Bio-Rad Laboratories, Inc.

BIO

is well poised for growth in the coming quarters, backed by strength in the Life Science and Clinical Diagnostics segments. The ongoing rebound in demand for Bio-Rad’s non-COVID businesses appears promising. A strong solvency position is an added plus. However, escalating costs raise apprehension over the company.

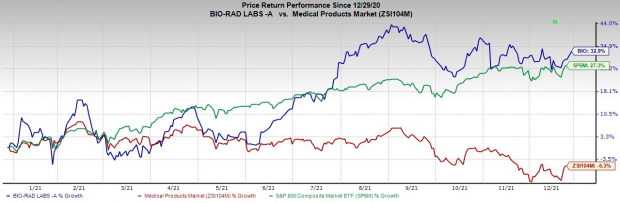

Over the past year, shares of this Zacks Rank #2 (Buy) company have charted a solid trajectory, appreciating 32.9% against the 5.3% fall of the

industry

it belongs to and 27.3% surge of the S&P 500 composite.

The renowned manufacturer and global supplier of clinical diagnostics and life science research products has a market capitalization of $22.75 billion. Its earnings for third-quarter 2021 surpassed the Zacks Consensus Estimate by 61.3%.

Over the past five years, the company registered earnings growth of 23.6%, which is way ahead of the industry’s 7.0% rise and the S&P 500’s 2.8% increase. The company projects 45.7% growth for the current year, which compares to the industry’s growth projection of 13.4% and the S&P 500’s estimated 64.2% increase for the current year.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Drivers

Segmental Growth:

We are upbeat about Bio-Rad’s Life Science segment, which recorded sales growth of 13.9% at a constant exchange rate (CER) and reported growth of 15.3% during the third quarter. The year-over-year sales growth was driven mainly by increases in Droplet Digital PCR products and excluding COVID-related sales. The company’s core qPCR business also experienced robust growth driven by strong uptake of the newer generation CFX Opus platform. Meanwhile, Bio-Rad witnessed constant currency sales growth of 13.7% and reported growth of 15.5% at its Clinical Diagnostics segment. The company also started to see a recovery of demand for non-COVID businesses.

Clinical Diagnostics Arm Grows:

Bio-Rad’s third-quarter Clinical Diagnostics sales were largely driven by a recovery of routine testing, raising optimism. During the quarter, the Diagnostics Group posted growth across its product lines. On a geographic basis, the Diagnostics Group’s currency-neutral year-over-year sales grew double-digits across all regions. A few notable developments undertaken by Bio-Rad in this segment include its collaboration with Seegene in June 2021 and the launch of the PREvalence ddPCR SARS-CoV-2 Wastewater Quantification Kit in the same month.

Strong Solvency:

Bio-Rad exited the third quarter with cash, cash equivalents and short-term investments of $1.34 billion. Meanwhile, total debt (including current maturities) came in at $12.4 million, much lower than the quarter-end cash and cash equivalent as well as investments level, indicating strong solvency. This is good news in terms of the company’s solvency position, at least during the year of economic downturn, implying that the company is holding sufficient cash for debt repayment.

Downsides

Escalating Costs:

Bio-Rad’s operating expenses surged 8.9% in the third quarter compared to the year-ago figure. The year-over-year rise in operating costs is building pressure on the company’s bottom line.

Tough Competitive Pressure:

Bio-Rad operates in a highly competitive environment dominated by firms varying from large multinational corporations with significant resources to start-ups. Also, the competitive and regulatory conditions in the company’s markets limit Bio-Rad’s ability to switch to strategies like price increases and other drivers of cost.

Estimate Trends

Bio-Rad has been witnessing a positive estimate revision trend for the current year. Over the past 90 days, the Zacks Consensus Estimate for its 2021 earnings has moved 7.9% north to $15.33.

The Zacks Consensus Estimate for its 2021 revenues is pegged at $2.90 billion, suggesting 13.7% growth from the year-ago reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are

Apollo Endosurgery, Inc.

APEN

,

Cerner Corporation

CERN

and

West Pharmaceutical Services, Inc.

WST

, each carrying a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apollo Endosurgery has a long-term earnings growth rate of 7%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed its industry over the past year. APEN has gained 130% versus the 9.3% industry growth.

Cerner has a long-term earnings growth rate of 13.3%. The company surpassed earnings estimates in the trailing three quarters and was in line in one, delivering a surprise of 3.2%, on average.

Cerner has outperformed its industry over the past year. CERN has gained 17.6% versus the 39% industry decline.

West Pharmaceutical has a long-term earnings growth rate of 27.6%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 29.4%.

West Pharmaceutical has outperformed its industry over the past year. WST has rallied 67.3% versus the industry’s 15.7% rise.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report