Shares of

Repare Therapeutics Inc.

RPTX

were up 20% in after-hours trading on Jun 1 following the announcement that RPTX has entered into a worldwide license and collaboration agreement with pharma giant

Roche

RHHBY

. Per the deal, both companies will develop and commercialize camonsertib (RP-3500) for treating tumors in cancer patients.

Per the terms of the agreement, Roche will take charge of developing camonsertib with the potential to expand the candidate into additional tumor indications as well as evaluate it across multiple combination studies. In return for granting these rights, Repare Therapeutics will receive an upfront payment of $125 million and is also eligible to receive an additional $1.2 billion of potential milestone payments from RHHBY. In addition, RPTX will be eligible to receive royalties on the drug’s global future sales, ranging from high-single digits to high teens.

The agreement also provides Repare Therapeutics with an option to share development costs and profit share arrangement in the United States equally with Roche. If RPTX exercises this option, not only will it be allowed to participate in U.S. co-promotion alongside Roche but will also be eligible to receive certain clinical, regulatory, commercial and sales milestone payments as well as earn royalties on ex-U.S. future sales of the drug.

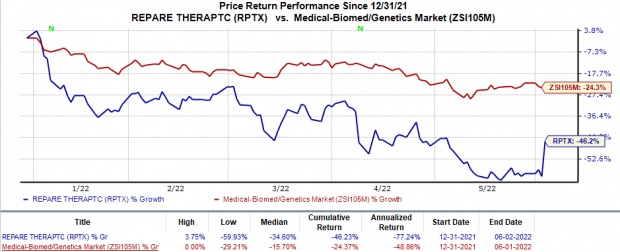

Shares of Repare Therapeutics have plunged 46.2% this year so far compared to the

industry

’s 24.4% decrease.

Image Source: Zacks Investment Research

Camonsertib is Repare Therapeutics’ lead pipeline candidate. The candidate is currently undergoing clinical development in the ongoing phase I/II TRESR study as a monotherapy for treating solid tumors.

At the 2022 AACR Annual Meeting, Repare Therapeutics presented data from the ongoing TRESR study, which showed that treatment with camonsertib monotherapy achieved durable clinical benefits across tumor types and genomic alterations. In fact, the overall clinical benefit rate (CBR) for all patients was 43%.

RPTX currently has no approved/marketed drug in its portfolio and therefore lacks a stable stream of revenues. Thus, the deal with Roche will help Repare Therapeutics support its own pipeline growth and expansion.

Apart from camonsertib, Repare Therapeutics is evaluating a second clinical candidate RP-6306, a PKMYT1 inhibitor, currently in early-stage clinical development for the treatment of molecularly selected advanced solid tumors

Zacks Rank & Stocks to Consider

Repare Therapeutics currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Aeglea BioTherapeutics

AGLE

and

Sesen Bio

SESN

. While Sesen Bio currently sports a Zacks Rank #1 (Strong Buy), Aeglea BioTherapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 30 days. Shares of SESN have fallen 28.4% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Aeglea BioTherapeutics’ loss per share estimates for 2022 have narrowed from $1.44 to $1.16 in the past 30 days. The same for 2023 has narrowed from $1.49 to $1.04 in the same period. Shares of AGLE have plunged 68.4% year to date.

Earnings of Aeglea BioTherapeutics beat estimates in two of the last four quarters and missed the mark on the remaining two occasions, the average surprise being 9.5%. In the last reported quarter, AGLE witnessed a negative earnings surprise of 5.7%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report