ACADIA Pharmaceuticals Inc.

ACAD

reported second-quarter 2021 loss of 27 cents per share, narrower than the Zacks Consensus Estimate of a loss of 30 cents. In the year-ago quarter, the company reported a loss of 27 cents.

Total revenues, comprising net sales of ACADIA’s only marketed drug, Nuplazid (pimavanserin), increased 5% year over year to $115.2 million in the second quarter, driven by sequential and year-over-year volume growth. However, the top line missed the Zacks Consensus Estimate of $127 million.

Nuplazid is the first and only FDA-approved treatment of hallucinations and delusions associated with Parkinson’s disease psychosis.

Quarter in Detail

Research and development (R&D) expenses were $56.9 million in the quarter, down 11.5% from the year-ago period on decreased development costs related to Nuplazid label expansion studies.

Selling, general and administrative (SG&A) expenses rose 14.8% year over year to $96.8 million due to higher costs associated with advertising and promotion, and stock-based compensation expenses.

As of Jun 30, 2021, ACADIA had cash, cash equivalents and investments worth $556.9 million compared with $577.8 million as of Mar 31, 2021.

2021 Guidance

Owing to the continuing negative impact of the COVID-19 pandemic, ACADIA lowered its financial guidance for 2021. Nuplazid net sales are now expected in the range of $480-$515 million for 2021, compared with the earlier projection of $510-$550 million. The Zacks Consensus Estimate for the metric stands at $524.3 million.

Per the company, fewer Parkinson’s disease patient office visits and lower occupancy rates at long-term care facilities, and a revised gross-to-net expectation of around 20% compared with prior expectation of high teens also resulted in the guidance to be reduced. This might have hurt investors’ sentiments, resulting in ACADIA’s stock to fall 8.8% in after-hours trading on Wednesday.

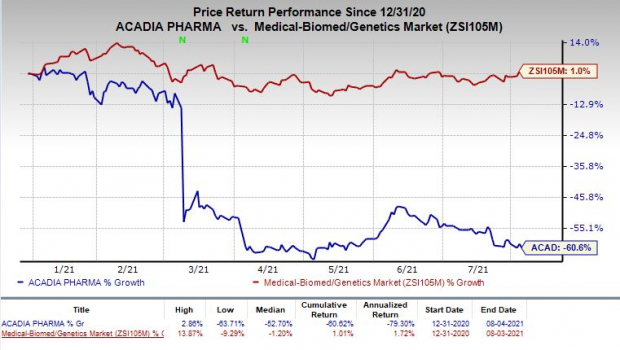

The stock has plunged 60.6% so far this year against the

industry

’s increase of 1%.

Image Source: Zacks Investment Research

The company also lowered its expectation for R&D expenses to the range of $250-$270 million band, which was earlier expected to be within $280-$300 million. SG&A expense guidance for the full year is expected to be in the range of $385-$415 million, unchanged from the previous guidance.

Pipeline Updates

Several additional studies on Nuplazid targeting different central nervous system (“CNS”) indications are currently underway.

Along with its earnings release, ACADIA announced that it has completed a Type A End of Review meeting related to the FDA’s complete response letter (“CRL”) for its supplemental new drug application (sNDA) seeking an approval for the label expansion of Nuplazid to treat hallucinations and delusions associated with dementia-related psychosis (“DRP”).

At the meeting, the FDA stated that Nuplazid should be studied by individual subgroups of dementia, and advised the company to conduct an additional clinical study in each of the subgroups. ACADIA plans to have another meeting with FDA authorities later this year.

In April 2021, the FDA

issued

a CRL to ACADIA’s sNDA for Nuplazid to treat hallucinations and delusions associated with DRP. Earlier in March, the FDA identified deficiencies in the sNDA, seeking an approval for Nuplazid to address the DRP indication.

Other studies on Nuplazid include the phase III ADVANCE study for treating negative symptoms of schizophrenia. The drug is also being evaluated in the phase III CLARITY study as an adjunctive treatment for major depressive disorder.

This apart, ACADIA completed enrollment in the phase III LAVENDER study evaluating its pipeline candidate trofinetide for the treatment of Rett syndrome, a rare neurodevelopmental congenital CNS disorder for girls aged between five and 20 years. Top-line data from the same is expected in the fourth quarter of 2021.

During the second quarter of 2021, the company initiated a phase II study evaluating ACP-044 for pain associated with osteoarthritis. In March 2021, ACADIA initiated a phase II study on ACP-044 for treating postoperative pain following bunionectomy surgery. Top-line data from the same is expected in the fourth quarter of 2021.

Zacks Rank & Stocks to Consider

ACADIA currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include

Bio-Techne Corporation

TECH

,

Spero Therapeutics, Inc.

SPRO

and

Cocrystal Pharma, Inc.

COCP

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Bio-Techne’s earnings estimates have been revised 0.2% upward for 2021 and 1.7% upward for 2022 over the past 60 days. The stock has rallied 53.3% year to date.

Spero Therapeutics’ loss per share estimates have narrowed by 1% for 2021 and 2% for 2022 over the past 60 days.

Cocrystal Pharma’s loss per share estimates have narrowed by 13.3% for 2021 and 11.7% for 2022 over the past 60 days.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report