AI has already reshaped industries like healthcare and finance.

But the next wave isn’t in software or data analytics—it’s in robotics.

We’re entering the era of Physical AI—where robots are no longer science fiction but practical tools redefining security, logistics, and everyday life.

This isn’t about apps or algorithms; it’s about real-world machines, solving real-world problems, in real-time.

Take Serve Robotics (NASDAQ: SERV), for instance.

With its fleet of delivery bots rolling through neighborhoods, Serve is turning heads and capturing investors’ imaginations.

And investors are buying in—literally.

Despite reporting just $164,000 in revenue for the first nine months of 2024, Serve commands a market cap of $369 million.1,2,3

That’s right, a company making less than $200,000 annually is commanding nearly half a billion dollars in valuation.

It’s the kind of speculative play that turns heads.

But here’s the problem: Serve’s robots are limited to food delivery, while a much bigger opportunity is taking shape in public safety.

While delivery bots are creating buzz, security robots are tackling some of today’s most urgent challenges—safety, crime prevention, and public protection.

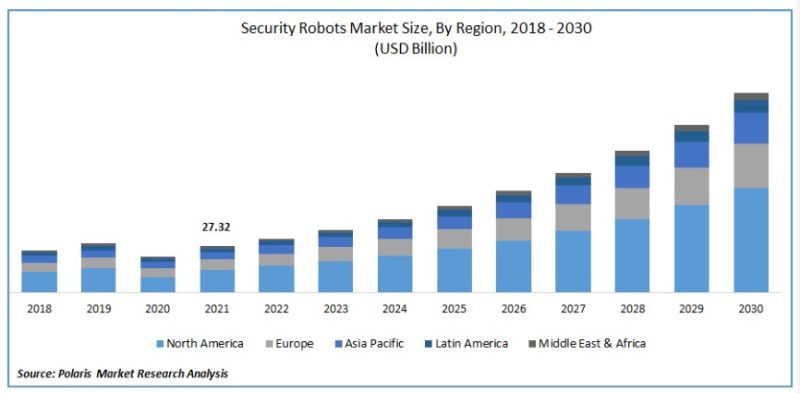

The global security robots market is already valued at $94 billion as of 2024, and it’s projected to soar to nearly $283 billion by 2032, growing at a CAGR of 14.7%.4

This isn’t just about hype—it’s a massive market opportunity, and one pioneering company is perfectly positioned to capitalize.

This company we’re watching closely is Knightscope, Inc. (NASDAQ:KSCP), a cutting-edge AI-security robot pioneer redefining safety with its Autonomous Security Robots (ASRs).

These AI-driven machines are built to deter, detect, and report crime, delivering real-world applications of cutting-edge technology.

Knightscope’s Q3 2024 revenue dwarfs Serve’s at $3.2 million, and its robots are already making a difference where it matters most—reducing crime in schools, hospitals, and corporate campuses.

Knightscope’s ASRs don’t just promise results—they deliver, with proven stats showing up to a 46% reduction in crime in areas they patrol.

Knightscope’s growth trajectory just got a major boost with the recent closing of a $12.1 million financing.5 This capital injection positions the company to scale its operations, advance its technology, and expand its footprint in the security robotics market.

