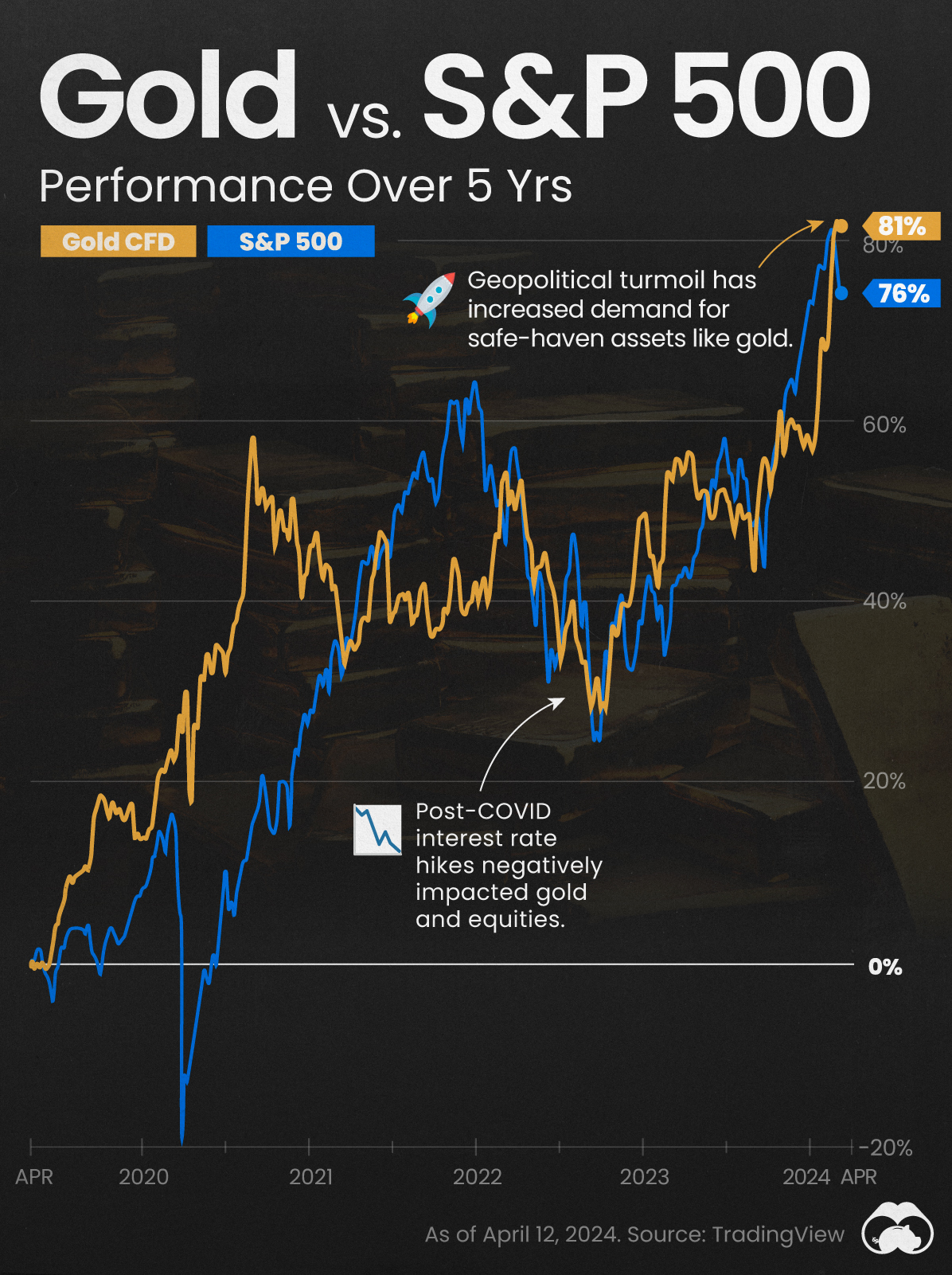

Bloomberg calls it a “scorching run”.1 Reuters says it’s “shattering new records”.2 And Goldman Sachs proclaims it an “unshakeable bull market.”3

Because while investors have been focused on the US stock market hitting non-stop record highs, the world’s oldest and most durable store of value has quietly launched into a bull market of its own…

A bull market that has outpaced even US stocks.4

In September, gold price hit a record-breaking $2,685.42 an ounce, marking a nearly 40% increase since the start of the year.5

But, major banks see this epic gold market bull run extending into 2025.6

Goldman Sachs is doubling down on its bullish call on gold, forecasting a continued gold rally to $2,900 an ounce by 20257 – implying further double-digit gains. JP Morgan sees gold hitting $2,600 an ounce next year8 – calling it its “#1 pick in commodities.”9 UBS just raised its forecast to $2,750 an ounce by the end of the year and $2,850 per ounce by mid-2025.10

Citi proclaims $3,000 an ounce is possible within six to 18 months.11 And hedge funds have been piling into gold.12

And it’s not just one factor driving the continued bull market, but an entire confluence of them all acting in concert to support gold’s continued rally.

