Pacira BioSciences, Inc.

PCRX

reported second-quarter 2021 earnings of 77 cents per share, beating the Zacks Consensus Estimate of 76 cents. The company reported earnings of 12 cents per share in the year-ago quarter.

Total revenues surged 79.6% to $135.6 million in the second quarter of 2021 from the year-earlier figure of $75.5 million, owing to strong uptake of Exparel. The top line also surpassed the Zacks Consensus Estimate of $134 million.

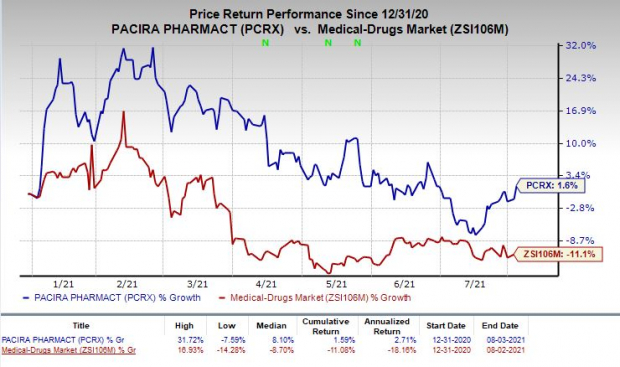

Shares of Pacira were up 2.7% on Tuesday following the announcement of better-than-expected earnings results. The stock has rallied 1.6% so far this year against the

industry

’s decrease of 11.1%.

Image Source: Zacks Investment Research

Quarter in Detail

Pacira’s top line mainly comprises of product revenues, other product sales and royalty revenues.

Exparel net product sales were $130.1 million, up 78.2% from $73 million generated in the year-ago quarter. Sale of the drug also increased 13.4% on a sequential basis.

Exparel/bupivacaine liposome injectable suspension sales came in at $1 million in the reported quarter compared with $0.8 million in the year-ago quarter. Exparel is a liposome injection of bupivacaine, indicated for a single-dose administration into the surgical site to produce postsurgical analgesia. Iovera system generated sales worth $3.8 million in the second quarter of 2021, reflecting a sequential increase of 15.1%.

Royalty revenues came in at $0.7 million in the reported quarter compared with $0.3 million reported in the year-ago quarter.

Research and development (R&D) expenses (excluding stock-based compensation) declined approximately 8.2% to $11.2 million.

Selling, general and administrative (SG&A) expenses (excluding stock-based compensation) increased around 17.4% year over year to $43.1 million in the reported quarter.

2021 Outlook

Pacira is not providing guidance for 2021 due to the COVID-19 pandemic still negatively impacting sales. As a result, it is reporting monthly intra-quarter unaudited net product sales until the company gains enough visibility around the impacts of COVID-19.

Recent Updates

In July 2021, the FDA approved Pacira’s enhanced manufacturing process for Exparel at a custom facility in Swindon, England under a partnership with Thermo Fisher Scientific Pharma Services. The company plans to start selling products manufactured at this suite later in 2021.

In May 2021, Pacira announced top-line data from the phase III STRIDE study which evaluated Exparel as a lower-extremity nerve block. In the study, Exparel did not demonstrate statistical significance of cumulative pain reduction from zero to 96 hours versus bupivacaine HCl – the primary endpoint of the study.

However, treatment with Exparel did demonstrate statistical significance versus bupivacaine HCl of reducing cumulative pain scores from 24 to 96 hours post-surgery and total opioid consumption from 24 to 96 hours post-surgery – the secondary endpoints. Exparel also achieved statistical significance versus bupivacaine HCl for area under the curve cumulative pain scores from 12 to 96 hours.

In March 2021, the FDA

approved

Pacira’s supplemental new drug application (sNDA) seeking approval of Exparel for use in children aged six years and above. The label expansion should boost Exparel sales in the future quarters.

Pacira BioSciences, Inc. Price, Consensus and EPS Surprise

Zacks Rank & Stocks to Consider

Pacira currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the same sector include

CanFite Biopharma Ltd

CANF

,

Ironwood Pharmaceuticals, Inc.

IRWD

and

Theravance Biopharma, Inc.

TBPH

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

CanFite Biopharma’s loss per share estimates have narrowed 26.8% for 2021 and 48% for 2022 over the past 60 days. The stock has soared 16.8% year to date.

Ironwood’s earnings estimates have been revised 3.8% upward for 2021 and 1.7% upward for 2022 over the past 60 days. The stock has rallied 14.2% year to date.

Theravance’s loss per share estimates have narrowed 5.2% for 2021 and 11.6% for 2022 over the past 60 days. The stock has rallied 50% year to date.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released

Century of Biology: 7 Biotech Stocks to Buy Right Now

to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report