HCA Healthcare, Inc.

HCA

recently entered into a joint venture with

McKesson Corporation

MCK

, a leading healthcare services provider and information technology company. The deal is a noteworthy one and will benefit HCA Healthcare significantly. The transaction is likely to be completed within 2022, subject to regulatory nod and other customary closing conditions.

Shares of HCA Healthcare gained 1.3% in the last couple of days.

Though McKesson will own a 51% stake in the joint venture following the closure of the deal, the benefits of the deal are likely to be massive for HCA Healthcare. This is primarily thanks to the integration of the research unit (Sarah Cannon Research Institute (SCRI)) of HCA’s Cancer Institute Sarah Cannon with the US Oncology Research (USOR) of McKesson. Being the research division of MCK’s The US Oncology Network, USOR gains from the prowess of experienced investigators and committed clinical staff excelling in oncology clinical trials.

The research arms intend to benefit community oncology providers and patients, encompassing even those residing in underserved areas, via the development of a fully integrated oncology research organization. The newly created entity with the combined capabilities of SCRI and USOR is expected to boost clinical research, ramp up the development of drugs, lead to better data and analytics capabilities, and pave the way for a wider portfolio of clinical trials.

The cancer care products suite of HCA Healthcare will receive a boost as a result of the recent joint venture. Per HCA’s management, the joint venture is anticipated to lead to the devising of advanced individualized therapies and extend new treatment options to cancer patients.

The latest move can be termed as time opportune for HCA Healthcare, considering the robust growth prospects of the worldwide cancer therapeutics market. The high demand for advanced cancer care is likely to prevail in the days ahead. This provides HCA a perfect opportunity to capitalize on the scenario, thanks to the SCRI arm of its Cancer Institute that boasts of early-phase oncology research and drug development prowess extending end-to-end clinical trial site support services.

Per a report by Allied Market Research, the global cancer therapeutics space is anticipated to witness a CAGR of 7.7% over the 2019-2026 period. Growing incidence of cancer cases, rise in tie-ups between pharmaceutical companies and increased cancer research are contributing to the expansion of the market.

HCA Healthcare has undertaken a wide array of measures ranging from buyouts and collaborations to joint ventures. These initiatives have enhanced its capabilities, boosted patient volumes and diversified the treatment network through which HCA strives to reach more patients with inadequate care access. These factors have made HCA Healthcare the preferred choice for obtaining high-quality care.

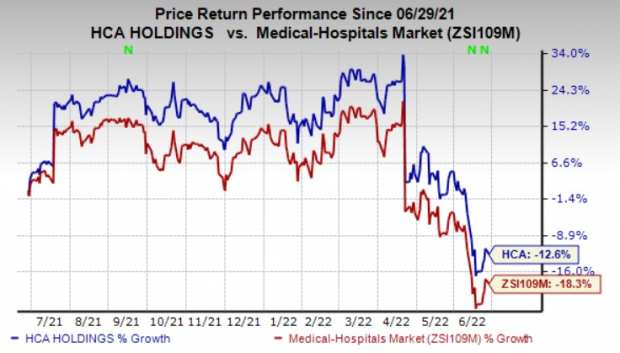

Shares of HCA Healthcare have lost 12.6% in a year compared with the

industry

’s decline of 18.3%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

HCA Healthcare currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the

Medical

space are

Assertio Holdings, Inc.

ASRT

and

Sensus Healthcare, Inc.

SRTS

. While Assertio sports a Zacks Rank #1 (Strong Buy), Sensus Healthcare carries a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Assertio has a trailing four-quarter earnings surprise of 26.39%, on average. The Zacks Consensus Estimate for ASRT’s 2022 earnings is pegged at 40 cents per share, which compares favorably with the prior year’s loss of 3 cents. The same for revenues indicates growth of 17.9%. The Zacks Consensus Estimate for Assertio’s 2022 earnings has moved north by 14.3% in the past 60 days.

The bottom line of Sensus Healthcare outpaced estimates in each of the trailing four quarters, the average surprise being 155.48%. The Zacks Consensus Estimate for SRTS’s 2022 earnings is pegged at $1.53 per share, which indicates a more than six-fold year-over-year increase. The same for revenues suggests an improvement of 55.3%. The consensus mark for Sensus Healthcare’s 2022 earnings has moved north by 115.5% in the past 60 days.

Shares of Assertio and Sensus Healthcare have rallied 18.3% and 78.4%, respectively, in a year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report