Vaxcyte

PCVX

completed patient enrollment in phase II of the ongoing phase I/II study evaluating its lead vaccine candidate, VAX-24. It is a 24-valent broad-spectrum investigational pneumococcal conjugate vaccine (PCV) being developed for the prevention of invasive pneumococcal disease (“IPD”) and pneumonia.

The phase II portion of the ongoing phase I/II proof-of-concept study will evaluate the safety of VAX-24 in healthy adults between 50 to 64 years of age.

The randomized, observer-blind, dose-finding, controlled phase I/II clinical study is a combined phase I and phase II study evaluating the tolerability and safety immunogenicity of VAX-24 in adults 18 to 64 years.

The phase I portion of the study includes 64 healthy adults 18 to 49 years of age and the phase II portion includes approximately 800 healthy adults 50 to 64 years of age.

Vaxcyte expects to announce top-line safety, tolerability and immunogenicity results from this study’s phase I and phase II portions by the end of 2022.

The company has also initiated a separate phase II study of VAX-24 and has already dosed the first participants to evaluate the efficacy of VAX-24 in healthy adults above 65 years of age.

The company expects to announce top-line safety, tolerability and immunogenicity results from this study in the first half of 2023.

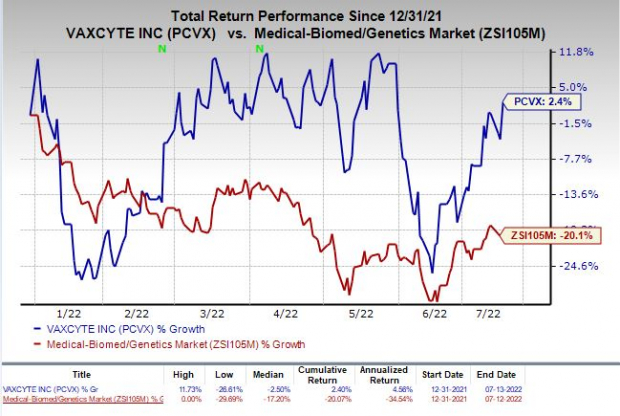

Shares of Vaxcyte rallied 6.98% on Jun 13, post the update. The stock has returned 2.4% year-to-date against the

industry

’s 20.1% decline.

Image Source: Zacks Investment Research

Please note that in January 2022, the FDA cleared the investigational new drug (“IND”) application for VAX-24 in adults.

Vaxcyte expects to submit a pediatric IND application to the FDA for its lead, 24-valent PCV candidate in the first half of 2023, pursuant to a pre-IND meeting with the FDA and the successful top-line results of phase I/II study in adults between 18 to 64 years of age.

The company also intends to pursue the clinical development of its other pipeline candidates beyond VAX-24, including its second PCV candidate VAX-XP, VAX-A1, a novel conjugate vaccine candidate designed to prevent Group A Strep; and VAX-PG, a novel protein vaccine candidate targeting the keystone pathogen responsible for periodontitis.

Last month, FDA approved an expanded indication for

Merck

’s

MRK

Vaxneuvance, a pneumococcal 15-valent conjugate vaccine, for use in infants and children between 6 weeks and 17 years of age to protect against IPD.

The approval follows FDA’s priority review of Merck’s supplemental biologics license application (sBLA) seeking approval of Vaxneuvance for the pediatric population.

Merck’s Vaxneuvance vaccine includes pneumococcal serotypes 22F and 33F, which are not included in the currently licensed 13-valent pneumococcal conjugate vaccines (PCV13).

Zacks Rank and Stocks to Consider

Vaxcyte currently carries a Zacks Rank #2 (Buy). Some similar-ranked stocks in the overall health sector are

Aquestive Therapeutics

AQST

and

Seagen

SGEN

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Aquestive Therapeutics’loss per share estimates for 2022 have narrowed from $1.50 to $1.34 cents in the past 30 days. The same for 2023 has narrowed from 95 cents to 74 cents in the same time frame.

Earnings of Aquestuve missed estimates in one of the trailing four quarters and beat the same on the remaining three occasions, the average surprise being 13.78%.

Seagen’s loss per share estimates for 2022 have narrowed from $3.50 to $3.49 in the past 30 days. The same for 2023 has widened from $1.41 to $1.43 cents in the same time frame. SGEN has returned 14.8% in the year-to-date period.

Earnings of Seagen missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 40.08%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report