Picture this: You’re sitting at a high-stakes poker table. The pot is massive. And you’ve got a royal flush in your hands.

That’s exactly what it feels like discovering this hidden gem in the $210 billion iGaming gold rush.

While everyone else is fighting over sports betting scraps, this company has found something better – the holy grail of online gambling.

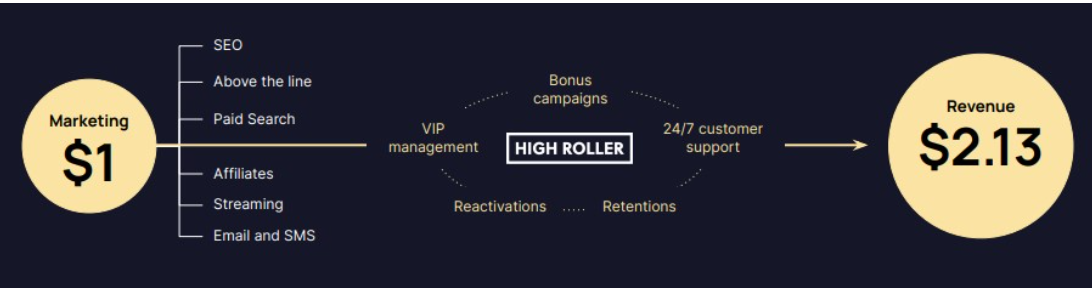

They’ve cracked the code that turns $1 into $2.13… like clockwork.

I’m not talking about some pie-in-the-sky startup burning cash.

This is a revenue-generating machine that just hit its first profitable quarter.

They’re growing 60% year-over-year1 while their competitors struggle to keep the lights on.

The secret? They’ve built the “Rolls Royce” of online casinos.

While others chase penny slots players, these guys focus on the whales – the high rollers who demand the best and aren’t afraid to pay for it.

And here’s the kicker: They’re keeping 20% of their players coming back month after month. In an industry where 10% retention is considered good, they’re nearly doubling the average.

It’s really no surprise that this company was the recipient of the Best Player Retention 2024 at the SiGMA Europe B2C Awards.2

But here’s why we’re really excited…

They recently launched a second AI-powered gaming platform to capture Latin America’s regulated market—which is expected to quadruple by 2027.

That’s like handing the keys to Fort Knox to a gold mining company.

The best part? Almost nobody knows about this stock yet. But they will soon.

Top 8 Reasons

to Consider High Roller Technologies (NYSEAMERICAN:ROLR)

1

Unmatched Player Retention: 20% retention rate, nearly double the industry average.

2

Explosive Growth Trajectory: 60% revenue growth in 2023.3 Achieved positive EBITDA in Q3 2024.4

3

Proprietary Technology Platform: Advanced AI-driven CMS powering over 4,400 games from more than 70 leading game providers.5 Enhanced scalability, SEO, and faster load times.

4

Strategic Partnerships: High Roller Technologies Inc. (NYSEAMERICAN:ROLR) inked deals with top firms for new market access, including a groundbreaking launch into the $12 billion Latin American market6

5

Experienced Leadership: Led by a team with 100+ years of combined iGaming experience, including a former Nasdaq vice chairman.

6

Booming Market Opportunity: The global iGaming market is expanding from $135 billion to $210 billion by 2027. High Roller Techologies is primed to capture this growth with its premium brand strategy.7

7

Efficient Revenue Model: High Roller Technologies (NYSEAMERICAN:ROLR) generates 213% returns on every marketing dollar spent,8 outpacing competitors in efficiency.

8

Insider Confidence and Strong Financials:High insider ownership reflects faith in the company’s trajectory.

While competitors scramble to dominate the crowded sports betting market, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is laser-focused on high-margin VIP casino players—a segment with unparalleled loyalty and profitability.

By combining cutting-edge technology, strategic partnerships, and operational efficiency, it has carved out a unique space in the $210 billion iGaming world.

This focused approach isn’t just different; it’s better, delivering results that stand out in a competitive landscape.

