Do You Have These Top Tech Stocks On Your March Watchlist?

Tech stocks led the broader market on this week’s opening bell. Evidently, the tech-heavy

Nasdaq Composite

saw gains of over 1.2% as the 10-year Treasury yield retreated from its 14-month high seen last week. Now, with investors rotating back into

tech stocks

, you might be in the market for some yourself. If anything, some of the top growth stocks now are tech stocks so I can understand if you are. This comes as no surprise because the applications across the broad tech industry are plentiful.

For example, companies like GoDaddy (

NYSE: GDDY

) and Shopify (

NYSE: SHOP

) help businesses establish their online presence amidst the pandemic. No doubt these services will continue to be a convenience to consumers even in a post-pandemic world. At the same time, tech companies can even complement each other’s offerings through collaborations. Case in point, Match Group’s (

NASDAQ: MTCH

) Tinder, is reportedly teaming up with ride-hailing company Lyft (

NASDAQ: LYFT

). Through this alliance, Tinder users will soon be able to gift Lyft rides to their dates within the mobile app.

In the larger scheme of things, the rapid development of new tech will likely continue regardless of most macro-environment changes. After all, the industry often adapts to meet the shifting needs of the times. With all that said, check out these four

top tech stocks

on investors’ radars now.

Best Tech Stocks To Watch This Week

-

Digital Turbine Inc.

(

NASDAQ: APPS

) -

Himax Technologies Inc.

(

NASDAQ: HIMX

) -

Box Inc.

(

NYSE: BOX

) -

Immersion Corporation

(

NASDAQ: IMMR

)

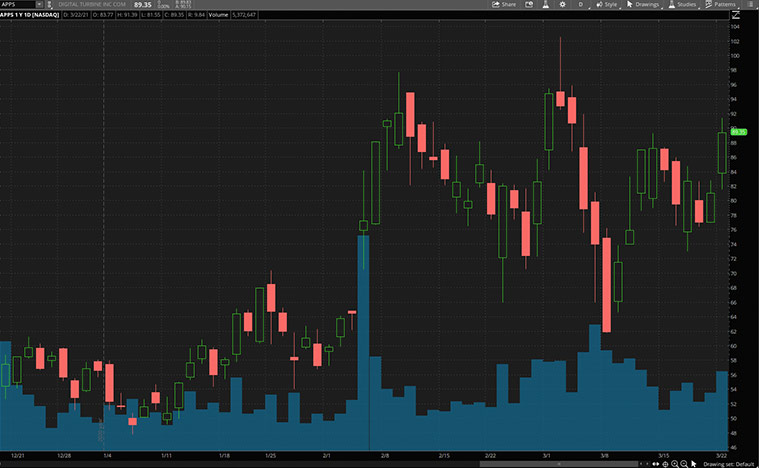

Digital Turbine Inc.

First up is content delivery software company, Digital Turbine. In short, the company operates via a media platform. Through the said platform, Digital Turbine simplifies content discovery and delivers relevant content directly to consumer devices. With Digital Turbine’s platform, organizations can boost user acquisition and engagement which helps monetize their content better. With most instances of user engagement happening in the digital medium, Digital Turbine’s services would be relevant now. This would especially be the case as its clients focus on refining their digital consumers’ experience. Notably, APPS stock has skyrocketed by over 2,000% in the past year. In fact, the company’s shares surged by over 10% during intraday trading yesterday after news of its latest acquisition broke.

Before the opening bell, Digital Turbine revealed that it is now involved in a definitive purchase agreement. Said agreement is to acquire 95% of the shares in Fyber N.V., a leading mobile advertising monetization platform. Namely, Fyber helps global app developers optimize profitability through quality advertising. This is a major deal for Digital Turbine, bolstering its media and advertising solutions in the long run. In terms of scale, the company is acquiring access to Fyber’s massive network of programmatic partners. The likes of which boast a total of 650 million monthly active users across 180 countries globally. According to Digital Turbine, this deal would see it become a leading end-to-end solution for mobile brand acquisition and monetization. Would you say this makes APPS stock worth watching now?

Read More

-

Top 5 Things To Watch In The Stock Market This Week

-

Nio (NIO) VS Xpeng (XPEV): Which Of These Electric Vehicle Stocks Is A Better Buy?

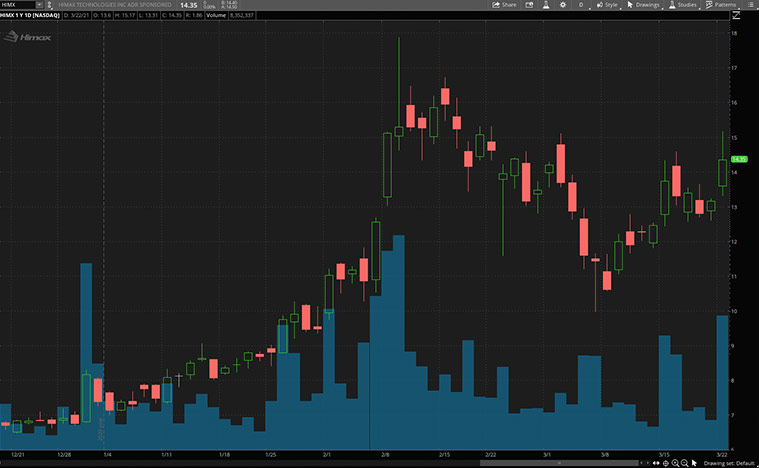

Himax Technologies Inc.