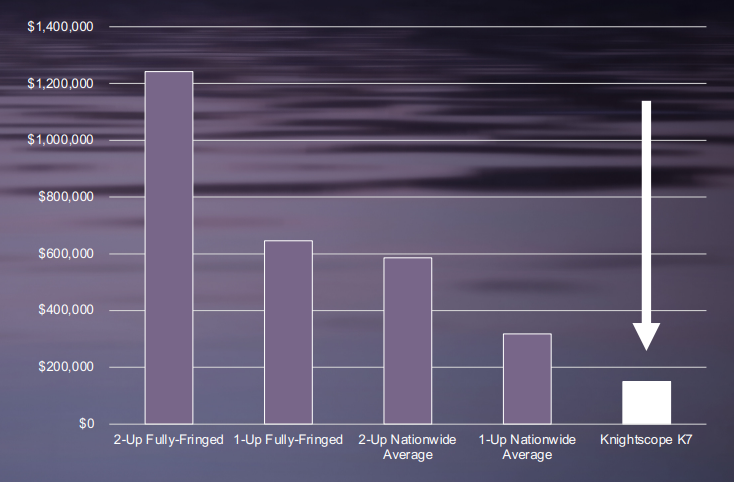

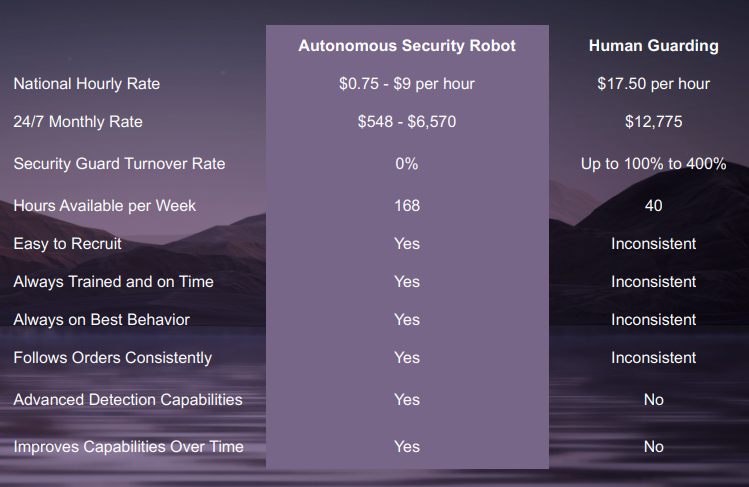

And let’s talk about cost-effectiveness. While Serve focuses on meal deliveries, Knightscope, Inc. (NASDAQ:KSCP) provides 24/7 security for as little as $0.75 per hour—a fraction of the cost of human guards, which range from $15 to $85 per hour.

What about growth potential? Knightscope’s innovative Machine-as-a-Service (MaaS) model is setting it up for recurring revenue streams, a gigantic advantage in the rapidly expanding market.

Despite this, Knightscope’s (NASDAQ:KSCP) market cap is a mere $59 million—less than 1/9th of Serve’s valuation.

This defies logic for a company with significantly higher revenue, proven success, and a foothold in a larger, more vital market.

And Knightscope isn’t slowing down.

The company recently announced over 30 new contracts6 and unveiled groundbreaking technology, such as gunshot detection systems that reduce response times to under two seconds.

Beyond its innovative advancements, what distinguishes Knightscope, Inc. (NASDAQ:KSCP) from its competitors is its tightly-held share structure and significant insider ownership.

Currently trading just over $15 per share with less than 3.5 million shares outstanding, this tightly held stock could experience notable movement as more investors recognize its potential.

This low float can drive substantial price swings, especially when positive developments occur.

Additionally, insiders hold a considerable stake in the company, aligning their interests with those of shareholders.

- CEO William Santana Li personally owns more than 140,000 shares, and a total of seven insiders have considerable ownership

- 54 institutional investors collectively own 121,670 shares, including major players like Vanguard Group, Geode Capital Management, and State Street.

This combination of insider and institutional ownership reflects strong confidence in Knightscope’s long-term growth potential.

While Serve Robotics rolls along with speculative hype, Knightscope, Inc. (NASDAQ:KSCP) is building a future in public safety—one of the most vital and lucrative sectors in AI robotics.

When comparing the two, the numbers don’t lie: Knightscope, Inc. (NASDAQ:KSCP) is an undervalued gem, and its growth story is just beginning.

Before we jump into the details about Knightscope’s (NASDAQ:KSCP), let’s discuss how this trending company has nearly unlimited blue sky market potential.

The global need for advanced security solutions has never been greater.

In 2022, the US faced over a million violent crimes, underscoring the urgency for innovative tools to enhance public safety.

With over 331 million Americans and just 660,288 full-time law enforcement officers7 alongside approximately one million security guards, that’s roughly one protector for every 200 people.8

And let’s be honest… That’s NOT a safe statistic at all.

Knightscope’s (NASDAQ:KSCP) ASRs are bridging this gap. Equipped with HD 360-degree cameras, thermal imaging, and public address systems, these robots provide continuous monitoring and real-time response capabilities, redefining the future of public safety.

Knightscope, Inc. (NASDAQ:KSCP) has secured federal authorization through an Authority to Operate (ATO) from FedRAMP, making its technology available to ALL federal agencies.9

This company isn’t short on big name clientele.

In November, Knightscope, Inc. (NASDAQ:KSCP) unveiled a game-changing partnership with Verizon Business.10

This collaboration isn’t just another agreement—it’s a strategic move that elevates Knightscope’s ASRs and K1 emergency communication devices to a new level of capability and reliability.

