Adverum Biotechnologies, Inc.

ADVM

announced that it has received feedback from the FDA on its investigational new drug (IND) application for initiating a phase II study to evaluate its eye disorder gene therapy candidate ADVM-022. ADVM is planning to complete the IND amendment process by mid-2022 and initiate dosing in the planned mid-stage study during the third quarter of 2022.

Adverum’s planned phase II study will evaluate ADVM-022 as a one-time therapy for wet age-related macular degeneration (wet AMD), a chronic eye disorder that causes blurred vision or a blind spot in your visual field.

ADVM had previously requested the FDA for a type C meeting to discuss the IND application to ensure alignment with the regulatory agency before filing for the amendment. Adverum’s plans to initiate dosing in the third quarter suggest that its planned amendments are in alignment with the regulatory authority.

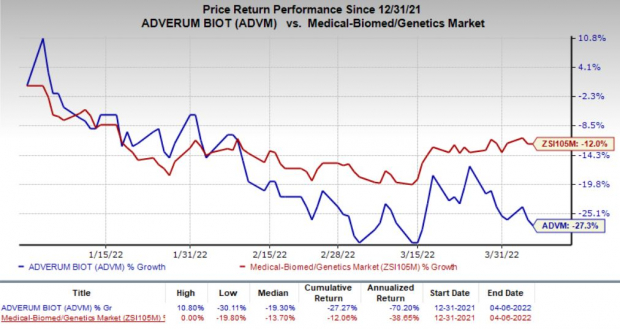

Shares of ADVM gained 3.1% in after-hours trading on Apr 6 following the news. The stock has declined 27.3% so far this year compared with the

industry

’s decrease of 12%.

Image Source: Zacks Investment Research

The planned phase II study will evaluate the 2 x 10^11 vg/eye dose of ADVM-022 used in earlier-stage studies. The new mid-stage study will also evaluate a lower dose of ADVM-022 (6 x 10^10 vg/eye). Adverum is also planning to use the new, enhanced prophylactic steroid regimens, including local steroids and a combination of local and systemic steroids along with ADVM-022, in the study.

Management believes that ADVM-022 has the potential to provide a durable and a safe treatment option.

Adverum had initially evaluated a 6 x 10^11 vg/eye dose of ADVM in an earlier study and later added a cohort for 2 x 10^11 vg/eye dose. ADVM already lowered the dose of ADVM-022 once earlier and is again planning to evaluate a lower dose of ADVM-022. The administration of 6 x 10^10 vg/eye and 2 x 10^11 vg/eye doses resulted in mild adverse events in all patients and different types of inflammation. A lower dose is supposed to lead to a reduction in inflammation events in patients. However, any negative impact on efficacy may hurt prospects.

Zacks Rank & Stocks to Consider

Adverum currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

Axcella Health

AXLA

,

Trevi Therapeutics

TRVI

and

Voyager Therapeutics

VYGR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Axcella Health’s 2022 and 2023 loss has narrowed 12.3% and 16.4%, respectively, over the past 60 days. Shares of AXLA have rallied 26.8% so far this year.

Earnings of Axcella Health surpassed estimates in three of the trailing four quarters and missed once, the average beat being 1.67%.

The consensus estimate for Trevi’s 2022 bottom line has narrowed 19.4% for 2022 and 14.1% for 2023 over the past 60 days. The TRVI stock has surged 142.9% so far this year.

Earnings of Trevi surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions, the average beat being 5.09%.

Estimates for Voyager’s 2022 and 2023 loss have narrowed 38.6% and 29%, respectively over the past 60 days. VYGR has rallied 227.7% so far this year.

Earnings of Voyager surpassed estimates in three of the trailing four quarters and missed once, the average beat being 41.00%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report