-

-

- Geopolitical tensions are soaring, with both the conflict in the Middle East and in Ukraine continuing to escalate.

- International central banks are snapping up gold for their reserves in an attempt to reduce the influence of the U.S. dollar. They bought a net 290 tons of gold for the first quarter of 2023 – the highest first quarter increase on record dating back to 2000.13

- The Federal Reserve’s expected rate cuts toward the end of the year is also expected to create another price surge for the yellow metal, as gold prices tend to move in the opposite direction as interest rates.14

-

In short, the gold bull market is here to stay. And one company worth paying close attention to is Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF) – A Junior Gold Miner That Could Blast Into the Spotlight With Potentially Large Discoveries on the Horizon

Here’s the issue for those looking to benefit from the ongoing bull market – a lot of it has already been priced in.

Look at the price of the Van Eck Gold Miners ETF, a fund that tracks a broad basket of gold mining stocks.

Since the end of February, it’s shot up by over 30% – and it won’t be surprising if it continues to surge as the gold price continues to increase.

For those looking to squeeze the most juice out of the ongoing bull market, companies like Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF) are in the “sweet spot” for junior gold miners.

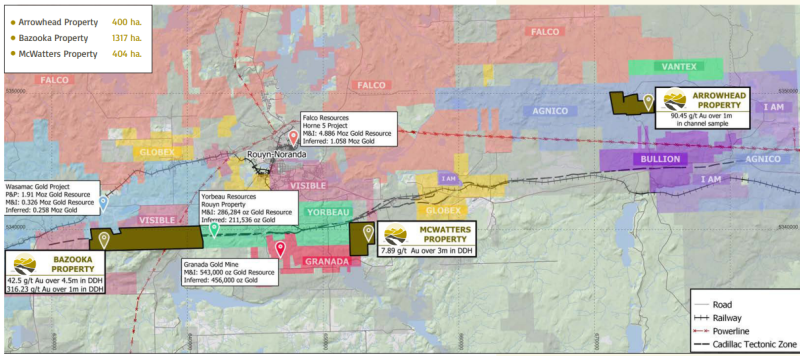

First of all, Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF) is operating smack dab in the middle of one of the most prolific gold belts in the world, with the company’s projects literally surrounded by the gold mining giants.

Previous drill programs at its two properties have already delivered highly promising results, and the company is about to embark on an expanded drill program that could catapult this junior gold miner straight into the spotlight.

Mining mogul Eric Sprott has already spotted the potential in this company, investing over $1 million into Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF).15

Now, Opawica Explorations is gearing up for its most exciting drilling season yet – With Phase 2 drilling about to kick off on both the Bazooka and Arrowhead properties, the company is positioned for exciting results.

At Bazooka, 59 high-priority drill targets have been identified to build on previous drilling, which revealed high-grade gold up to 18.7 g/t. Located near the Wasamac deposit (2.2 million ounces of gold), this project has massive upside.

Arrowhead, fully surrounded by Agnico Eagle’s operations, is equally promising. Seismic surveys revealed major fault structures, and earlier drilling hit mineralization up to 18 g/t. Phase 2 drilling will focus on unlocking even more potential.

Adding to the excitement, a neighboring property of Bazooka was just snapped up in a C$25 million deal by Yorbeau Resources,16 showing just how hot this area has become.

In other words, now is the perfect opportunity to learn more about Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF), a promising junior gold miner operating in a lucrative gold belt as the company begins a major expansion of its drilling program.

Press Releases

- Opawica Explorations Inc. Announces Non-Brokered Private Placement for Aggregate Proceeds Up To CAD$1,500,000

- Opawica Receives Drill Permits for the Arrowhead Project.

- Opawica Announces the Closing of Final Tranche of Oversubscribed Non-Brokered Private Placement

- Opawica Explorations Announces the Upsize and Closing of First Tranche of Non-Brokered Private Placement

- Opawica Explorations Begins Field Work at its Arrowhead Gold Project in Quebec, Canada in Preparation For Upcoming Drill Campaign.

