Trillium Therapeutics Inc.

TRIL

entered into a definitive agreement with pharma giant

Pfizer

PFE

, whereby it will be acquired by the latter.

Per the terms, Pfizer will acquire all outstanding shares of Trillium for an equity value of $2.26 billion, or $18.50 per share, in cash. The offer price represents a premium of 203.8% to Trillium’s closing price on Aug 20.

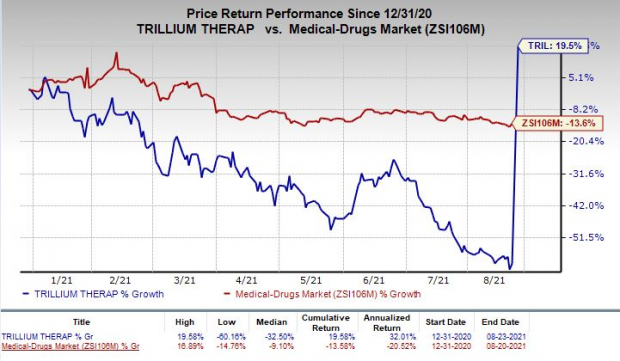

Shares of Trillium were up 188.8% on Monday following the announcement of the news. In fact, the stock has rallied 19.5% so far this year against the

industry

’s decline of 13.6%.

Image Source: Zacks Investment Research

The above acquisition is expected to close upon court and regulatory approvals, as well as upon meeting other customary closing conditions. The acquisition is also likely to give Trillium a chance to globalize its portfolio with help of Pfizer’s global reach and deep expertise in oncology.

For Pfizer, the acquisition is expected to strengthen its hematology portfolio with the addition of Trillium’s next-generation immuno-therapeutics targeting hematological malignancies.

Shares of Pfizer have rallied 35.7% so far this year compared with the

industry

’s rise of 19.3%.

Image Source: Zacks Investment Research

Trillium’s cancer portfolio includes two lead molecules, TTI-622 and TTI-621, which are currently being evaluated in phase Ib/II studies targeting several cancer indications, with primary focus on hematological malignancies.

Per the company, both TTI-622 and TTI-621 block the signal-regulatory protein α -CD47 axis – a key immune checkpoint in hematological malignancies. The candidates are designed to increase the ability of patients’ innate immune system to detect and destroy cancer cells.

Both TTI-622 and TTI-621, as monotherapies, have demonstrated encouraging activity in relapsed or refractory lymphoid malignancies, including diffuse large b-cell lymphoma, peripheral t-cell lymphoma, follicular lymphoma and other lymphoid malignancies in clinical studies to date.

Zacks Rank & Stocks to Consider

Trillium currently carries a Zacks Rank #4 (Sell) while Pfizer carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the healthcare sector include

Galmed Pharmaceuticals Ltd.

GLMD

and

Avenue Therapeutics, Inc.

ATXI

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Galmed Pharmaceuticals’ loss per share estimates have narrowed 7.7% for 2021 and 5.6% for 2022, over the past 60 days.

Avenue Therapeutics’ loss per share estimates have narrowed 3.7% for 2021 and 2.6% for 2022, over the past 60 days.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report