As part of this year’s holiday season,

Turtle Beach Corporation

HEAR

recently announced that its brands have unveiled an avant-garde line-up of products. These include keyboards, mice, microphones and console gaming headsets, which are considered ideal for content creators and gaming enthusiasts. HEAR’s notable brands are Turtle Beach, Neat Microphones and ROCCAT.

It is quite evident that the Covid-19 pandemic has triggered a sudden surge in demand for consoles and video games. Against this backdrop, HEAR’s 2021 robust and augmented product portfolio is likely to further strengthen its commitment to introducing industry-leading features by consistently leveraging its in-depth expertise to drive innovation in the global market.

Turtle Beach’s line-up of wireless gaming headsets has been highly appreciated by customers. With cutting-edge gaming audio technology, the Turtle Beach brand has introduced an award-winning suite of gaming accessories — Recon 70 ($39.95), Recon 200 Gen 2 ($59.95), Recon 500 ($79.95), Stealth 600 Gen 2 ($99.95), Stealth 700 Gen 2 ($149.95), Recon Controller for Xbox ($59.95) and VelocityOne Flight ($379.95).

ROCCAT has launched Elo X Stereo ($49.99), Elo 7.1 USB ($69.99), Elo 7.1 Air ($99.99), Syn Pro Air ($149.99), Kone Pro ($79.99), Kone Pro Air ($129.99), Magma ($59.99), Pyro ($99.99), Vulcan Pro ($199.99), Vulcan TKL Pro ($159.99), Torch ($99.99), Sense Mousepads and Bundles (prices subjected to size and style) and Dr Disrespect Limited Edition Products collection.

Meanwhile, Neat Microphones unveiled Skyline ($69.99), King Bee II ($169.99), Worker Bee II ($99.99) and Bumblebee II ($99.99). Out of these products, Worker Bee II and Bumblebee II are slated to launch on Dec 6 and Dec 13, respectively. The Worker Bee II microphone is currently available for pre-order from participating retailers like American Music Supply and zZounds.

In early 2021, the company acquired Neat Microphones — the maker of high-quality digital USB and analog microphones. Neat has launched more than 60 products since founding Blue Microphones in 1995. The acquisition facilitated HEAR’s entry into the $2.3 billion global microphone market.

It also expanded the audio technology company’s total addressable market for its brands from $5.1 billion to $7.4 billion. HEAR has added almost 40 Neat patents and 70 Neat trademark registrations to its portfolio due to the buyout. In 2021, Neat plans to launch updated versions of some of its popular analog and digital microphones. The company is developing the next-gen products to meet the growing demand for high-quality, affordable microphones.

Driven by such a stellar product and high-quality equipment line-up, Turtle Beach’s solid market share on the back of a booming consumer electronics environment is likely to benefit the White Plains, NY-based audio technology company with record 2021 sales ahead of the holiday season.

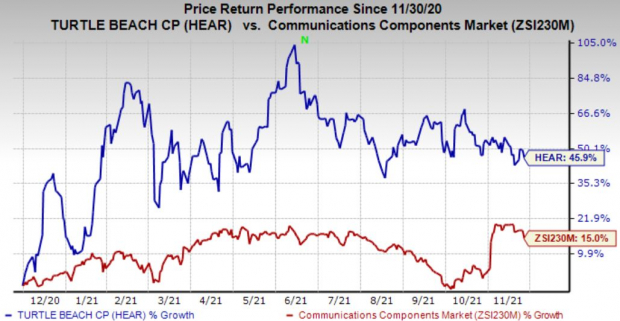

HEAR currently has a Zacks Rank #4 (Sell). Its shares have returned 45.9% compared with the

industry

’s growth of 15% in the past year.

Image Source: Zacks Investment Research

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Harmonic, Inc.

HLIT

is a better-ranked stock in the industry, sporting a Zacks Rank #1. The consensus estimate for current-year earnings has been revised 23.1% upward over the past 30 days.

Harmonic delivered a trailing four-quarter earnings surprise of 61.1%, on average. The stock has appreciated 64.2% in the past year. HLIT has a long-term earnings growth expectation of 15%.

Clearfield, Inc.

CLFD

also flaunts a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised 8.8% upward over the past 30 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.8%, on average. It has surged 172.2% in the past year.

Qualcomm Incorporated

QCOM

is another solid pick for investors, carrying a Zacks Rank #2 (Buy). The consensus estimate for current-year earnings has been revised 14.1% upward over the past 30 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 11.2%, on average. It has gained 19.4% in the past year. QCOM has a long-term earnings growth expectation of 15.3%.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report