Earnings season is upon us and initial estimates show that this will be another strong quarter for companies. But with most companies likely to benefit from easier comps, choosing the true winners can be tricky.

A basic strategy of sticking to Buy or Hold ranked stocks with positive earnings Expected Surprise Prediction (ESP) could help you identify those that are most likely to beat estimates. And usually, companies that beat estimates also see their prices appreciate over the next few months. So this gives you a chance to pick up some quick gains.

However, there’s also another way to make the most of earnings season. And that involves taking stock of the companies that have already reported. The companies that will have already reported at this time are the ones that have their quarters ending in April or May.

The stocks you’d want to pick are ones with strong upward revisions in estimates. Just make sure that they also have Zacks #1 (Strong Buy) or #2 (Buy) ranks, that they operate in attractive industries and have a VGM Score of A or B to increase your chances of success.

When such stocks are still undervalued, you can be sure that they are headed up. Here are a few examples-

Commercial Metals Company

CMC

Commercial Metals Company manufactures, recycles and markets steel, metal products and related materials and also offers related services.

The Zacks Rank #1 stock with a VGM Score of B operates in the attractive Steel – Producers industry, which is in the top 5% of Zacks classified industries.

After reporting strong results in the May quarter when reported earnings topped estimates by 28.4%, the Zacks Consensus Estimate for 2021 (ending August) jumped 20.6% while that for 2022 jumped 15.2%. The four-quarter average surprise is also attractive, at 17.5%. So this isn’t a one-off thing.

However, the shares are still trading at a 10.9X P/E multiple, which is well below the S&P average of 22.2X and also its own median value of 11.5X over the past year. So further upside seems likely.

GMS Inc.

GMS

Zacks #1 ranked GMS sells wallboard, suspended ceilings systems and complementary interior construction products used in commercial and residential buildings.

Since it is also a member of the Building Products – Retail industry, which is at the top 7% of Zacks-classified industries, there’s a strong likelihood of near-term share price appreciation.

Its VGM Score of A indicates that the stock suits value, growth and momentum investment styles.

The Zacks Rank is of course related to the company’s recent strong performance wherein it topped the Zacks Consensus Estimate by 25.9%, as well as the strong estimate revision action (the Zacks Consensus for fiscal 2022 ending in April is up 19.3% while that for 2023 is up 25.9%).

The fact that the last 4-quarter average surprise is 15.7% indicates that this is the continuation of an ongoing trend.

What’s more, the shares still look cheap at a forward P/E of just 9.7X (median 10.2X over the past year). For comparison, the S&P 500 is trading at 22.2X while the concerned industry is trading at 20.0X.

Earthstone Energy, Inc.

ESTE

Earthstone develops and operates oil and gas properties with primary assets in the Midland Basin of west Texas and the Eagle Ford trend of south Texas. Given recent pricing trends, the related industry (Oil and Gas – Exploration and Production – United States) is currently at the top 9% of Zacks-classified industries. The Zacks Rank #1 stock also has a VGM Score of B.

These factors in combination are a good enough indication of upside potential. But it’s also encouraging to note that the company topped The Zacks Consensus Estimate by 240% in the last quarter and that its four-quarter average surprise stands at 103.8%. Not only that – since the announcement of these strong results, its 2021 (ending December) estimate is up 22.4% while the 2022 estimate is up a whopping 56.0%.

Valuation also looks attractive with a forward P/E of 10.1X that remains well below its median value of 19.2X over the past year.

Smart Global Holdings, Inc.

SGH

Smart Global is a designer, manufacturer and supplier of electronic subsystems to OEMs in the computer, industrial, networking, telecommunications, aerospace and defense markets.

The Zacks Rank #1 stock, which belongs to the Electronics – Semiconductors industry (top 41%) has a VGM Score A.

The company reported strong results in the last quarter, beating estimates by 26.4%. This surprise was stronger than the four-quarter average of 12.2%, indicative of the momentum in its business. Analysts are also optimistic about the stock, raising the 2021 (ending August) estimate by 17.1% and the 2022 estimate by 13.5%.

Valuation remains attractive at 9.8X forward P/E, which is why the stock could be worth buying right now. Both the S&P 500 and the concerned industry look way more expensive.

Smith & Wesson Brands, Inc.

SWBI

This well-known provider of pistols, revolvers, rifles, handcuffs and other related products and accessories is ranked #1 by Zacks. The company belongs to the attractive Leisure and Recreation Products industry (top 9%), so the shares look set for appreciation. They also have a VGM Score of A, which generally indicates that investors would find them useful, irrespective of whether they are inclined toward value or growth investing or simply, momentum trading.

After the company topped April-quarter estimates by 59.8%, estimates were raised for 2022 and 2023 (ending April) by a respective 100.0% and 66.0%. The combined earnings surprise for the four preceding quarters is 58.9%, so demand doesn’t appear to be slowing down. Given the strong demand the company is seeing, further upward revisions certainly seem to be in the cards.

As far as valuation is concerned, the forward P/E of 6.5X makes the shares really cheap, both with respect to the S&P 500, which is trading at 22.2X and the industry, which is trading at 29.3X. They are also trading below their median level over the past year.

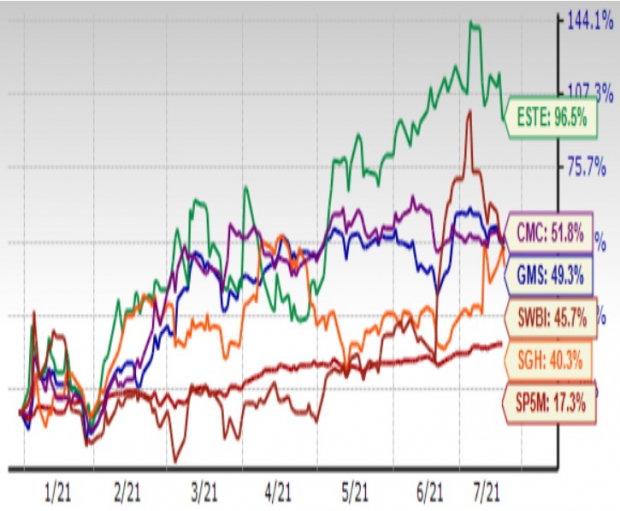

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report