Now, let’s take a closer look at how High Roller Technologies Inc. (NYSEAMERICAN:ROLR) stacks up against its peers.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Crushing the Competition: Why High Roller Technologies Inc. (NYSEAMERICAN:ROLR) Stands Out

Picture this: David versus not one, but three Goliaths. And David’s winning.

While the gambling giants burn through mountains of cash-chasing sports bettors, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) has found the sweet spot – the premium casino player who spends more and stays longer.

Let’s look at how this nimble operator stacks up against the industry titans:

Here’s why High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is the smartest bet:

Superior Economics

While DraftKings struggles to achieve consistent profitability in its sports betting segment ($58.5 million Adjusted EBITDA loss in Q3 2024),9 High Roller Technologies just delivered positive EBITDA—a rare achievement in the iGaming sector.

On top of that, High Roller generates $2.13 in revenue for every $1 spent on marketing,10 far outpacing DraftKings’ heavy spending to acquire and retain customers. That’s not just better – it’s a completely different league.

Premium Player Focus

Flutter and Betsson chase every player with a pulse. High Roller Technologies Inc. (NYSEAMERICAN:ROLR) targets the whales – the high-value players who demand the best and aren’t afraid to pay for it. These players stick around twice as long as the industry average.

Insider Confidence

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) management and insiders own over 70% of the company, a testament to their unwavering belief in the company’s long-term success. In contrast, DraftKings11 and Flutter12 insiders have been actively selling shares, raising questions about their confidence in future growth. When the people running the show bet big on themselves, smart investors pay attention.

Technology Edge

Unlike competitors relying on off-the-shelf solutions, High Roller Technologies operates a proprietary AI-powered Content Management System (CMS) that automates essential operations, enhances user engagement, and ensures seamless scalability.

This AI-driven technology isn’t just a backend upgrade—it actively improves player experience, reduces churn, and maximizes lifetime value. It’s a key differentiator in a crowded market, where customer experience directly drives revenue growth.

Undervalued Potential

Despite its superior economics, proven platform, and premium-player focus, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) boasts a market cap of just $34 million—a fraction of DraftKings or Flutter.

With sustainable profitability, a laser focus on high-value players, and cutting-edge AI technology, this valuation gap may not last long.

In an industry where giants like DraftKings are still chasing profitability, High Roller Technologies is already there. Investors looking for a smarter, more efficient path to iGaming growth should be paying close attention.

Press Releases

- High Roller Technologies Wins Double Honors at the 2024 WN iGaming Summit

- High Roller Technologies Announces Financial Results for the Three Months Ended September 30, 2024

- High Roller Technologies Inc. Plans to File its Third Quarter Form 10-Q Within 45-Days of the Effective Date of its IPO Registration Statement, as Permitted by Exchange Act Rules

- High Roller Technologies Awarded Best Player Retention 2024 at SiGMA Europe B2C Awards

- High Roller Technologies Announces Closing of its Initial Public Offering

A Revenue Model Built for Growth

The beating heart of High Roller Technologies Inc. (NYSEAMERICAN:ROLR) isn’t just another online casino – it’s a highly sophisticated platform built for scalability, efficiency, and sustained profitability

This model is designed to not only capture market share but to redefine industry benchmarks through a combination of cutting-edge technology and strategic market focus.

Proprietary AI-Driven Content Management Platform

High Roller’s foundation is built on a proprietary AI-powered Content Management System (CMS) that automates essential operations, enhances user engagement, and ensures seamless scalability.

Key features include:

-

-

- Real-time targeted promotions and bonuses tailored to individual player behavior to enhance user engagement and retention.

- Operational automation across risk management, fraud prevention, and payment processing.

- Multi-platform optimization across mobile, desktop, and tablet devices.

- Seamless scalability without a linear increase in operational costs.

- Optimized player experiences across mobile, desktop, and tablet platforms, ensuring every user interaction is smooth and responsive

-

By integrating advanced analytics and direct API connections, the platform reduces processing times and amplifies search engine visibility, drawing in high-value players while maintaining operational agility.

