Ultragenyx Pharmaceutical Inc.

RARE

, along with partner GeneTx Biotherapeutics LLC, a privately-held biotechnology company, announced that they have dosed the first patient in a phase I/II study in Canada, evaluating GTX-102 for the treatment of Angelman syndrome, a rare neurogenetic disorder. Three other patients have been enrolled and scheduled for dosing.

The open-label, multiple-dose study is investigating the safety, tolerability and efficacy of GTX-102 in pediatric patients with Angelman syndrome having genetically confirmed diagnosis of full maternal UBE3A gene deletion.

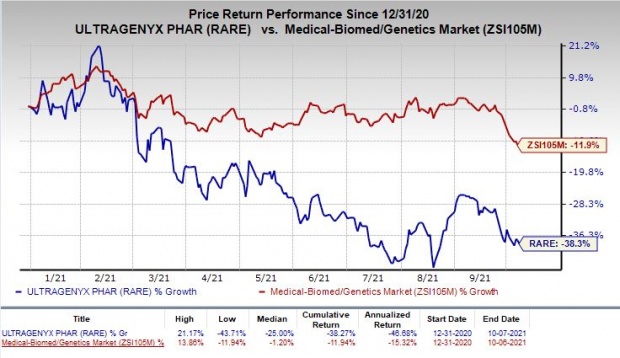

Shares of Ultragenyx have plunged 38.3 % so far this year compared with the

industry

’s decrease of 11.9%.

Image Source: Zacks Investment Research

Earlier this year, Health Canada cleared a protocol amendment and the Medicines and Healthcare Products Regulatory Agency in the United Kingdom approved a Clinical Trial Application to initiate the phase I/II study on GTX-102 in the two countries, respectively.

Per the approved protocol in the United Kingdom and Canada, 12 patients will be enrolled in the study and split into two cohorts according to their age. Patients aged between four to less than eight years will be enrolled in the cohort 4 and receive GTX-102 (3.3 mg). Patients aged between eight to less than 18 years will be enrolled in the cohort 5 and receive GTX-102 (5 mg). A preliminary update on the same is expected by the end of 2021.

We remind investors that in October 2020, Ultragenyx announced interim data from the phase I/II study on GTX-102 for treating Angelman syndrome. Back then, the companies decided to cease enrollment and dosing in the study after all patients experienced a serious adverse event of lower extremity weakness related to local inflammation, following treatment with the highest doses of GTX-102.

Last month, the FDA removed the clinical hold from Ultragenyx and GeneTx’s phase I/II study evaluating GTX-102 for the treatment of Angelman syndrome. The companies can now begin dosing naïve patients in the same for treating pediatric patients with Angelman syndrome.

Zacks Rank & Stocks to Consider

Ultragenyx currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector include

vTv Therapeutics Inc.

VTVT

,

Gritstone bio, Inc.

GRTS

and

Evelo Biosciences, Inc.

EVLO

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

vTv Therapeutics’ loss per share estimates have narrowed 8% for 2021 and 2.8% for 2022 over the past 60 days.

Gritstone bio’s loss per share estimates have narrowed 26.1% for 2021 and 31.8% for 2022, over the past 60 days. The stock has skyrocketed 142.7% year to date.

Evelo Biosciences’ loss per share estimates have narrowed 0.4% for 2021 and 3.5% for 2022, over the past 60 days.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report