Wall Street has been suffering from extreme volatility since Black Friday when the news of a new variant of coronavirus – Omicron – hit global financial markets. All the major stock indexes have suffered due to regular market fluctuations. However, small-cap stocks have suffered the most as the rapid spread of Omicron is likely to hit small businesses hard.

Nevertheless, despite severe volatility in the past six trading sessions, a few small-cap stocks have popped defying market’s downtrend. Investment in such stocks with a favorable Zacks Rank should reap returns going forward. We have selected five such stocks. These are:

Build-A-Bear Workshop Inc.

BBW

,

REX American Resources Corp.

REX

,

Medallion Financial Corp.

MFIN

,

First Community Corp.

FCCO

and

Sensus Healthcare Inc.

SRTS

.

Small-Caps Suffer the Most

Small cap stocks suffered the most during the pandemic-ridden 2020. Given their small-scale of operations, these businesses are generally cash-starved. These companies operate on a thin profit margin and most new businesses will take time to achieve profitability. Moreover, these organizations; virtually have no geographical diversification and depends on U.S. consumers.

Consequently, the normal functioning of the U.S. economy is essential for small businesses. These companies survived 2020 due to unprecedented fiscal and monetary stimulus measures by the U.S. government and Fed. Therefore, Fed Chairman Jerome Powell’s recent statement that hints at the possibility of the central bank to complete tapering of the quantitative easing program faster-than-expected does not bode well for these companies.

Small businesses depend on easy access to cheaper credit. A higher interest rate will be detrimental to their growth. As a result, any disturbance in the normal functioning of the U.S. economy due to resurgence of the COVID-19 and higher interest may significantly affect small businesses.

During Nov 25 to Dec 3, the large-cap specific indexes — the Dow, the S&P 500 and the Nasdaq Composite — fell 3.4%, 3.5% and 4.8%, respectively. The mid-cap specific S&P 500 slid 5.9%. The small-cap-centric Russell 2000 and the S&P 600 dropped 7.4% and 6.1%, respectively. The Russell 2000 is currently in correction territory, trading at 12.2% below its all-time high of 2,458.86 recorded on Nov 8.

Importance of Small Businesses

Small businesses create a significant number of jobs in the U.S. economy. More than 50% of the newly created jobs in the private sector originate from these businesses. These people, working in small-scale organizations, constitute a large part of customers for big U.S. businesses.

Moreover, small companies are a major part of the supply chain management systems of large companies for innovative and technologically superior inputs. Additionally, small businesses more often than not form a vital cog in corporate America’s customer base.

Our Top Picks

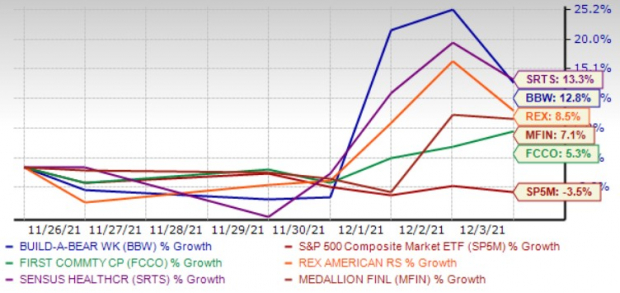

We have narrowed our search to five small cap (market capital < 1 billion) stocks that have surged since the Thanksgiving Day, while all other benchmarks took a southbound turn in the same time period.

These stocks have solid growth potential for the rest of this month and have seen positive earnings estimate revisions in the last 30 days. Finally, each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The chart below shows the price performance of our five picks from Nov 25 to Dec 3.

Image Source: Zacks Investment Research

Sensus Healthcare Inc.

manufactures, distributes and markets superficial radiation therapy devices to healthcare providers worldwide. Sensus Healthcare specializes in the treatment of non-melanoma skin cancers and other skin conditions, such as keloids, with superficial radiation therapy. SRTS’s portfolio of treatment devices consists of the SRT-100(TM) and SRT-100 Vision(TM).

Zacks Rank #1 Sensus Healthcare has expected earnings growth of 95.2% for the current year. The Zacks Consensus Estimate for its current-year earnings has improved more than 100% over the last 30 days. The stock price of SRTS jumped 13.3% from Nov 25 to Dec 3.

Build-A-Bear Workshop Inc.

operates as a multi-channel retailer of plush animals and related products. Build-A-Bear Workshop operates through three segments: Direct-to-Consumer, International Franchising, and Commercial. BBW operates its stores under the Build-A-Bear Workshop brand name and sells products through its e-commerce sites.

Zacks Rank #1 Build-A-Bear Workshop has expected earnings growth of more than 100% for the current year (ending January 2022). The Zacks Consensus Estimate for its current-year earnings has improved 26.7% over the last 7 days. The stock price of BBW climbed 12.8% from Nov 25 to Dec 3.

REX American Resources Corp.

produces and sells ethanol in the United States. REX American Resources operates in two segments — Ethanol and By-Products, and Refined Coal. REX also offers distillers grains and non-food grade corn oil and dry distillers grains with solubles, which are used as a protein in animal feed. In addition, REX produces, processes, and sells refined coal.

Zacks Rank #1 REX American Resources has expected earnings growth of more than 100% for the current year (ending January 2022). The Zacks Consensus Estimate for its current-year earnings has improved 15.2% over the last 7 days. The stock price of REX appreciated 8.5% from Nov 25 to Dec 3.

Medallion Financial Corp.

operates as a specialty finance company that originates and services loans to finance taxicab medallions and various commercial loans in the United States. MFIN offers consumer loans for the purchase of recreational vehicles, boats, motorcycles, and trailers and to finance home improvements; commercial loans for the purchase of equipment and related assets necessary to open a new business.

Zacks Rank #2 Medallion Financial has expected earnings growth of more than 100% for the current year. The Zacks Consensus Estimate for its current-year earnings has improved 6.3% over the last 30 days. The stock price of MFIN advanced 7.1% from Nov 25 to Dec 3.

First Community Corp.

operates as the bank holding company for First Community Bank which offers various commercial and retail banking products and services to small-to-medium-sized businesses, professional concerns, and individuals. FCCO operates through the Commercial and Retail Banking, Mortgage Banking, and Investment Advisory and Non-Deposit segments.

Zacks Rank #2 First Community has expected earnings growth of 49.6% for the current year. The Zacks Consensus Estimate for its current-year earnings has improved 5.9% over the last 30 days. The stock price of FCCO gained 5.3% from Nov 25 to Dec 3.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report