Premium Game Portfolio

With 4,400+ games from 70+ providers, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) offers:

-

-

- Top-tier content providers, including Evolution, Pragmatic Play, NetEnt, Red Tiger, and more.

- Strong partnerships with trusted suppliers, ensuring a consistent flow of high-quality content.

- Cross-platform accessibility, delivering seamless experiences on desktop, mobile, and tablet devices.

-

These partnerships allow High Roller to maintain a competitive edge in the online gaming space while offering a superior player experience.

Impressive Player Metrics

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) has demonstrated significant year-over-year growth across key performance indicators, highlighting the effectiveness of its revenue model:

-

-

- Active Users: 51,400 (+77% YoY)

- Average Deposit Per User: $1,500 (+24% YoY)

- Average Revenue Per User (ARPU): $575 (+11% YoY)

- Total Bets: $714 million (+79% YoY)

- Customer Deposits: $74.7 million (+114% YoY)

-

These results are driven by effective marketing strategies, personalized engagement efforts, and a dedicated VIP management team.

Seizing the Boundless Growth Prospects in Latin America and Beyond

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is strategically advancing into Latin America, one of the most exciting and rapidly growing regions in the global iGaming industry. With a tailored approach and a technology-driven foundation, the company is poised to capture a significant share of this booming market, which is projected to reach $12 billion in gross gaming revenue by 2028.13

Fruta: The Gateway to Latin America

In December 2023, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) successfully launched Fruta, its second active iCasino brand, specifically designed to cater to Spanish-speaking players.14

Leveraging localized engagement strategies and established marketing channels, Fruta is set to become a recognizable name in the region, offering a seamless and engaging gaming experience.

Timing Couldn’t Be Better

The global iGaming market, valued at $135 billion in 2023, is projected to reach a staggering $210 billion by 2027.15 Latin America’s regulated market is a major driver of this growth, offering immense opportunities for early movers like High Roller Technologies.

But High Roller Technologies Inc. (NYSEAMERICAN:ROLR) isn’t just riding the wave—they’re actively engineering success.

By focusing on high-value players and leveraging their proprietary AI-powered CMS platform, the company captures more revenue per player while keeping acquisition costs lower.

Expansion Fueled by Smart Investments

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) plans to strategically allocate proceeds from its $10 million IPO into:16

-

-

- Accelerating market entry initiatives in Latin America and other key regions.

- Enhancing its AI-driven technology platform to optimize scalability and player experiences.

- Driving player acquisition campaigns tailored to regional markets.

-

This isn’t just another iGaming company—it’s a technology-powered profit engine with a focus on sustainability, scalability, and long-term success.

By combining exceptional player retention, data-driven decision-making, and a laser focus on high-value customers, High Roller Technologies is setting a new standard in how iGaming operators approach emerging markets.

The Latin American market isn’t just an expansion strategy—it’s a catalyst for exponential growth. High Roller Technologies is ready, the infrastructure is in place, and the market is ripe for disruption.

The question isn’t whether they’ll succeed—it’s how far they’ll go.

Stock Highlights & Technical Analysis

Smart investors know the best opportunities often come when insiders are buying heavily – especially near IPO prices. That’s exactly what’s happening at High Roller Technologies Inc. (NYSEAMERICAN:ROLR).

Just look at the recent insider purchases: CEO Ben Clemes scooped up 4,000 shares at $6.48, while CFO Matthew Teinert grabbed 2,000 shares at $6.34. Multiple directors even bought at the $8.00 IPO price.17 When management puts their own money on the line, it’s time to pay attention.

Why This Stock Structure Matters

Here’s what makes this opportunity special: with only 8.2 million shares outstanding and a tiny public float of 1.48 million shares, positive news could send this stock soaring. The majority of shares are locked up tight – insiders and major institutions hold over 70% of the company.

Think about that for a moment. When a company with strong insider ownership, proven revenue growth, and multiple near-term catalysts has such a small trading float, the upside potential can be explosive.

