SeaSpine Holdings Corporation

SPNE

announced the complete commercial launch of its Admiral ACP System for anterior cervical discectomy and fusion (ACDF) procedures. Admiral ACP features the next generation of anterior cervical plating. The same was intended to strike the best balance between strength, profile and construct rigidity.

Notably, the next-generation Admiral ACP System is part of the largest section in the estimated $1.30-billion cervical spine surgery market. The latest system marks another instance of SeaSpine’s commitment to launch best-quality spinal implant systems.

More on Admiral ACP System

Admiral ACP System is intended to be utilized as a fixation for ACDF procedures in combination with SeaSpine’s interbody offerings, including 3D-printed Waveform C and Shoreline RT, featuring NanoMetalene surface technology and Reef Topography.

Admiral ACP System features 1-5 level plating options with several crossover sizes, allowing surgeons to intraoperatively handle specific surgical requirements.

Significance of the Admiral ACP System

Per management, Admiral ACP System is the most versatile and robust ACDF system. This system is expected to be a significant growth driver for SeaSpine.

Image Source: Zacks Investment Research

Admiral ACP System’s differentiated plate features together with step-eliminating advanced instrumentation work effortlessly in surgeons’ hands to build a more efficient and consistent ACDF experience.

Industry Prospects

Per a report by MARKETSANDMARKETS

, the global spinal implants and surgery devices market is projected to reach $13.80 billion by 2025 from $10.30 billion in 2019, witnessing a CAGR of 5%.

Advancements in spine surgery technologies, the growing incidence of spinal disorders, the launch of advanced bone grafting products, and the rising adoption of minimally invasive spine surgeries are the factors driving the market.

Recent Developments

In November 2021, SeaSpine announced the limited commercial launch and completion of the first surgeries of the Mariner MIS Wayfinder System. Mariner MIS Wayfinder is a one-step, k-wireless screw delivery system for pedicle screw fixation. It eliminates the dependence on traditional guidewires for percutaneous screw placement by offering a fully-integrated, surgeon-led solution that allows real-time feedback.

In October 2021, SeaSpine announced the full commercial roll-out of its NorthStar OCT Posterior Cervical Fixation System, representing the company’s first fully commercial launch of a new posterior cervical system since 2007. The system offers a differentiated and stronger product offering to tackle a market segment estimated to exceed $250 million in the United States alone.

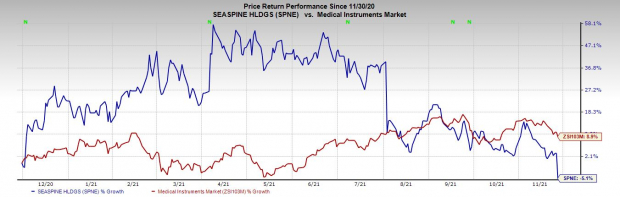

Price Performance

Shares of the company have lost 5.1% in a year against the

industry

’s rise of 8.9%.

Zacks Rank and Stocks to Consider

SeaSpine currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks from the broader medical space are

Chemed Corporation

CHE

,

Laboratory Corporation of America Holdings

, or LabCorp

LH

and

Medpace Holdings, Inc.

MEDP

, each presently carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemed has a long-term earnings growth rate of 7.7%. CHE surpassed earnings per share (EPS) estimates in three of the trailing four quarters and missed in one, delivering a surprise of 5.6%, on average.

Chemed has outperformed its industry over the past year. CHE has gained 1.1% against the industry’s 41.6% decline.

LabCorp reported a third-quarter 2021 adjusted EPS of $6.82, which surpassed the Zacks Consensus Estimate by 42.9%. LH’s revenues of $4.06 billion outpaced the Zacks Consensus Estimate by 13.4%.

LabCorp has an estimated long-term growth rate of 10.6%. LH surpassed estimates in the trailing four quarters, the average surprise being 25.7%.

Medpace reported third-quarter 2021 adjusted EPS of $1.29, surpassing the Zacks Consensus Estimate by 20.6%. MEDP’s revenues of $295.57 million beat the Zacks Consensus Estimate by 1.2%.

Medpace has an estimated long-term growth rate of 16.4%. MEDP surpassed estimates in the trailing four quarters, the average surprise being 11.9%.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report