Henry Schein, Inc.

HSIC

has been gaining from robust global dental sales. The company ended the third quarter of 2021 on a bullish note with better-than-expected results. Solid performances by all three of the company’s operating businesses appear promising. A steady improvement in patient traffic amid a resurgence in new COVID-19 cases also buoys optimism. However, mounting expenses and stiff competition do not bode well for the company.

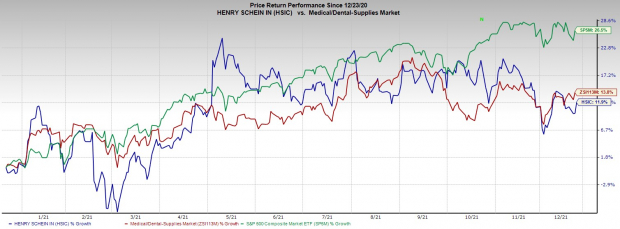

Over the past year, this Zacks Rank #3 (Hold) stock has gained 11.9% versus the 13.8% rise of the

industry

and 26.5% rise of the S&P 500 composite.

The renowned global distributor of health care products and services has a market capitalization of $10.31 billion. Its third-quarter 2021 earnings surpassed the Zacks Consensus Estimate by 17%.

The company’s projected long-term earnings growth of 11.3% compares with the industry’s growth projection of 12.6% and the S&P 500’s estimated 11.7% growth.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors At Play

Dental Business Trends Favorable for the Long Term:

We are encouraged by Henry Schein’s strategy to expand digital dentistry worldwide. The company is promoting digital workflows for general dentistry as well as dental specialties. During the third quarter, Henry Schein’s global dental sales increased 10.5% year over year. The company noted that growth was strong in each of the dental specialty categories, including implants, oral surgery, endodontics and orthodontics in the reported quarter. Henry Schein is currently focused on offering a diversified portfolio and value-added services along with a favorable end market.

Widespread Network and Channel Mix:

Henry Schein’s distribution business boasts a wide global footprint with 61 distribution centers. We believe Henry Schein’s worldwide reach is a major competitive advantage over other players in the healthcare distribution industry. During the third quarter, the company witnessed a steady improvement in patient traffic despite a rise in new COVID-19 cases. Henry Schein One billings associated with dental claims processing were 100% of the pre-pandemic level, driving greater practice purchases. Global dental consumable merchandise internal sales increased 2.9% year over year in the reported quarter, with solid dental consumable merchandise sales growth in the United States, Canada, Australia, New Zealand, Brazil and Asia.

Impressive Q3 Results:

Henry Schein exited the third quarter with better-than-expected earnings and revenues. The company saw robust performances by all three of its operating businesses. The international performance was too impressive. Strengthening demand in the global dental and medical markets drove strong year-over-year increases in sales in the reported quarter. Overall dental sales reflect a continued recovery in patient traffic compared to the pre-pandemic levels. Expansion of the gross margins is an added advantage.

Downsides

Escalating Expenses:

During the third quarter, Henry Schein’s selling, general and administrative expenses rose 25.4%. The escalating expenses are building significant pressure on the company’s bottom line, leading to a 23-basis point contraction in adjusted operating margin year over year.

Contagion of Economic Problems:

Henry Schein’s financial operations continued to be impacted by the global macroeconomic environment. Governments and insurance companies continue to look for ways to contain the rising cost of healthcare, which might put pressure on players like Henry Schein in the healthcare industry. The company is also susceptible to fluctuating currency rates, given that it derives a substantial amount of its revenues from international markets.

Tough Competition:

The U.S. healthcare products and service distribution industry is highly competitive and consists principally of national, regional and local distributors. Henry Schein continues to face significant rivalry from notable MedTech players in the North American dental products and animal healthcare markets. Moreover, the competitive landscape in overseas markets is also challenging.

Estimate Trend

Over the past 90 days, the Zacks Consensus Estimate for Henry Schein’s 2021 earnings has moved 1.4% north to $4.34.

The Zacks Consensus Estimate for fourth-quarter 2021 revenues is pegged at $3.18 billion, suggesting a 0.6% rise from the year-ago reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are

Apollo Endosurgery, Inc.

APEN

,

McKesson Corporation

MCK

and

Thermo Fisher Scientific Inc.

TMO

, each carrying a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apollo Endosurgery has a long-term earnings growth rate of 7%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed its industry over the past year. APEN has gained 126.3% versus the 7.2% industry growth.

McKesson has a long-term earnings growth rate of 9%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 19.9%, on average.

McKesson has outperformed its industry over the past year. MCK has gained 39.1% versus the 13.8% industry rise.

Thermo Fisher has a long-term earnings growth rate of 14%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 9%.

Thermo Fisher has outperformed its industry over the past year. TMO has rallied 42.2% versus the industry’s 7.2% rise.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report