The competition in the COVID-19 therapy and vaccine segment is likely to rise in the upcoming months as

Merck

’s

MRK

new oral antiviral medicine, molnupiravir, demonstrated promising results in a late-stage study.

Merck is evaluating molnupiravir in the phase III study — MOVe-OUT — as a potential treatment for at-risk, non-hospitalized adult patients with mild-to-moderate COVID-19. Data from the interim analysis of the study demonstrated that the risk of hospitalization or death following treatment with molnupiravir was reduced by approximately 50% compared to placebo.

While 7.3% of patients treated with the candidate were either hospitalized or dead within 29 days of treatment in the study, the figure was 14.1% in the placebo-arm. There were no deaths in the molnupiravir-arm while eight patients receiving placebo died during the study duration. The study results boosted investors’ confidence, leading to an 8.4% rise in the company’s shares on Oct 1. The candidate will be the first oral antiviral pill for treating COVID-19 in non-hospitalized patients following a potential authorization.

The company stopped enrollment in the MOVe-OUT study, following the recommendation from an independent Data Monitoring Committee and consultation with the FDA, which was based on the promising study data. The company is planning to file an application for emergency use authorization (EUA) to the FDA as soon as possible. A potential authorization to molnupiravir will boost the company’s prospects as it will help the company gain significantly amid the pandemic.

Impact on Present Players

Although there are a few medicines/injections already available for treating COVID-19 infection in patients who are required to visit a hospital, the oral therapy from Merck will make administration easier compared to the currently available COVID-19 drugs. Shares of some companies marketing monoclonal antibody medicines to treat COVID-19 including Regeneron,

Gilead

GILD

and Vir Biotechnology were down on Oct 1. Meanwhile, some analysts believe that the availability of effective and easy-to-administer drugs will likely make people less fearful of COVID-19, which may lead to lower demand for vaccine. In anticipation, the stocks of vaccine makers including

Moderna

MRNA

,

Novavax

NVAX

and BioNTech declined on Oct 1, following Merck’s study data readout.

Stocks in Focus

Here we present three stocks with oral COVID-19 therapies in their pipeline. These have the potential to gain success going forward.

Pfizer

PFE

Although Pfizer is currently the leading COVID-19 vaccine player, it is also developing an oral COVID-19 therapy. Successful development of its oral pill will help offset some potential loss in sales of its COVID-19 vaccine, if any.

Pfizer is currently developing its oral COVID-19 therapy candidate, PF-07321332, in a phase II/III study. Considering the faster development timeline for COVID-19 vaccine and therapies as seen since the start of 2020, the company may have study data to support an EUA submission in the upcoming months.

Pfizer shares have risen 16.6% so far this year compared with the

industry

’s increase of 8.6%.

Image Source: Zacks Investment Research

Pfizer has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Atea Pharmaceuticals

AVIR

Shares of Atea, which is also engaged in developing an oral pill to treat COVID-19, gained almost 20% following Merck’s robust study data readout. The company is developing an orally administered, novel antiviral agent, AT-527, in collaboration with Roche to treat mild or moderate COVID-19 in the outpatient setting in a phase III study. The companies are also developing the drug for hospitalized patients. Results from the late-stage study are expected by the end of this year. Atea has no approved product in its portfolio. Positive data followed by a potential authorization will likely drive the company’s shares significantly as it will be the first-approved product for Atea and also present a huge market opportunity.

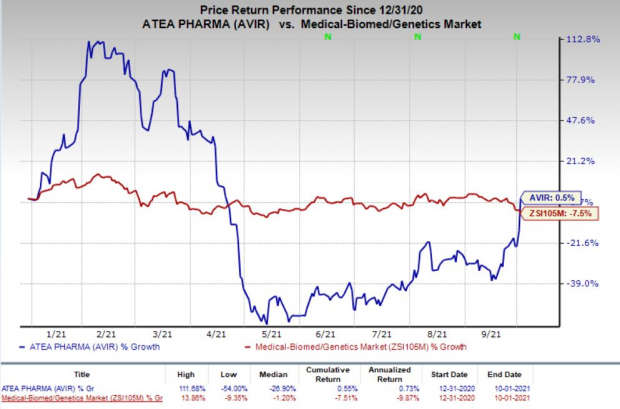

So far this year, shares of Atea have gained 0.5% against the

industry

’s 7.5% decrease.

Image Source: Zacks Investment Research

Atea has a Zacks Rank #3 (Hold).

Adamis Pharmaceuticals

ADMP

Shares of Adamis gained 4.1% on Oct 1 following Merck’s announcement. The company is also developing an oral COVID-19 treatment candidate, Tempol, in a phase II/III study in high-risk patients with early COVID-19 infection. The candidate was highlighted by the National Institutes of Health (NIH) as a promising treatment for COVID-19 based on potent antiviral activity in laboratory studies conducted by the NIH.

However, Adamis phase II/III study was initiated last month and EUA-supporting data may be available after a few months. Although Atea may lag in competition with Pfizer and Merck in the oral COVID-19 therapy space due to the late study data readout, the COVID-19 treatment market provides a significant market opportunity, which can help several players to gain. Moreover, the small size of the company may provide room for a strong upside on positive updates. Investors should remain focused on updates from the phase II/III study. The company may provide an update on its third-quarter earnings call expected next month.

The company’s stock has surged 108.2% so far this year against a decrease of 15.1% for the

industry

.

Image Source: Zacks Investment Research

Adamis has a Zacks Rank #3.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report