By integrating Verizon’s Frontline capability provides Knightscope’s entire technology portfolio to gain priority cellular telecommunication access available only to first responders. Knightscope’s devices now offer enhanced real-time threat detection, faster incident reporting, and improved operational efficiency. These advancements are critical as organizations increasingly look for dependable, scalable security solutions in both the private and public sectors.

The partnership also brings added weight to Knightscope’s K5 ASR, which already holds the prestigious FedRAMP Authority to Operate (ATO) from the US Department of Veterans Affairs.

This designation underscores the K5’s compliance with the federal government’s stringent security standards and paves the way for broader adoption across high-security government sites and federal facilities.

With Verizon’s robust connectivity backing its technology, Knightscope, Inc. (NASDAQ:KSCP) is poised to expand its reach and effectiveness, delivering cutting-edge security solutions at scale.

But the Verizon deal is just one piece of the puzzle.

Since April 2024, the company has signed over 30 new contracts, marking a 128% increase in revenue for 2023.11

Highlights include:

- A $1.25 million contract with Rutgers University.12

- A $1.2 million order for K1 Call Boxes to enhance communication infrastructure.13

- Deployment of its K5 robot in a pilot program with the NYPD, patrolling a Manhattan subway station – now being redeployed at a undisclosed location in the City.14

Knightscope’s (NASDAQ:KSCP) technology is also trusted by the Huntington Park Police Department, which recently renewed its contract for the sixth consecutive year, citing significant crime reductions in areas like Salt Lake Park.15

Other notable clients include Port Authorities of New York and New Jersey, Penn Entertainment, and the University of Tennessee.

On top of all that, Knightscope, Inc. (NASDAQ:KSCP) just began sales of its Automated Gunshot Detection (AGD) technology,16 slashing response times to dangerous situations down to just two seconds.

According to InvestorPlace, Knightscope could even be a surprise hit among must-own AI stocks.17

Knightscope‘s momentum caught the attention of Ascendiant Capital Markets analyst Edward Woo, who highlighted the company’s Q3 successes as a promising indicator for 2024 in a recent research report.

Let’s take a look at some of the reasons this company is a force to be reckoned with in the public safety arena.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

8 Reasons

to Pay Close Attention to Knightscope (NASDAQ:KSCP)

1

Rapid Revenue Growth: Knightscope, Inc. (NASDAQ:KSCP) reported 128% year-over-year revenue increase in 2023, generating $12.8 million, reflecting expanding market presence.18

2

High Market Potential: The global security robots market is valued at $94 billion (2024) and is projected to grow to $283 billion by 2032.19,20

3

Tight Share Structure and Strong Ownership: Only 3.5 million shares outstanding, significant insider and institutional ownership, including Vanguard Group, Geode Capital Management, and State Street

4

Innovative Technology: Autonomous Security Robots (ASRs) are equipped with state-of-the-art technology, including HD 360-degree recording, thermal cameras, and public address speakers for enhanced public safety.

5

Strategic Contracts and Partnerships: Over 30 new contracts since April 2024, including a $1.25 million contract with Rutgers University and a $1.2 million order for K1 Call Boxes, as well as federal authorization through an Authority to Operate (ATO) from FedRAMP

6

Cost-Effective Business Model: Machine-as-a-Service (MaaS) model Machine-as-a-Service (MaaS) model offers security services at $0.75-$9 per hour, providing long-term recurring revenue streams for Knightscope, Inc. (NASDAQ:KSCP)

7

Experienced Leadership Team: Knightscope, Inc. (NASDAQ:KSCP) is led by a team of seasoned professionals including Co-founder & CEO, Chairman William Santana Li, a former senior executive at Ford Motor Company

8

Future Expansion and Technological Innovation: Continuously developing new technologies including drone integration, enhanced emergency systems, and expanding gunshot detection capabilities.

Tapping into a $120 Billion Market

The global security robots market is projected to hit $120 billion by 2030.21 This growth opens a golden door for innovators like Knightscope, Inc. (NASDAQ:KSCP).

As more organizations see the value in autonomous security, the demand for Knightscope’s robots could potentially soar..

With strong institutional backing and a float of only 2 million shares, Knightscope’s stock is well-positioned for significant movement as it continues to expand its market presence and secure new contracts.

Comparable Companies in the Security Technology Space

Here’s how Knightscope, Inc. (NASDAQ:KSCP) is setting itself apart in the autonomous security robot market and stands out among other significant players in the security technology sector:

Axon Enterprise (NASDAQ: AXON): Axon equips law enforcement with Tasers, body cameras, and VR training systems.28 While Axon enhances officer tools, Knightscope offers autonomous robots for continuous, proactive surveillance. In a way, Knightscope complements Axon’s reactive approach.

