The pandemic has led to an exponential surge in the use of digital technologies due to the imposition of social-distancing norms and nationwide lockdowns. People and organizations all over the world have had to adjust to new ways of work and life. As the world went into a lockdown mode, digital adoption in the fields of education, health, jobs and many others got a boost. Gadgets have become an integral part of most people’s daily lives, whether for work, entertainment, or simply staying connected. This dependence on gadgets has led to increased incidents of Computer Vision Syndrome (CVS) or digital eye strain.

The longer screen times and the resulting rise in eye fatigue have given rise to the need to use vision correction and anti-fatigue glasses. This has driven sales of anti-fatigue and blue light canceling lenses, thereby resulting in overall market growth over the last one-and-a-half years.

Optical Care Market Prospects Widen in Pandemic

According to a WHO world report on vision (2019)

, nearly 2.2 billion people have vision impairment globally, out of which 1 billion have vision impairment that is yet to be addressed. Nearly 2.6 billion people suffer from myopia, while 1.8 billion suffer from presbyopia.

Per a report by RESEARCHANDMARKETS

, amid the COVID-19 crisis, the global market for eyeglasses is estimated at $139.90 billion for the year 2020 and is projected to reach $197.20 billion by 2027, at a CAGR of 5%.

The lenses market is projected to record a 4.8% CAGR and reach $76.9 billion by 2026. After an early analysis of the business implications of the pandemic and its induced economic crisis, growth in the Frames segment is readjusted to a 5.8% CAGR.

The growth can be attributed to rising consciousness among the population pertaining to different eye diseases such as myopia, hypermetropia, dry eye syndrome and astigmatism, among others. Also, growing prevalence of different ocular problems worldwide is expected to drive the market.

Stocks With Great Future Potential

The following four stocks offering optical care solutions are well-poised to gain amid growing demand for eye care products.

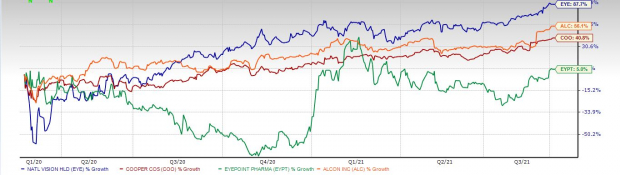

Price Performance Through the Pandemic

Image Source: Zacks Investment Research

Alcon Inc.

ALC

is our first pick. During second-quarter 2021, the company’s top line improved 74.8% from the year-ago number on improvements in the eye care market, led by strong recovery in the United States and varied paces of recovery in international markets from the COVID-19 pandemic. Total Vision Care (comprising Contact lenses and Ocular health) was up 49% year over year. The company continues to witness strong demand for Precision1, Systane and Pataday.

In August 2021, the company announced plans to launch TOTAL30 — the first-and-only monthly replacement, Water Gradient lens that feels like nothing, even on day 30. Alcon earlier noted about chances of the commercial availability of TOTAL30 sphere at the start of September 2021. In Europe, TOTAL30 will be rolled out to a limited number of countries in 2021, with full commercial availability in early 2022. Notably, the reusable lens account for an estimated 45% of the $9-billion global contact lens market. This opens up a huge opportunity for Alcon to grow in the reusable lens market.

The company currently carries a Zacks Rank #2 (Buy). You can see

the complete list of Zacks #1 Rank (Strong Buy) stocks here.

National Vision Holdings, Inc.

EYE

is our second pick. The company continues to gain on solid positive comparable store sales (comps) in eyeglasses. In the second quarter of 2021, adjustable comparable store sales growth was 76.6%. Eyeglass World witnessed a 67.6% increase and America’s Best saw an 81.8% rise. The Legacy segment recorded nearly a 58.2% comp increase. The pandemic-induced increased demand for low-cost eye exams, glasses and contact lenses contributed to making an outstanding second quarter. The contact lens category continued to see growth in average ticket as contact lens customers are increasingly adopting newer technology lenses that have higher prices — a trend expected to continue. National Vision has raised long-term projected whitespace opportunity by 300 stores to at least 2,150 locations (effective 2021). It expects the optical category in a post-COVID environment to remain ready for expansion.

The company currently carries a Zacks Rank #3 (Hold).

The Cooper Companies, Inc.

COO

is the third pick. The company’s CooperVision segment maintained its leading position in the markets of specialty lenses, supported by the highly exclusive products of Biofinity and Clariti. The company’s flagship silicone hydrogel lenses are also expected to continue delivering strong sales in the coming quarters as well. In the fiscal third quarter, MiSight and Ortho K grew 187% and 68%, respectively. Per management, on the basis of the current strength observed, the company anticipates this portfolio to rake in $65 million in revenues in fiscal 2021 and exceed $100 million in fiscal 2022. The company also witnessed substantial growth across CooperVision’s Toric, Multifocal, single-use sphere, Non-single use sphere sub units. Also, Silicone hydrogel dailies grew 31%, with MyDay and clariti performing well.

The company currently carries a Zacks Rank #3.

Last but not the least is

EyePoint Pharmaceuticals, Inc.

EYPT

. The company is focused on developing and commercializing therapeutics to help improve the lives of patients with serious eye disorders. Currently, the company has two commercial products: DEXYCU — the first approved intraocular product for the treatment of postoperative inflammation, and YUTIQ — a three-year treatment of chronic non-infectious uveitis affecting the posterior segment of the eye. The company continues to witness higher demand for both its commercial products. During second-quarter 2021, customer demand for YUTIQ rose by nearly 540 units and around 10,900 units for DEXYCU, reflecting an increase of 26% and 404%, respectively, from second-quarter 2020. Based on the continued momentum, the company continues to see solid customer demand for both products into the third quarter as well. Additionally, the company is making significant progress with the Phase 1 DAVIO trial for EYP-1901.

The company currently carries a Zacks Rank #3.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report