To Pay Close Attention to Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF)

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

A Little-Known Junior Gold Miner with Promising Projects in the Middle of Canada’s Hottest Gold District

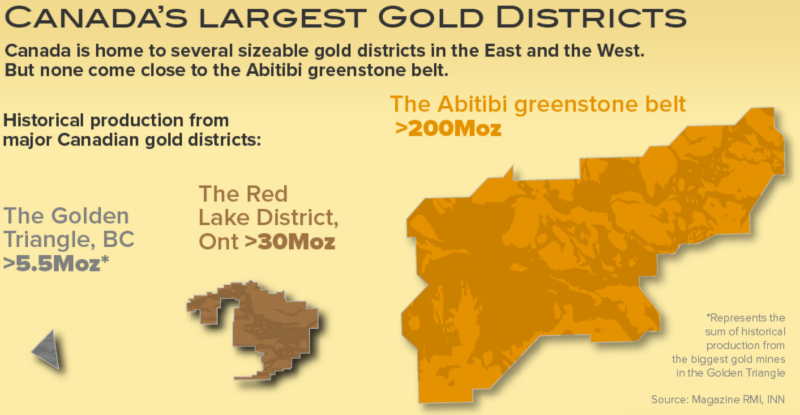

In 2023, Canada ranked as the world’s fourth largest gold producer – even ahead of the United States – with close to 200 tonnes of gold produced.20

And within Canada, there is zero question as to where the #1 gold district is – the Abitibi Greenstone Belt.

It is Canada’s primary source of gold. Its mining history dates back over a century, with over 100 mines currently operating in the belt.

This prolific region spans over 65,000 square kilometers21 and has already produced over 200 million ounces of gold, it is estimated there is still well over 100 million ounces that have yet to be mined.22

That’s over $230 billion worth of gold at current prices.

It’s no wonder why mining giant Agnico Eagle has continued acquiring more projects in the region over the last few years, including the Canadian Malartic complex in Abitibi, which has 7.9 million ounces of gold proven and probable.23

And the monstrous LaRonde Complex, which contains 2.88 million ounces of gold at 4.51 grams per tonne (g/t) and is less than 10 km away from Opawica Explorations’ project.24

In fact, Agnico Eagle is drilling so close to the border of one of Opawica Explorations Inc’s (TSXV:OPW) (OTC:OPWEF) they could literally have a conversation.

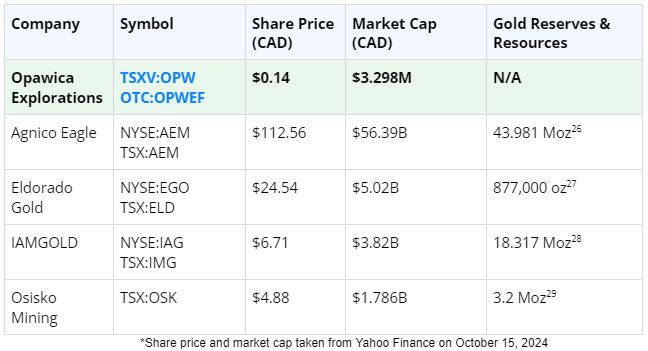

Of course, LaRonde isn’t Opawica Explorations’ (TSXV:OPW) (OTC:OPWEF) only exciting neighbor – there are seven producing mines located within just 10 kilometers/6 miles of its projects (5 of them owned by Agnico Eagle).

Another neighboring project within 10km of Opawica’s project is IAMGOLD’s Westwood project, which just increased its mineral reserves by 109% to 1.2 million ounces (5.3 Mt at 7.14 g/t).25

Since the start of the year, IAMGOLD has seen its share price increase by 47% from $2.44 up to $3.60.

In fact, most of the companies in the region have experienced an uptick in share prices this year as the gold market takes off.

It’s only a matter of time before the market catches on to what Opawica Explorations (TSXV:OPW) (OTC:OPWEF) has to offer.

While most market watchers already know about these major gold miners – something that’s already reflected in their stock prices – Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) is still relatively unknown, even though it’s operating in exactly the same high-potential area as these giants.

Yet, Opawica Explorations Inc’s (TSXV:OPW) (OTC:OPWEF) “unknown status” could soon change, because:

Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) Gears Up for Most Promising Drill Season Yet

With over $5 million already spent in the ground over the past few years, Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) is fully funded and ready to commence Phase 2 drilling program across its flagship properties, Bazooka and Arrowhead. The 2024-2025 exploration season is shaping up to be one of the company’s busiest and most promising yet.