Wrap Technologies (NASDAQ: WRAP): Wrap provides non-lethal restraint devices like the BolaWrap for specific suspect restraint scenarios.29

In contrast, Knightscope’s ASRs offer round-the-clock monitoring and incident response, addressing broader security needs.

OSI Systems (NASDAQ: OSIS): OSI specializes in large-scale security screening for infrastructure protection.30

While OSI focuses on stationary solutions, Knightscope provides mobile, adaptable robots for real-time threat detection and response, suitable for diverse environments.

SoundThinking (formerly ShotSpotter) (NASDAQ: SSTI): Known for gunshot detection systems, high-tech security cameras, and data analysis tools,31 SoundThinking aligns with Knightscope’s AGD system, which reports gunshots within two seconds.32

Why Knightscope, Inc. (NASDAQ:KSCP) Stands Out:

-

-

- 24/7 Surveillance and Real-Time Analysis: Knightscope’s ASRs provide constant surveillance, real-time data analysis, and instant incident reporting. This ensures cities and various environments, from corporate campuses to public parks, are always protected.

- AI and Machine Learning: What truly sets Knightscope, Inc. (NASDAQ:KSCP) apart is the company’s use of AI and machine learning. Their robots detect anomalies, identify threats, and respond swiftly, providing a significant competitive edge in smart security solutions.

- Adaptability and Coverage: Unlike stationary security solutions, Knightscope’s robots are mobile and adaptable, capable of operating in diverse environments. This flexibility allows them to meet the growing demand for efficient and effective security.

-

Innovative Business Model for Recurring Revenue

Knightscope’s (NASDAQ:KSCP) isn’t just innovating with its autonomous security robots; it’s completely transforming the business model for public safety.

