Shares of

Curis, Inc.

CRIS

were down 8.3% on Monday after the FDA placed a partial clinical hold on its TakeAim lymphoma study evaluating its IRAK4 kinase inhibitor, emavusertib (CA-4948).

The open-label, dose-escalating phase I/II study is evaluating emavusertib for treating patients with B-cell malignancies, both as a monotherapy and in combination with

J&J

JNJ

/

AbbVie

’s

ABBV

BTK inhibitor, Imbruvica (ibrutinib).

AbbVie markets Imbruvica in partnership with J&J.

Imbruvica is currently approved for treating various hematologic cancers. AbbVie and J&J are conducting several studies on Imbruvica to evaluate the drug alone or in combination in different patient segments. The drug has multi-billion-dollar potential.

With this partial clinical hold, the FDA requested additional safety, efficacy and other data on emavusertib, including data related to rhabdomyolysis and the likely recommended phase II dose for emavusertib.

Concurrently, enrollment of new patients has been stopped in the TakeAim lymphoma study as a result of the FDA’s partial clinical hold.

The company remains focused on resuming the study soon following appropriate review by the regulatory body.

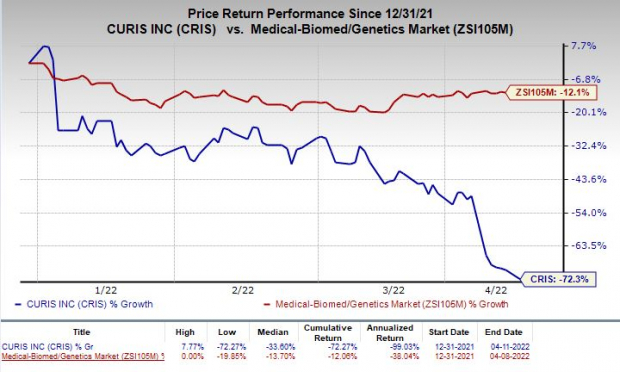

Curis’ stock has plunged 72.3% so far this year compared with the

industry

’s decrease of 12.1%.

Image Source: Zacks Investment Research

Earlier this month, the FDA placed a partial clinical hold on Curis’ phase I/II TakeAim leukemia study, which is evaluating emavusertib for treating patients with relapsed or refractory acute myeloid leukemia or high-risk myelodysplastic syndrome.

Back then, Curis decided to voluntarily pause enrollment of new patients in the TakeAim lymphoma study after the FDA placed a partial clinical hold on the TakeAim leukemia study.

Curis currently has no approved product in its portfolio. Therefore, the successful development of emavusertib, along with other pipeline candidates, remains a key focus for the company.

Zacks Rank & Stock to Consider

Curis currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech sector is

Voyager Therapeutics, Inc.

VYGR

, which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Voyager Therapeutics’ loss per share estimates have narrowed 38.6% for 2022 and 29% for 2023 over the past 60 days. The VYGR stock has skyrocketed 203.7% year to date.

Earnings of Voyager Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report