Opawica’s Bazooka property, located within the heart of the Abitibi Greenstone Belt, has already yielded impressive results in prior drill campaigns.

Past drilling between 2021 and 2022 confirmed high-grade gold of up to 18.7 g/t, and historical drilling returned bonanza-grade results of up to 316.2 g/t, which is over ten times the threshold needed for bonanza classification.30

And this could just be the start, as drilling conducted in 2003–2005 at Bazooka returned gold mineralization of up to a staggering 316.2g/ton31 – which is over 10 times higher than the threshold needed to be considered “bonanza grade.”32

Those numbers shouldn’t be surprising. The Bazooka property is right in the middle of two gold jackpots – with a 2.9-million ounce gold deposit on one side, and a 1.4 million ounce deposit on the other.

In the upcoming Phase 2 drilling, Opawica will be building on these results. With 59 new high-priority drill targets identified—supported by a comprehensive 384-line-kilometer geophysical survey—the company is focused on testing new areas of mineralization and expanding known zones.

And that’s just one of the properties Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) is planning to conduct expanded drilling on.

There’s the Arrowhead property, which is basically surrounded on all sides by Agnico Eagle’s operations, making it one of the most highly prospective properties in the company’s portfolio.

The area is so promising that Agnico Eagle has drilled all the way up till and into the Arrowhead project, giving Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF) the opportunity to put down a seismic viewer down one of their drill holes.

The seismic survey could explain why. It revealed major fault structures and a rich vein that Agnico Eagle has already started mining.

The Phase 2 drilling program at Arrowhead will build on these seismic results and previous drill data, which included mineralization of up to 90.5 g/t.33 – meaning Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) knows exactly where they need to drill on the Arrowhead Property to maximize their chances of striking big.

With Arrowhead located so close to Agnico’s drilling activity, this next round of exploration could lead to significant discoveries.

And should positive data emerge from the expanded drilling programs on both these promising properties, that could immediately establish Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF) as THE junior gold miner to pay attention to in Canada.

That’s why the company has already been able to successfully raise millions of dollars to fund its drill programs.

That’s why one of Canada’s largest gold miners is drilling right up and into the company’s territory.

And that’s why Opawica Explorations Inc’s (TSXV:OPW) (OTC:OPWEF) management team is so personally invested in the company’s prospects.

An Incredibly Tight Share Structure With an Extremely Committed Management Team

It’s very easy for a management team to say they are committed to a company. Every company does that.

But what’s far more difficult – and far more rare – is for them to be able to actually prove their commitment.

That’s why, although Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) has 23 million shares outstanding, its management team, close shareholders and other insiders own a whopping 75% of all outstanding shares.

Company Structure:

-

-

- Market Cap: C$3.298 Million

- Shares Outstanding: 23.5 Million

- Institutional Ownership: 50%

- Insider Ownership: 25%

-

And even though many of these insiders bought into the company at prices far higher than they are today, they are resolutely holding on.

Opawica Explorations Inc.’s (TSXV:OPW) (OTC:OPWEF) CEO Blake Morgan himself has personally bought almost $600,000 worth of shares on the open market over the past few years.34 That includes over 2 million shares from the company’s past two oversubscribed private placements alongside billionaire Canadian mining investor Eric Sprott.35

Why? Because as mining industry veterans, they know Opawica Explorations Inc’s (TSXV:OPW) (OTC:OPWEF) true value has yet to be unlocked – that it has only scratched the surface of its full potential.

Investors Should Add Opawica Explorations Inc (TSXV:OPW) (OTC:OPWEF) to Their High-Priority Watchlist

The macro conditions are there. Gold is in an unshakeable bull market – and it only looks set to continue.

Meanwhile, while market participants take the predictable route – bidding up the prices of the gold miners everyone else already knows about – one little-known junior gold miner could be on the verge of a major discovery in the heart of Canada’s richest gold district.

That junior gold miner is Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF).

Its management team, insiders, and close shareholders have already got the share structure “locked down” in anticipation of findings from its expanded drilling program – which has already been fully funded.

And that means Opawica Explorations Inc. (TSXV:OPW) (OTC:OPWEF) could soon become the hottest name in junior gold mining.

Don’t miss the chance to learn more about this exciting under-the-radar company, the window of opportunity could slam shut soon once the market catches wind.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Blake Morgan President & CEO

Blake Morgan President & CEO Marcy KiesmanCPA, CMA – Chief Financial Officer

Marcy KiesmanCPA, CMA – Chief Financial Officer