Endo International plc

’s

ENDP

wholly owned subsidiary, Endo Ventures Limited, has entered into an agreement with

Quoin Pharmaceuticals Inc.

QNRX

for the development, supply, commercialization and distribution of the latter’s pipeline candidate, QRX003, in Canada.

Quoin’s lead product, QRX003, is currently being developed for the treatment of Netherton syndrome, a rare hereditary skin disorder. Currently, there is no satisfactory treatment option available for the given indication.

If successfully developed and upon potential approval, QRX003 is likely to offer a new treatment option for appropriate pediatric patients suffering from this rare disease.

Endo’s operating company, Paladin Labs Inc. will solely take responsibility for all commercial activities related to QRX003 in Canada. Paladin plans to launch QRX003 in Canada in 2025.

QNRX is engaged in developing products that treat rare and orphan diseases. Apart from Netherton Syndrome, Quoin is developing its pipeline candidates for treating Peeling Skin syndrome, Palmoplantar Keratoderma, Scleroderma, Epidermolysis Bullosa, among others.

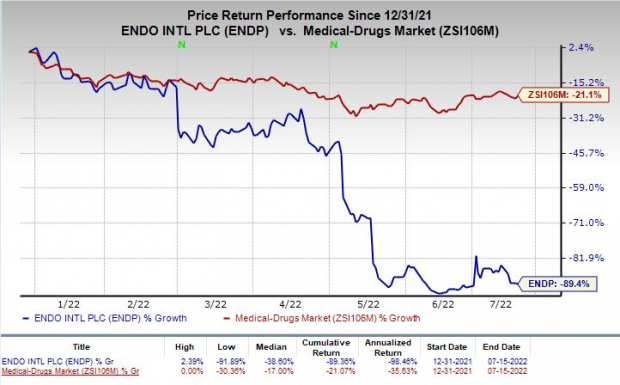

Shares of Endo have plunged 89.4% so far this year compared with the

industry

’s decline of 21.1%.

Image Source: Zacks Investment Research

Endo’s stock has been under the hammer of late. Shares of the company have tanked significantly after a Wall Street report stated that the company has started negotiations with its lenders and senior bondholders about a possible restructuring of more than $8 billion of debt.

ENDP is knee-deep in trouble with several litigation suits over opioid sales, which has been an overhang on its shares for quite some time now.

Per a recent Bloomberg article, Endo’s senior leaders have advised the company to file for bankruptcy to survive this turmoil. They have also suggested that Endo skip paying the upcoming interests to shareholders to preserve company cash.

Since the bulk of the due interests will be collected by junior bondholders, they want Endo to restructure the debt out of court.

As of March 2022, the company had $1.4 billion of cash and equivalents and long-term debt of $8.0 billion.

Zacks Rank & Stocks to Consider

Endo currently carries a Zacks Rank #3 (Hold). Top-ranked stocks in the same sector are

Verrica Pharmaceuticals Inc.

VRCA

and

Galmed Pharmaceuticals Ltd.

GLMD

, both carrying a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Verrica Pharmaceuticals’ loss per share has narrowed 44.6% for 2022 and 21% for 2023 in the past 60 days.

Earnings of Verrica Pharmaceuticals have surpassed estimates in each of the trailing four quarters. VRCA delivered an earnings surprise of 28.45%, on average.

Galmed Pharmaceuticals’ loss per share estimates narrowed 37.9% for 2022 and 45% for 2023 in the past 60 days.

Earnings of Galmed Pharmaceuticals have surpassed estimates in each of the trailing three quarters. GLMD delivered an earnings surprise of 23.09%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report