Paratek Pharmaceuticals, Inc.

PRTK

announced that the FDA has granted an Orphan Drug designation to its sole marketed drug, Nuzyra (omadacycline), for the treatment of infections caused by Nontuberculous Mycobacteria (“NTM”).

The Orphan Drug designation is granted to drugs that are capable of treating rare diseases that affect less than 200,000 people in the United States. This tag also makes the company entitled to certain other benefits, including tax credits related to clinical trial expenses, an exemption from the FDA user fee and marketing exclusivity upon potential approval.

Per the press release, the above Orphan Drug tag includes NTM pulmonary disease caused by Mycobacterium abscessus complex (MABc), for which a phase IIb study on Nuzyra is currently ongoing.

The placebo-controlled phase IIb study is evaluating Nuzyra monotherapy for treating patients with M. abscessus pulmonary disease who are in the early phase of treatment and are not taking other antibiotics. The primary endpoints of the study are to check the improvement in symptoms, and safety and tolerability following 12 weeks of treatment.

Per the company, pulmonary infections caused by M. abscessus affect around 11,500 patients in the United States. Currently, there is no FDA-approved antibiotic therapy for the indication. Hence, if successfully developed and upon potential approval, Nuzyra can provide a new treatment option for the given patient population.

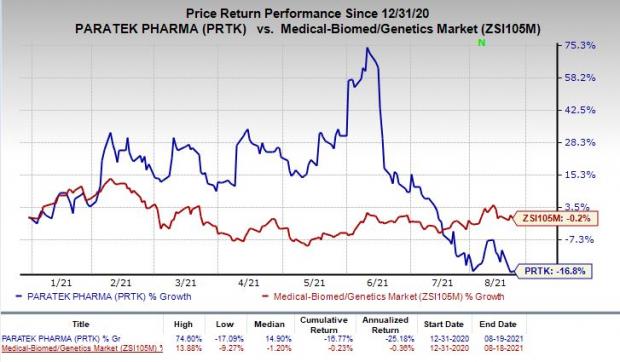

Shares of Paratek have plunged 16.8% so far this year compared with the

industry

’s decrease of 0.2%.

Image Source: Zacks Investment Research

We remind investors that Nuzyra is currently marketed as a once-daily antibiotic with both oral and intravenous formulations, for the treatment of community-acquired bacterial pneumonia and acute bacterial skin and skin structure infections.

Nuzyra generated sales worth $66 million in the first half of 2021, reflecting a significant increase year over year. Potential label expansions to treat other indication will boost the drug’s sales in the days ahead.

We note that, in 2019, the Biomedical Advanced Research and Development Authority (“BARDA”) awarded a contract to Paratek for up to $284.5 million to support the development and manufacturing of Nuzyra in the United States for the treatment of pulmonary anthrax. During the second quarter of 2021, the BARDA accepted the first procurement of Nuzyra, valued at $37.9 million.

Zacks Rank & Stocks to Consider

Paratek currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include

Repligen Corporation

RGEN

,

Corvus Pharmaceuticals, Inc.

CRVS

and

Vertex Pharmaceuticals Incorporated

VRTX

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Repligen’s earnings estimates have been revised 22.1% upward for 2021 and 17.9% upward for 2022 over the past 60 days. The stock has surged 32.9% year to date.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 24.4% for 2021 and 21.4% for 2022, over the past 60 days.

Vertex’s earnings estimates have been revised 10.2% upward for 2021 and 6.4% upward for 2022 over the past 60 days.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report