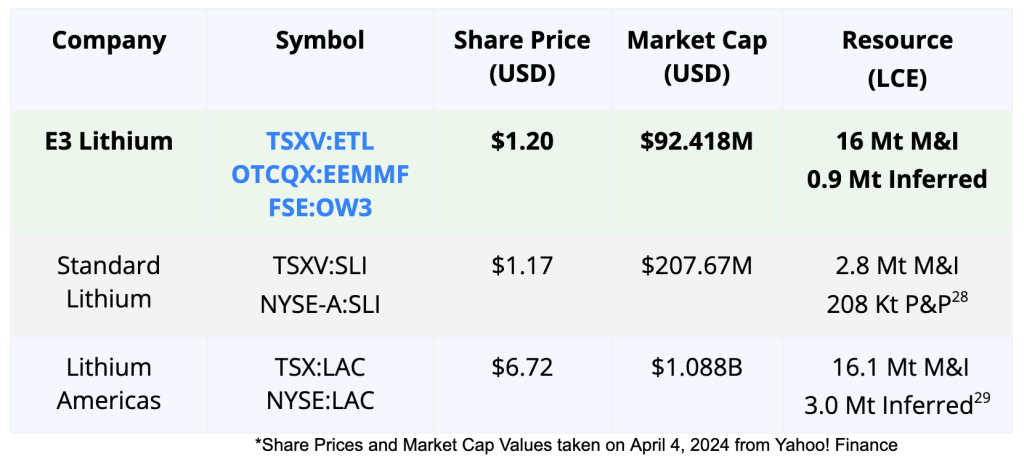

It’s worth noting that both Lithium America’s Thacker Pass and E3’s Clearwater Project have similar resource sizes; with 16.1 Mt and 16.0 Mt respectively in the Measured & Indicated category.

Press Releases

- E3 Lithium Announces Upcoming Schedule For Conferences And Presentations

- E3 Lithium’s Collaborations with Two Universities Receive Federal NSERC Funding

- E3 Lithium Receives Final Alberta Innovates Payment, Successfully Completing Its $1.8M Grant

- E3 Lithium Announces Expansion Of Team And Presentations At Upcoming Conferences

- E3 Lithium Welcomes Former Alberta Energy Minister, Hon. Sonya Savage, to its Board of Directors

Meanwhile, the market is also giving attention to Standard Lithium’s flagship Smackover Projects located in Southern Arkansas near the Louisiana border.

Much like E3’s Clearwater, the Smackover Projects are set to use a fully integrated, start to finish, DLE process.

E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) Direct Lithium Extraction (DLE) process offers significant advantages over conventional methods. This efficient process recovers lithium in minutes instead of months, drastically reducing the time for production.

All the while, the market is giving E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) a valuation that’s significantly lower than both Standard Lithium and Lithium Americas.

But as E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) works its way towards production, the market will have no choice but to pay closer attention to this exciting company.

And to sweeten the pot further, E3 has a clean share structure and strong funding, having received over C$32 million in government grants and raising close to C$30 million in 2023.

Additionally, a significant investment of $6.35M from Imperial Oil (Canada’s second largest oil company, and majority-owned by ExxonMobil) into E3’s pilot project in Alberta’s Leduc oilfield further strengthens their standing.

E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) unique approach and solid financial backing distinctly position it in the competitive lithium market, poised for success as it approaches its commercial production phase.

Clearwater’s Significant Money-Making Potential

E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) Clearwater project isn’t just impressive in scale, it’s progressing steadily along the milestones to commercialization.

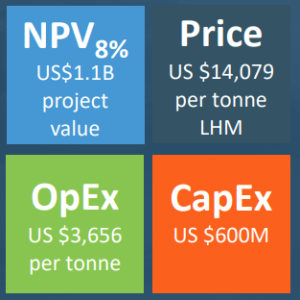

According to its Preliminary Economic Assessment (PEA), E3’s Clearwater project showcases its high financial potential with an NPV 8% of US$1.1 billion pre-taxes and US$820 million post-taxes.

It also boasts a remarkable Internal Rate of Return (IRR) of 32% before taxes and 27% after taxes, underlining the project’s robust economic prospects.

Looking ahead, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is focused on completing a comprehensive Pre-Feasibility Study (PFS) by the end of the year, which will outline detailed plans for its first commercial facility. The completion of the PFS is a critical step towards the realization of commercial production.

