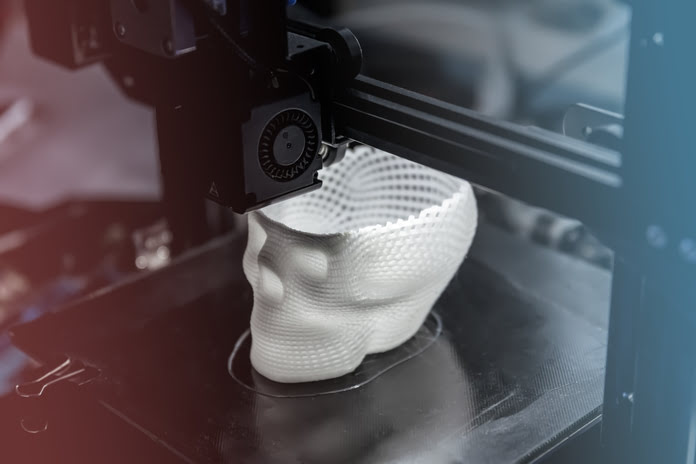

On the most recent Q4 results call, Markforged’s (NYSE:MKFG) CEO expressed optimism about the company’s overall direction. This company is in the additive 3D printing field, and its cloud-based AI-powered platform (Digital Forge) enables seamless interaction between materials and software, resulting in laser-fast manufacturing outputs. The CEO made it plain to investors that by investing aggressively today, Markforged has the potential to deliver outsized returns in the future.

Unfortunately, the market was not as enthused with management’s confidence following the presentation of the company’s fourth-quarter earnings (where the negative EPS of $0.07 actually outperformed forecasts). In fact, the company has lost more than 30% of its market capitalization in the last five weeks alone. As a result, shares have already fallen much below $1 per share, with a current market worth of $171.58 million.

Although short interest in the stock has maintained around 5%, the technical chart below shows that the price continues to record lower lows, which is certainly concerning. Bulls will be hoping that the recent December 22 lows can be maintained, but this remains to be seen.

Management, as previously stated, is optimistic about how its Digital Force platform might disrupt the manufacturing space in the future. Furthermore, the lack of major debt on the balance sheet, as well as the firm’s healthy pipeline, all suggest good fundamentals and a desire to ride this out until the company can ultimately become profitable.

Management noted that it does not expect the company to become profitable until the fourth quarter of fiscal 2024 and that this will only be on a non-GAAP earnings basis. This raises the question of whether the company’s ongoing cash-flow burn will be sufficient to keep the market interested in the interim time.

To summarize, in the short run, stability in the following two areas is required to ensure that Markforged shares do not fall any further from their current levels.

Gross Profit

Despite the fact that management has cut about $20 million from its cost structure since the second quarter of last year, the company’s gross margin fell to 47.5% in Q4. This was a significant decrease from the same quarter a year ago (57.6%), and it is worth noting. The reason for this is that, while revenues increased in the quarter, higher-than-expected costs from the recent introduction of the FX20 resulted in a negative operating profit print of $19.3 million and an $8.2 million negative operational cash flow. To summarize, while expenses are moving in the correct direction, there is still a long way to go before reaching positive profitability.

As a result, with ongoing cost-cutting measures required to remain fully on the agenda in fiscal 2023 and beyond, it will be fascinating to watch if the company can continue to aggressively grow its sales in this tough cost-cutting climate. Although top-line growth of just over 4% is predicted in fiscal 2023, analysts covering Markforged estimate over 17% growth in fiscal 2024. These figures will be required at the very least to keep the market engaged, as cost-cutting has a finite life. Top-line growth, on the other hand, has no bounds.

Growth

From a growth aspect, the CEO discussed “Digital Forge’s” bullish fundamentals and how manufacturers continue to exploit the platform. It is clear that as the value of Markforged products grows, more clients are beginning to use the technology. Trends from the recent 2022 acquisitions (Tetan Simulation & Digital Metal) indicate that greater value will be added, resulting in higher revenues (most likely recurring revenues on the Tetan Simulation side).

Given how quickly this market is moving, we believe Markforged will require more M&A to stay ahead of the curve (which will keep the cash-flow burn rising in the short run). Managing working capital on the balance sheet will thus be critical to ensuring that the balance sheet is protected to the best of the company’s capacity.

Conclusion

Markforged’s robust balance sheet and rising sales are promising signs in this battered stock. Management’s continuous mission to reduce costs as much as possible while investing extensively in the firm continues. However, the market requires further evidence that profitability is on the way. Let’s see what Q1 has in store.

Featured Image: Freepik @ timothy