Orthopedic device, an integral part of MedTech, has been on a gradual rebound following a pandemic-battered 2020. The opening up of the economy following the lifting of strict social-distancing norms and increased hospital visits with rush toward opting for earlier-deferred non-COVID procedures were vastly seen after the widespread vaccination drives. The orthopedic device subsector, which covers orthopedic implants, minimally-invasive surgeries and robotic surgeries, had been witnessing robust performances over the past few months after a pandemic-led hiatus in elective procedures.

However, the emergence of the highly-contagious Delta variant of coronavirus seems to again derail the growth trajectory of elective orthopedic surgeries.

Orthopedics’ Snapshot

After an impressive performance over the past few months where the key orthopedic players recorded improved patient volumes on the back of pent-up demand, the potential concerns over the emergence of new variants looms large. With increasing cases of infections with the Delta strain, patients are increasingly deferring their elective orthopedic surgeries as they fear getting infected with the latest potentially vaccine-resistant strain.

Not only patients, even hospitals are increasingly attending to COVID-19 patients, thereby pushing other admissions to the back. This is also likely to hamper sales of orthopedic implants of key orthopedic MedTech players by leading to lower procedure volumes.

Aggravating the fear of the Delta impact, key MedTech player

NuVasive, Inc.

NUVA

has voiced concerns. The company, during its second-quarter 2021 earnings call, confirmed that patient sentiment is a major factor that will determine elective procedure deferrals.

However, given the fact that a meaningful portion of this orthopedic sub-sector comprises essential, nondeferrable surgeries, the adverse business impacts are likely to be mitigated to some extent. Particularly, spine surgeries and trauma settings are expected to fetch business even amid the difficult pandemic situation. Market watchers are of the view that enabling technologies within orthopedic and spine are going to steal the limelight amid the difficult financial situation of the hospitals in the coming months.

Per a report published on Fortune Business Insights

, the global orthopedic devices market size was worth $53.44 billion in 2019 and is anticipated to reach $68.51 billion by 2027, at a CAGR of 6.6%. Factors like rising cases of osteoporosis and musculoskeletal diseases, increasing incidents of sports and traumatic injuries, and an expanding elderly population are expected to drive the market.

5 Stocks to Focus on

Here we have listed five orthopedic stocks that have an upside growth potential despite the looming concern over surging infection rates. Investors can turn their attention to these stocks, which can turn out to be prudent investment choices for long-term benefits.

OrthoPediatrics Corp.

KIDS

, in August, announced the continuation of its navigation partnership with Mighty Oak Medical, Inc., thereby extending its current five-year deal by another five years till August 2027. This Zacks Rank #2 (Buy) company, which has been the exclusive distributor of Mighty Oak Medical’s FIREFLY Technology in children’s hospitals across the United States, will be able to maintain that exclusivity through August 2027 via the extended agreement. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

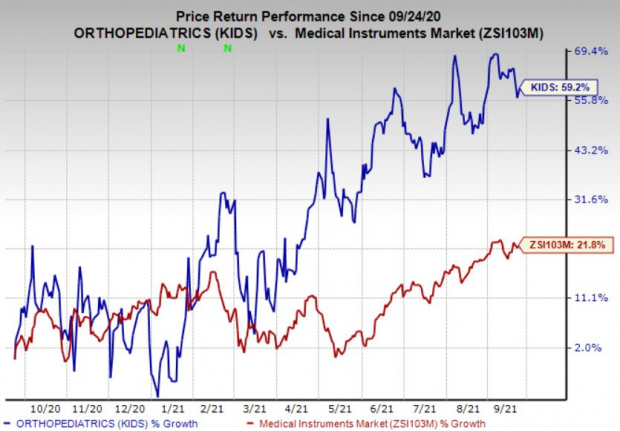

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2022 is pegged at 45.6%. The company is likely to report 2021 revenue growth of 39.6%. Over the past year, the stock has gained 59.2% compared with the

industry

’s 21.8% rise.

Global medical device company focused on spine and orthopedics,

Orthofix Medical Inc.

OFIX

, announced the full market launch of the Opus Mg Set osteoconductive scaffold, a synthetic magnesium-based bone void filler for orthopedic procedures, this month.