Next, Himax Technologies is a supplier and fabless semiconductor manufacturer. Particularly, the Taiwan-based company’s products are used in display processing tech. Himax’s end markets consist of handheld consumer electronics, car navigation displays, and even virtual reality (VR) devices. With over 3,000 tech patents across three continents, Himax is a global leader in the display processing semiconductor market. Given the current pent-up demand for semiconductors worldwide, Himax would be a go-to for tech investors. Likewise, investors have been flocking to HIMX stock which has doubled in value just this year.

On the operational front, the company has also been hard at work. Last week, Himax announced a development to its Artificial Intelligence of Things (AIoT) platform. Before diving into the details, what is AIoT? Simply put, it is the combination of artificial intelligence (AI) tech with the Internet of Things (IoT) infrastructure. AIoT tech facilitates more efficient IoT operations and improves human-machine interactions while enhancing data management and analytics. The platform has recently received Microsoft (

NASDAQ: MSFT

) Azure’s IoT Plug n Play certification. Following that, Himax’s platform is now listed in the Azure Certified Device Catalog. For one thing, this would boost Himax’s overall market reach significantly. With its platform gaining new recognition, will you be watching HIMX stock now?

[Read More]

Looking For The Top Biotech Stocks To Watch This Week? 4 To Watch

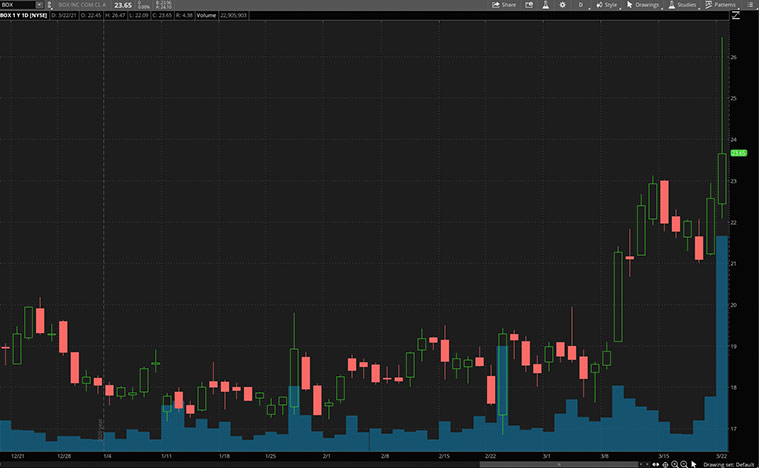

Box Inc.

Following that, we have Box. In brief, Box offers cloud content management and file-sharing services to clients of varying sizes. The company’s platform enables organizations to accelerate business processes, power workplace collaboration, and protect valuable information. In terms of clients, Box caters to leading organizations globally. The likes of which include AstraZeneca (

NASDAQ: AZN

), General Electric (

NYSE: GE

), and Morgan Stanley (

NYSE: MS

). Given Box’s current position in the quickly growing enterprise software industry, investors could be eyeing BOX stock. This could be the case seeing as BOX stock closed yesterday at a 2-year high. Possibly, this could be in response to the latest news regarding the company.

According to Reuters, the company is supposedly looking to be acquired. The report mentions that Box has discussed a potential deal with several interested buyers. On top of that, investment firm D.A. Davidson released a positive note on BOX stock after the news broke. The firm suggests that BOX stock may be worth over $34 in the case of a takeover. Should this be the case, it would mark a 43% premium over BOX stock’s current price of $23.65 a share. To this end, would you consider adding BOX stock to your watchlist?

[Read More]

Making A List Of The Best Software Stocks To Buy? 4 To Consider

Immersion Corporation

Immersion is another tech company that is making waves right now. For some context, the company develops and licenses touch feedback technology. Tech enthusiasts would better know this as haptic tech. For one thing, Immersion’s sensory tech is part of a booming industry. Whether it is through gaming consoles, automobiles, or smartphones, Immersion’s products enable more interactive experiences for consumers. According to the company, its tech is supposedly found in over 3 billion devices worldwide. Specifically, the company’s haptic feedback product is also part of Sony’s (

NYSE: SNE

) PlayStation 5 gaming console. With the high demand for the console throughout the pandemic, IMMR stock would be on the radar now. The question is, can it keep up its momentum in a post-pandemic world?

Well, the company has been expanding the applications of its tech as well. Earlier this month, Immersion revealed a new partnership with VR peripheral manufacturer StrikerVR. The duo will be working on producing consumer gaming peripherals. In theory, this would be another new frontier in the video game industry. Why? Well, Immersion’s tech would introduce a tactile element to conventional VR gaming. Additionally, the company is also currently working with French automobile manufacturing giant, Faurecia. This would allow Immersion to benefit from the growing adoption of smart technology in the latest automobiles as well. With Immersion firing on all cylinders now, could IMMR stock flourish this year?