Corcept Therapeutics

CORT

announced that it has completed the enrolment of patients in the phase II GRATITUDE study, which is evaluating its investigational selective cortisol modulator, miricorilant, as a potential treatment for antipsychotic-induced weight gain.

The ongoing GRATITUDE study is evaluating the efficacy, pharmacokinetics and safety of miricorilant versus placebo in adults with schizophrenia or bipolar disorder who have recently gained weight due to the use of antipsychotic medications. While the study participants will be randomized into equal groups to receive either a 600 mg dose of the drug or placebo, participants in both groups will continue to receive their established antipsychotic medications.

The primary endpoint of the GRATITUDE study is a reduction in body weight in participants dosed with miricorilant compared to those administered placebo. The study will also examine other metabolic variables. Corcept expects data from the study in fourth-quarter 2022.

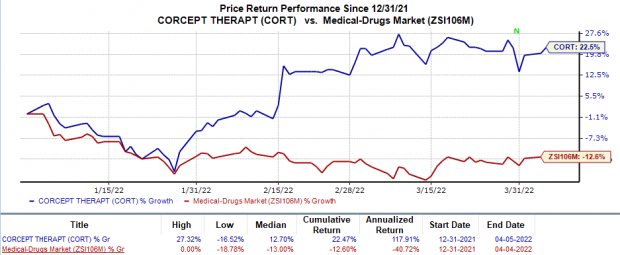

Shares of Corcept have surged 22.5% so far this year against the

industry

’s 12.6% decrease.

Image Source: Zacks Investment Research

While antipsychotic drugs have shown efficacy in the treatment of life-threatening psychiatric disorders like depression and schizophrenia, the use of these drugs also induces weight gain, which can have adverse impacts on a person’s health. Per management estimates, 6 million patients in the United States consume antipsychotic drugs. Miricorilant is designed to reverse the effect of weight gain caused by antipsychotic medications.

While the GRATITUDE study is evaluating miricorilant as a potential treatment for reversing recent antipsychotic-induced weight gain, the company is also conducting another phase II GRATITUDE II study that is evaluating the potential of the candidate to reverse long-standing weight gain caused by antipsychotic drugs.

The GRATITUDE II study, which completed enrolment earlier this year, will randomize participants into three equal groups — two groups will receive 600mg and 900mg doses of the drug, while the third group will be administered placebo. The primary endpoint is similar to the GRATITUDE study and data is expected by CORT in fourth-quarter 2022.

We note that though Corcept has a large portfolio of proprietary compounds, it has only one marketed drug in its portfolio, Korlym, which is approved for the treatment of patients with Cushing’s syndrome. During full-year 2021, Korlym generated sales worth $366 million in 2021, reflecting an increase of 3.4% year over year.

Currently, the lead candidate in CORT’s pipeline is relacorilant, which is being evaluated in two phase III studies for the treatment of patients with Cushing’s syndrome. Corcept plans to submit a new drug application for relacorilant in the second quarter of 2023. The candidate is also being evaluated for ovarian cancer and adrenal cancer indications. The successful development of any of its pipeline candidates will reduce the company’s dependence on Korlym for revenues.

Zacks Rank & Stocks to Consider

Corcept currently carries a Zacks Rank #3 (Hold).Some better-ranked stocks in the overall healthcare sector include

AVROBIO

AVRO

,

Collegium Pharmaceutical

COLL

and

ProPhase Labs

PRPH

. While Collegium Pharmaceutical and ProPhase Labs sport a Zacks Rank #1 (Strong Buy), AVROBIO carries a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Collegium Pharmaceutical’s earnings per share estimates for 2022 have increased from $3.79 to $5.76 in the past 60 days. The same for 2023 has increased from $4.79 to $7.96 in the past 60 days. Shares of COLL have risen 3% year to date.

Earnings of Collegium Pharmaceutical missed estimates in three of the last four quarters and beat the mark on one occasion, with the negative surprise being 57.6%.

ProPhase Labs’earnings per share estimates for 2022 have increased from 3 cents to 27 cents in the past 60 days. The same for 2023 has increased from 65 cents to 73 cents in the past 60 days. Shares of PRPH have risen 13.4% year to date.

Earnings of ProPhase Labs missed estimates in three of the last four quarters and beat the mark on one occasion, with the negative surprise being 157.7%.

AVROBIO’s loss per share estimates for 2022 have narrowed from $2.16 to $2.02 in the past 60 days. The same for 2023 has narrowed from $1.81 to $1.80 in the past 60 days.

Earnings of AVROBIO beat estimates in two of the last four quarters while missing the mark in the other two, delivering an average surprise of 2.6%.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report