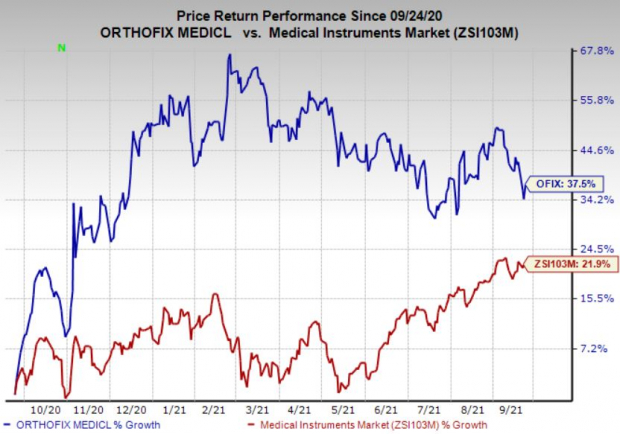

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2022 is pegged at 58.9%. The company is expected to report 2021 revenue growth of 16.1%. Over the past year, this Zacks Rank #2 company has gained 37.4% compared with the industry’s 21.8% rise.

Renowned MedTech player

Zimmer Biomet Holdings, Inc.

ZBH

along with Canary Medical (a medical data company) announced the FDA’s De Novo classification grant and authorization to market the tibial extension for Persona IQ, the world’s first and only smart knee cleared by the FDA for total knee replacement surgery, in August.

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 8.8%. The company is expected to report 2021 revenue growth of 15.4%. Over the past year, this Zacks Rank #3 (Hold) company has gained 10.3% compared with the

sector

’s 0.2% rise.

Stryker Corporation

SYK

, well-known medical technology company, announced robust second-quarter 2021 results along with strong segmental performance in July.

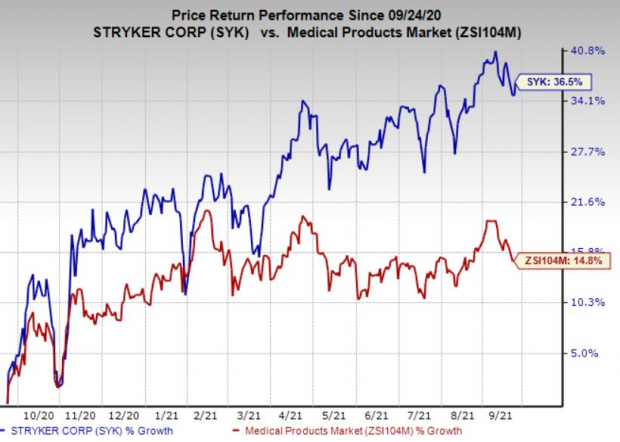

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 9.6%. This Zacks Rank #3 company is expected to report 2021 revenue growth of 20.7%. Over the past year, the stock has gained 36.5% compared with the

industry

’s 14.9% rise.

Renowned medical technology company,

SeaSpine Holdings Corporation

SPNE

, entered into a distribution agreement with OrthoPediatrics this month to exclusively distribute its 7D Surgical FLASH Navigation platform for pediatric applications.

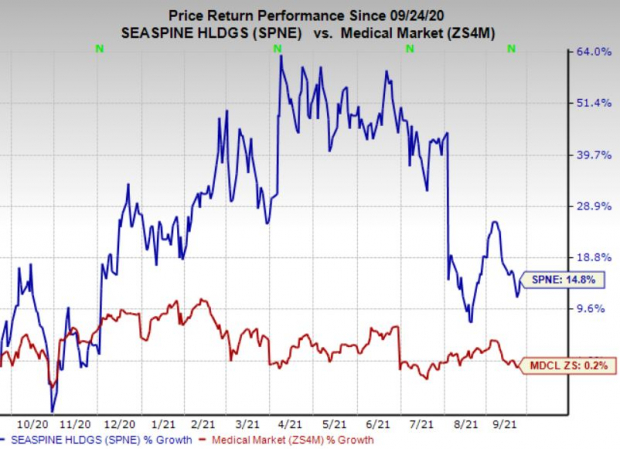

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2022 is pegged at 14.4%. The company is likely to report 2021 revenue growth of 31.1%. Over the past year, this Zacks Rank #3 company has gained 14.8% compared with the sector’s 0.2% rise.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report