Following the PFS, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) plans an exhaustive Feasibility Study (FS), obtaining all necessary regulatory approvals, and securing project finance arrangements.

These steps are crucial for the construction of its pioneering commercial facility in Alberta, which when in operation is surely set to transform the lithium production landscape.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is advancing beyond mere lithium extraction. It aims to redefine industry standards, fuel sustainable energy advancements, and catalyze Alberta’s economic progress.

With its pioneering approach and meticulous planning, E3 Lithium is on track to emerge as a key player in the global lithium market.

Breakthrough Direct Lithium Extraction Technology

In the heart of Canada’s petroleum landscape in the province of Alberta, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is redefining the future of lithium production with the results from field testing ground-breaking Direct Lithium Extraction (DLE) technology.

DLE utilizes a proprietary sorbent, designed to be highly selective towards lithium ions, ensuring an efficient and effective extraction process.

DLE technology has been rigorously tested at E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) pilot plant within the Clearwater Project Area. Here, the company has achieved remarkable milestones, significantly advancing the lithium extraction process.

In November, the completion of the project’s field pilot test was a pivotal moment30, demonstrating E3 Lithium’s capability to unlock the true value of its lithium resources. This milestone significantly de-risks the commercial design and sets a solid foundation for future developments.

One of the most impressive outcomes achieved at E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) field pilot plant, which came from one test run, include:31

-

-

- 94% lithium recovery

- 80.1% and 909.0 mg/L lithium grade in the lithium product stream

- Flow rate ratio of 9

-

The company measured the success of the field pilot plant against the KPIs below, outlining their significance:

In addition to these technical achievements, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has produced 99.78% pure battery-quality lithium.32 This level of purity is critical for the high demands of the battery industry and showcases E3 Lithium’s commitment to delivering top-tier products.

E3 Lithium is also strengthening its position through strategic partnerships. The company has collaborated with top-tier equipment vendors to refine its advanced processes for full-scale commercial operation. Furthermore, industry powerhouse Fluor has been enlisted to lead the Pre-Feasibility Study (PFS) for the commercial project, ensuring that every step towards commercialization is guided by expertise and innovation.33

In a significant collaboration, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) partnered with Pure Lithium to create a successful lithium metal battery using lithium from its resources. This collaboration is not just about producing lithium; it’s about demonstrating the practical application of their product. The ongoing series of tests will define how their technologies can be combined to produce a commercially viable production process for lithium metal batteries and electrodes.

In the News

- ‘Game-Changing’ Tech Could Disrupt Lithium Extraction Market – StreetWise Reports

- Exxon aims to become a top lithium producer for electric vehicles with Arkansas drill operation – CNBC

- E3 to Test Whether it Can Get Lithium From Abandoned Oil Fields in First for Canada – Financial Post Speaks to E3 Lithium’s Progression

- Lithium Players Race for Breakthrough to Meet Electric Car Demand – Another Bloomberg Feature for E3 Lithium

E3 Lithium’s advancement in DLE technology, combined with its strategic location in Alberta, marks a new era in lithium production. The company’s innovative approach, backed by strong partnerships and technical excellence, sets it on a path to becoming a leading name in the global lithium market.

With these achievements, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is not just extracting lithium; it is shaping the future of energy.

RECAP: 7 Reasons

To Admire E3 Lithium’s Vision

1

Lithium Market Boom: High demand for EVs and tech batteries leads to lithium shortage.

2

Pure Lithium Hydroxide Production: E3 Lithium achieved 99.78% purity in Lithium Hydroxide Monohydrate.

3

Significant Lithium Resource: Canada’s largest Measured and Indicated LCE resource at 16 Mt

4

Innovative, ESG-Friendly Technology: 100% brine aquifer reinjection, minimal land impact.

5

Robust Funding: Over C$32 million in non-dilutive investments, plus close to C$30 million raised in 2023.

6

Prime Location in Alberta: Over 600,000 hectares of brine permits in a well-established oil and gas region.

7

Experienced Leadership Team: Over 150 years of collective experience in emerging technologies and resource management.

As you’ve now seen, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is at the forefront of revolutionizing lithium production.

With the largest Measured and Indicated lithium resource in Canada, this company is poised to play a pivotal role in the energy sector.

Discover more about E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3), its innovative approaches, and how this company is shaping the future of lithium production at their official website.