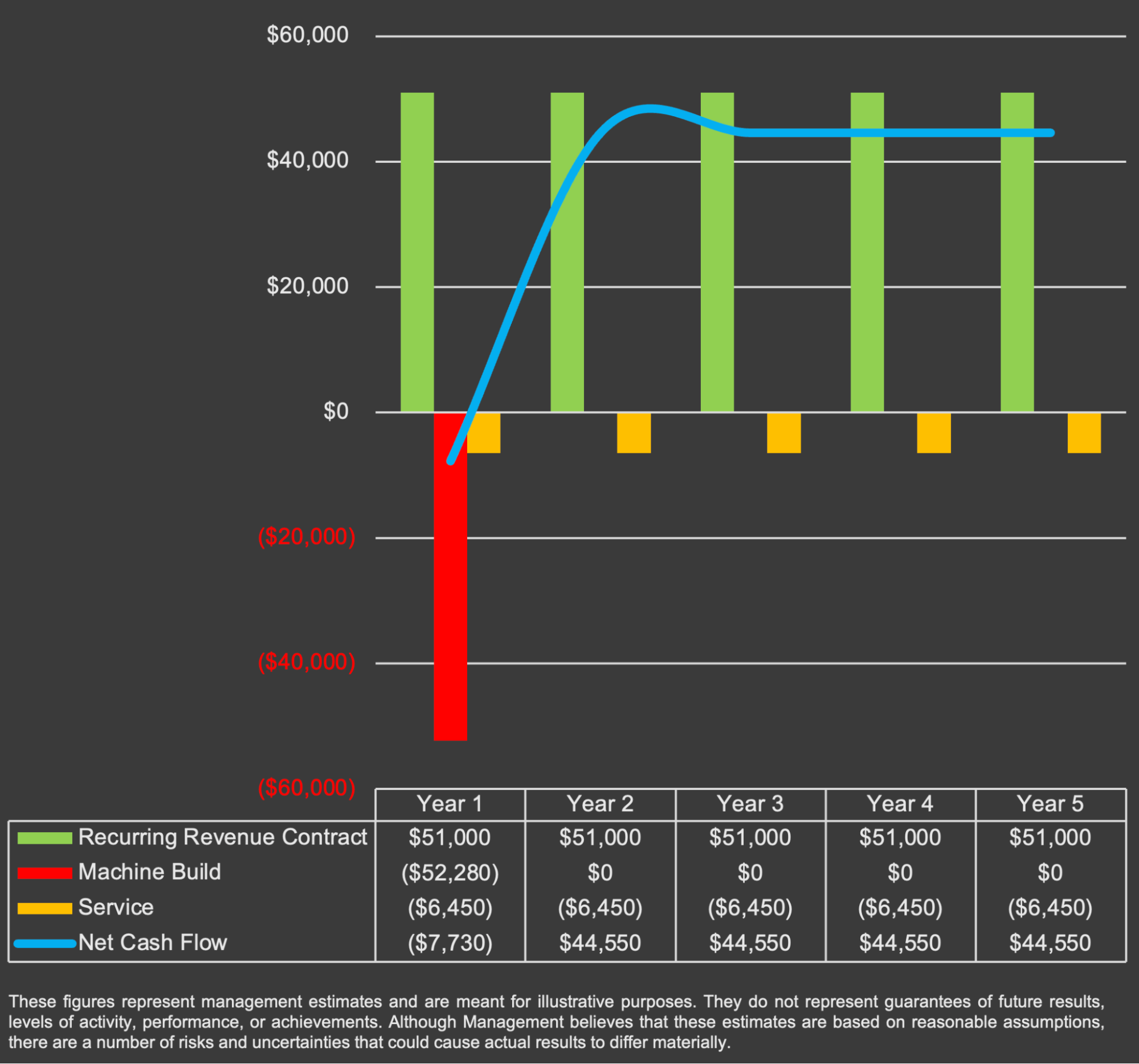

Forget one-time hardware sales—Knightscope’s Machine-as-a-Service (MaaS) subscription model is rewriting the playbook.

Here’s how it works: Clients subscribe to Knightscope’s ASRs for as little as $0.75 to $9.00 per hour—a fraction of the $15 to $85 per hour cost of traditional human security guards. For businesses, the math speaks for itself.

Now, consider this: The base salary for a police officer ranges between $57,000 and $67,000 annually.33 Factor in benefits, training, and overtime, and that number jumps to $149,000 per year. Knightscope’s robots don’t need sick days, overtime pay, or benefits—and they operate 24/7.34

This subscription model ensures recurring revenue. For clients, it’s a no-brainer. For Knightscope (NASDAQ:KSCP), it’s a recurring revenue machine.

Take the K5 ASR as an example. Over a five-year subscription, a single unit generates $255,000 in revenue with a healthy 67% margin—providing predictable, stable income.35

Total cash outflows over the period amounted to ($84,530), resulting in a margin of $170,470 or 67% as the long-term target.36

Why is this important?

To put it simply: long-term returns.

Knightscope’s (NASDAQ:KSCP) MaaS model creates long-term cash flow and unlocks enormous growth potential. This isn’t just a sale; it’s an ongoing partnership that ensures reliable revenue year after year.

And it’s not just about the numbers. Knightscope’s robots have already proven their value in the field—helping solve real crimes, from tracking down hit-and-run suspects to identifying armed perpetrators.

Delivering Real-World Impact

Knightscope’s (NASDAQ:KSCP) ASRs aren’t just about high-tech features—they deliver real-world results.

Cutting Crime by 46%: In various deployments, Knightscope robots have dramatically reduced crime rates. For instance, areas patrolled by Knightscope, Inc. (NASDAQ:KSCP) robots have seen up to a 46% drop in crime,37 proving their effectiveness as a deterrent.

Silicon Valley Success: At a prominent Silicon Valley corporate campus, a K5 ASR helped cut vehicle break-ins by over 50% in just one year. The robot’s constant surveillance and immediate alerts made the area much safer for everyone.

Mall Security Boost: In Southern California, a shopping mall plagued by vandalism and theft saw a 20% decrease in these incidents within six months of deploying Knightscope’s K3 robots. Their ability to patrol indoor spaces and detect threats played a crucial role.

Press Releases

Parking Lot Patrol: Knightscope robots have also been effective in reducing criminal activities in parking lots. For instance, at a retail center, the presence of Knightscope’s K5 ASR resulted in a 22% decrease in reported incidents over three months.

Hospital Security: At a large hospital, the implementation of Knightscope robots resulted in a 30% reduction in trespassing and unauthorized entries within the first year of deployment.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Law Enforcement Collaboration: In another case, a Knightscope robot identified a vehicle linked to criminal activity in a parking lot. This quick alert led to the arrest of a suspect involved in multiple burglaries, showcasing how Knightscope’s technology aids law enforcement.

Knightscope’s (NASDAQ:KSCP) robots don’t just promise security—they deliver it, making communities safer and setting new standards for public safety.

