Energy companies recovered from last year when the coronavirus pandemic hit the global oil demand massively. Economies are now reopening with more people socializing and going to work, improving the outlook for fuel demand. This has bolstered optimism for oil players’ significant earnings generations in the second half of this year.

Recovering Oil Price

The price of West Texas Intermediate (WTI) crude, trading at more than $70 per barrel mark, has improved drastically from the pandemic-hit April 2020, when oil was in the negative territory. With the massive coronavirus vaccine rollout, the demand for fuel will possibly improve further. This has paved the way for more recovery in the oil price.

Recently, the price of WTI crude touched its six-year high mark briefly and then retreated. The volatility in the commodity price signifies the tensions within the OPEC cartel since there are possibilities of some producers in the block to boost production in the coming months. However, the volatility is not going to be a headwind. Notably, many analysts are expecting the cartel to reach a deal to gradually raise the output in the coming months, as higher production will match the increasing global consumption level.

Notably, the U.S. Energy Information Administration (“EIA”) expects a relatively balanced oil market for the second half of this year. This is because increasing production will stop the continuous draw in the global crude oil inventory, added EIA.

Impressive Earnings Outlook

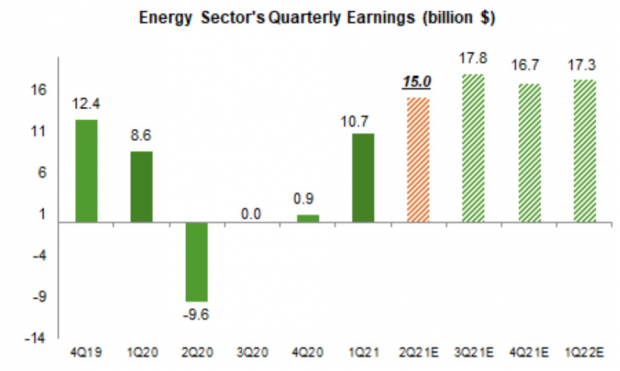

Soaring demand for fuel in the United States and other developed economies is improving energy companies’ earnings outlooks. Per the Zacks Earnings Trends report, the energy sector will likely generate respective earnings of $17.8 billion and $16.7 billion in the third and fourth quarters of 2021, suggesting massive improvements from the prior-year comparable quarters.

Image Source: Zacks Investment Research

Thus, most analysts are projecting fuel demand recovery to continue in the July-December period. Notably, the momentum started from the beginning of 2021 when countries commenced boosting their coronavirus vaccine arsenal to beat the pandemic. In the March-end quarter of this year, the energy sector generated earnings of $10.7 billion, improving from $8.6 billion in the prior-year quarter. Also, the energy sector is likely to generate earnings of $15 billion in the June-end quarter of this year, whereas it reported $9.6 billion losses in the prior-year quarter.

4 Stocks in the Spotlight

Given the backdrop that the energy sector is recovering and is poised to generate significant earnings in the second half; it would be an opportune moment for investors to include oil stocks in the portfolio. We have employed our proprietary

stock screener

to zero down four oil stocks. The companies currently sport a Zacks Rank #1 (Strong Buy) and are likely to generate impressive earnings in the third quarter and 2021. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Continental Resources, Inc.

CLR

is a leading producer of crude in the United States and, hence, is well-placed to cash in on the oil price rally. Notably, the company has a strong presence in the core of a prolific oil field — the Bakken play of North Dakota and Montana.

Along with the announcement of its first-quarter results, the company said that it expects to generate $3.1 billion of operating cashflow and $1.7 billion of free cashflow for this year, considering WTI crude trades at $60 per barrel. The projections suggest a significant year-over-year improvement from the last year’s $1.4-billion operating cashflow and $275-million free cashflow.

The stock has witnessed upward earnings estimate revisions for the third quarter and 2021 in the past seven days.

Oasis Petroleum Inc.

OAS

has positioned itself exclusively in the Williston Basin, following the sale of its Permian assets. Considering the robust inventory life along with the scale and size of its operations, the company expects significant value creations for its shareholders.

Notably, in the past seven days, the stock has witnessed upward earnings estimate revisions for the third quarter and 2021.

Earthstone Energy, Inc.

ESTE

is a leading upstream company, having a footprint in the core of the Midland Basin of west Texas and the Eagle Ford Trend of south Texas. By hedging 88% of 2021 oil production, the company is not exposed significantly to volatility in commodity prices.

In the past seven days, the stock has witnessed upward earnings estimate revisions for the third quarter and 2021.

Headquartered in Dallas, TX,

Matador Resources Company

MTDR

has a strong footprint in the liquid-rich Delaware Basin’s Wolfcamp and Bone Spring plays. The company is likely to see earnings growth of 560% and 366% in the third quarter and 2021, respectively.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report