bluebird bio, Inc.

BLUE

reported an adjusted loss of $1.66 per share from continued operations for the first quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $1.26. In the year-ago quarter, BLUE posted a loss of $1.81 from continued operations.

Revenues from continued operations were $1.9 million, which missed the Zacks Consensus Estimate of $15 million. During the year-ago quarter, bluebird posted revenues of $0.9 million.

bluebird successfully completed the separation of the oncology business into an independent entity called

2seventy bio, Inc.

TSVT

during fourth-quarter 2021. We note that TSVT has been listed on the NASDAQ since Nov 5, 2021. Following the split, BLUE does not have any approved drug in the United States as Abecma, an FDA-approved multiple myeloma drug, is transferred to 2seventy bio.

Following the oncology business separation, BLUE is focusing on the severe genetic diseases business while 2seventy bio is focusing on research and development of its oncology pipeline as well as supporting the commercialization of Abecma.

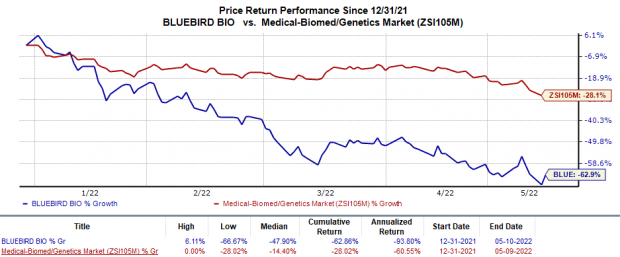

Shares of bluebirdhave plunged 62.9% so far this year compared with the

industry

’s 28% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development expenses from continuing operations decreased to $77.9 million from $82.8 million a year ago.

Selling, general and administrative expenses from continuing operations were $36.1 million, down from $63.6 million in the year-ago quarter.

The decline in both the aforementioned categories of expenses was owing to the restructuring initiatives undertaken by bluebird during the quarter, thus leading to a reduction in employee-related expenses.

Recent Updates

Earlier in January, bluebird

announced

that the FDA extended the review period of biologics licensing applications (BLAs) for betibeglogene autotemcel (beti-cel) and elivaldogene autotemcel (eli-cel), the potential treatments of β-thalassemia and cerebral adrenoleukodystrophy (CALD), respectively, by three months.

The FDA cited that the delay is due to the additional data submitted by bluebird on its request. The new PDUFA action dates for bluebird’s both lentiviral vector gene therapies are Aug 19, 2022, for beti-cel and Sep 16, 2022, for eli-cel.

In the past year, bluebird has suffered multiple regulatory setbacks for its pipeline. The FDA placing multiple clinical holds on BLUE’s pipeline programs does not bode well for the stock, as it is already marring its prospects persistently.

bluebird is in active communication with the FDA regarding the clinical hold placed by the latter on the studies of eli-cel for CALD since August 2021, following a safety report. Management believes that it will be able to resolve the regulatory agency’s queries concurrently with the ongoing review of eli-cel.

In January 2022, bluebird announced that it received written queries from the FDA about the partial clinical hold placed by the regulatory body on lovotibeglogene autotemcel (lovo-cel) gene therapy for patients under the age of 18 with sickle cell disease (SCD). While BLUE is in active communication with the regulatory body to resolve this issue of partial clinical hold, management reaffirms its plans to file a BLA for lovo-cel in first-quarter 2023 to treat SCD.

bluebird also faces the risk of a severe cash crunch. Last month, BLUE announced implementing a comprehensive restructuring plan to save up to $160 million to control its cash burn, thus allowing it to extend its cash runway to first-half 2023. To achieve this target, BLUE intends to trim its workforce nearly 30%, which in turn, is expected to save 35-40% of estimated operating costs. This reduction should be reflected in bluebird’s operating budget for 2023.

These streaming initiatives are intended to advance the near-term opportunities, including the pending FDA decision on beti-cel and eli-cel and the support for potential submission for lovo-cel next year.

Zacks Rank & Stocks to Consider

bluebird currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

and

Alkermes

ALKS

. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, Abeona Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have risen 14.4% in the year-to-date period.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 33 cents in the past 30 days. Shares of ABEO have declined 54.2% in the year-to-date period.

Abeona Therapeutics has a mixed surprise history, with its earnings having surpassed expectations in one of the trailing four quarters, missing the mark in another and meeting the same on the remaining two occasions, the average surprise being 0.7%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 7.7%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report