How Knightscope is Investing in the Future of Public Safety

Knightscope, Inc. (NASDAQ:KSCP) is truly leading the way in public safety innovation, constantly developing new technologies to keep us safe.

Here are some of the upcoming innovations they have cooking in their R&D department:

Exciting New Gunshot Detection Tech: Knightscope’s Automated Gunshot Detection (AGD) responds to requests from schools, corporations, airports, hotels, and cities. It helps stop active-shooter events, reduces false alarms, and integrates with other security solutions. Notifications are sent in less than two seconds, whether the shots are indoors or outdoors. This quick response can save lives. Sales of Knightscope’s gunshot detection system began only in Q4 2023.

NOTE: The market for gunshot detection systems is expected to reach $646 million by 2031 in North America.38

Expanding Robot Network: Knightscope, Inc. (NASDAQ:KSCP) is expanding its network of robots across more locations. More robots mean better data, faster response times, and safer public spaces.

Introducing KEMS: The Knightscope Emergency Management System (KEMS) enhances over 7,000 devices, including K1 Blue Light Towers, E-Phones, and Call Boxes, with real-time monitoring, instant error detection, and performance reporting. This makes our public safety infrastructure smarter and more efficient.39

Drone Integration: Knightscope plans to partner with Draganfly (NASDAQ:DPRO) (CSE: DPRO) to integrate drone technology with its ASR tech.40 Imagine ground and aerial surveillance working together seamlessly. Greater coverage, greater security.

RTX Premium: Enhanced Remote Monitoring Services: Knightscope has recruited a team of Risk & Threat Exposure (RTX) Analysts to provide clients with remote, event-based monitoring using Knightscope technologies. This move brings RTX Premium (formerly Knightscope+) in-house, enhancing coordination, quality control, flexibility, and incident management.41

As Knightscope, Inc. (NASDAQ:KSCP) rolls out new technologies and expands its reach, the company’s market presence and revenue are expected to grow substantially.

Meet the Minds Guiding Knightscope’s Security Revolution

The same team that founded, funded, grew, and listed Knightscope, Inc. (NASDAQ:KSCP) over the last decade is leading the company today. They plan to continue driving growth organically over the next two to three decades, all while achieving their goal of making America safer. Among the talented roster are:

This experienced leadership team drives Knightscope’s vision and success, leveraging decades of expertise to revolutionize public safety with cutting-edge technology.

RECAP: 8 Reasons

to Pay Close Attention to Knightscope, Inc. (NASDAQ:KSCP)

1

Rapid Growth: 128% revenue increase in 2023, generating $12.8 million.

2

Market Potential: Security robots market projected to reach $120 billion by 2030.

3

Advanced Technology: ASRs with HD cameras and thermal imaging; AGD system reports gunshots within two seconds.

4

Tight Share Structure and Strong Ownership: With only 2.7 million shares outstanding and significant insider and institutional ownership, Knightscope is positioned for potential stock growth.

5

Strategic Deals: Over 30 new contracts secured, including major deals with federal agencies and large institutions, expanding Knightscope’s market presence and credibility.

6

Cost-Effective Model: Machine-as-a-Service (MaaS) costs $0.75 to $9.00 per hour versus $15 to $85 for human guards.

7

Experienced Leadership: Led by former Ford executive William Santana Li, and the same team of experienced founders.

8

Future Innovations: Integrating drones, enhancing KEMS, and expanding AGD technology.

As we’ve highlighted, the need for robust security solutions is greater than ever.

Knightscope, Inc. (NASDAQ:KSCP) is pioneering AI-driven security technology to meet this critical demand.

Don’t miss your chance to engage with the rapidly expanding $55 billion security robots market.42

Add Knightscope, Inc. (NASDAQ:KSCP) to your watchlist and follow their journey as they redefine public safety.

Transformative technology like this is rare—stay ahead of the curve and watch what Knightscope achieves next.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

William Santana Li Chairman and CEO

William Santana Li Chairman and CEO Stacy D Stephens EVP and Chief Client Officer

Stacy D Stephens EVP and Chief Client Officer Mercedes Soria EVP and Chief Intelligence Officer / CISO

Mercedes Soria EVP and Chief Intelligence Officer / CISO Apoorv S Dwivedi EVP and Chief Financial Officer

Apoorv S Dwivedi EVP and Chief Financial Officer Aaron J Lehnhardt EVP and Chief Design Officer

Aaron J Lehnhardt EVP and Chief Design Officer