The Technical Setup

Currently trading at $4.17, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) has a market cap of just over $34 million. The RSI of 32.91 suggests oversold conditions – exactly when smart investors start paying attention.

What’s particularly interesting is the minimal short interest of just 1.33% of the float.18 This means there’s little downward pressure from short sellers, and any positive news could trigger significant upward movement.

A Rare Opportunity

Consider these key factors:

-

-

- Management and insiders own over 70% of the company19

- The public float is tiny at 1.48 million shares20

- Insiders are buying at higher prices

- Technical indicators suggest oversold conditions

-

This combination of factors – tight share structure, strong insider ownership, recent insider buying, and oversold technical indicators – creates a compelling setup for potential price appreciation as High Roller Technologies executes its growth strategy.

With multiple catalysts on the horizon, including expansions into new markets, this could be the perfect time to add High Roller Technologies Inc. (NYSEAMERICAN:ROLR) to your watchlist.

Remember, stocks with this type of share structure can potentially move quickly when positive news hits. The time to pay attention is before these catalysts materialize.

The Dream Team Behind the Next Gaming Revolution

Key Directors

This experienced leadership team collectively brings over 90 years of iGaming industry experience, with significant skin in the game through substantial share ownership. Their combined expertise spans technology development, operational efficiency, financial management, and strategic growth in regulated markets.29

8 Compelling Reasons

to Watch High Roller Technologies Inc. (NYSEAMERICAN: ROLR)

1

The Money-Making Machine: Every marketing dollar generates $2.13 in revenue – a level of efficiency that puts competitors to shame. While others burn cash chasing sports betting market share, High Roller’s focus on premium casino players delivers superior margins.30

2

Explosive Growth Trajectory: Revenue grew an impressive 60% in 2023,31 with Q3 2024 marking their first profitable quarter. This isn’t just growth – it’s sustainable, profitable expansion.

3

Proprietary Technology Platform: High Roller’s AI-driven Content Management System (CMS) supports over 4,400 games from 70+ providers, ensuring enhanced scalability, optimized search engine visibility, and seamless multi-platform performance

4

Strategic Expansion: Strategic alliances, including the launch of Fruta.com targeting Latin America, are accelerating market access and expansion

5

Experienced Leadership: Led by a team with 90+ years of combined iGaming experience, including proven leaders with extensive backgrounds in operations, finance, and technology

6

Massive Market Opportunity: The global iGaming market is expanding from $135 billion to $210 billion by 2027. High Roller Techologies Inc. (NYSEAMERICAN:ROLR) is perfectly positioned to capture this growth with its premium brand strategy.32

7

Efficient Revenue Model: High Roller generates approximately $2.13 in revenue for every $1 spent on marketing, significantly outpacing industry averages and reflecting highly efficient capital deployment

8

Tight Share Structure: With only 8.2 million shares outstanding and over 70% held by insiders and institutions, positive news could send High Roller Techologies Inc. (NYSEAMERICAN:ROLR) stock soaring.

Final Thoughts: A Rare Ground-Floor Opportunity

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) isn’t just another gaming company – it’s a precision-engineered profit machine targeting the most lucrative segment of a booming market.

While competitors burn cash chasing sports bettors, High Roller has cracked the code on profitable growth in the premium casino space.

The numbers tell the story: 60% revenue growth, 20% player retention, and $2.13 generated for every marketing dollar spent.33

This isn’t hope and hype – it’s proven execution.

With major catalysts on the horizon in 2025, a tight share structure where insiders own over 43%, and a market cap of just $35 million, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) presents a rare opportunity to get in early on what could become a dominant player in the $210 billion iGaming market.34

Consider this: The company’s current valuation represents just 0.02% of their total addressable market.

As they execute their expansion plans and continue delivering superior unit economics, that gap between market opportunity and valuation could close rapidly.

Smart investors know the best opportunities come when proven execution meets massive market potential.

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) checks both boxes, making it a compelling watch for anyone seeking exposure to the explosive growth of premium online gaming.

Remember, stocks with this type of share structure can move quickly when positive news hits. The time to pay attention is before these catalysts materialize.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers