Nvidia (NASDAQ:NVDA) experienced a slight pullback in early trading on Thursday after a significant rally pushed the company past a $3 trillion market cap for the first time. The stock opened at $1,240.09 per share but dipped approximately 0.4% in the morning session.

On Wednesday, Nvidia’s surge briefly positioned it above Apple (NASDAQ:AAPL) as the second-most-valuable company in the U.S. stock market, behind Microsoft (NASDAQ:MSFT). This rally was part of a broader upswing in tech stocks, driven by softer U.S. economic data and a decline in Treasury yields, which increased market hopes for a Federal Reserve rate cut as early as July.

Nvidia has been a focal point for investor interest in artificial intelligence, a trend that accelerated following the release of OpenAI’s ChatGPT in late 2022. The stock has soared over 140% this year and 200% over the past year, with a remarkable 3,300% gain over the last five years. By comparison, the Nasdaq has seen gains of 14%, 29%, and 126% over the same periods, respectively.

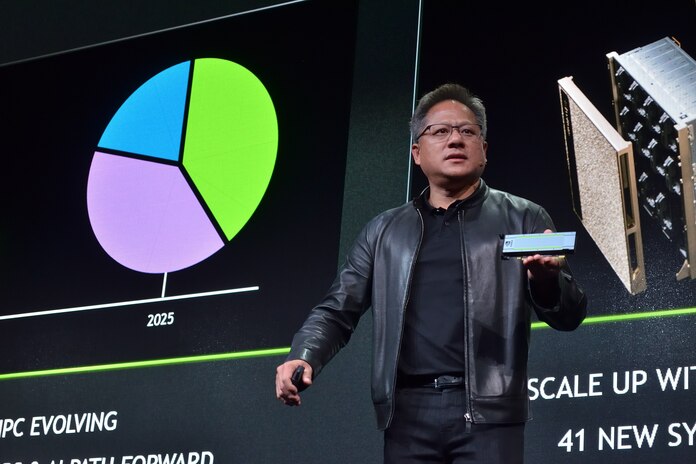

The latest rally in Nvidia followed an announcement from CEO Jensen Huang at an industry conference. Huang revealed plans to release a high-powered version of its Blackwell chip, named Blackwell Ultra, in 2025, and a new AI chip platform, Rubin, in 2026. An Ultra version of Rubin is set to debut in 2027.

Nvidia remains a crucial supplier of AI chips and integrated software for major tech companies such as Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOG), Meta (NASDAQ:META), Microsoft, and Tesla (NASDAQ:TSLA). These companies utilize Nvidia’s hardware for their cloud-based AI offerings and internal AI models.

In the first quarter, Nvidia reported adjusted earnings per share of $6.12 on revenue of $26 billion, representing increases of 461% and 262%, respectively, from the same period last year. Data Center revenue for the quarter surged 427% year-over-year to $22.6 billion, accounting for 86% of the company’s total revenue. The gaming segment, previously the company’s main business, generated $2.6 billion in revenue.

Nvidia also announced a 10-for-1 stock split scheduled for June 7 and an increase in its dividend from $0.04 per share to $0.10 per share.

However, Nvidia faces competition from AMD (NASDAQ:AMD) and Intel (NASDAQ:INTC), both of which are advancing their own AI chip technologies. AMD plans to release its MI325X and MI350 in 2024 and 2025, respectively, with the next-generation MI400 AI accelerator platform set for 2026. Intel aims to undercut competitors with its Gaudi 2 and Gaudi 3 AI accelerators, offering cost savings to companies investing heavily in AI chips.

Nvidia also contends with increasing competition from its customers, as Amazon, Google, and Microsoft work to reduce their reliance on Nvidia’s chips to save on capital expenditures.

Despite these challenges, Nvidia continues to dominate the AI sector and is expected to maintain its leading position for the foreseeable future.

Featured Image: Wikipedia