Nabriva Therapeutics plc

NBRV

announced positive top-line data from the phase I study evaluating its marketed drug, Xenleta (lefamulin), for a new indication.

The phase I study is evaluating the safety and pharmacokinetics (PK) of oral and intravenous (IV) Xenleta for the treatment of adult patients with cystic fibrosis (CF).

Per the company, the data demonstrates PK of Xenleta in CF patients is similar to that seen in previous studies, which evaluated the approved oral and IV dosing of Xenleta for treating adults with community-acquired bacterial pneumonia (CABP).

Additionally, treatment with Xenleta was generally well-tolerated and the adverse side effects in CF patient population were consistent with that seen across the clinical program. The data from the above phase I study underlines the potential utility of lefamulin in patients with CF.

NBRV plans to announce complete data from the study in the first half of 2023.

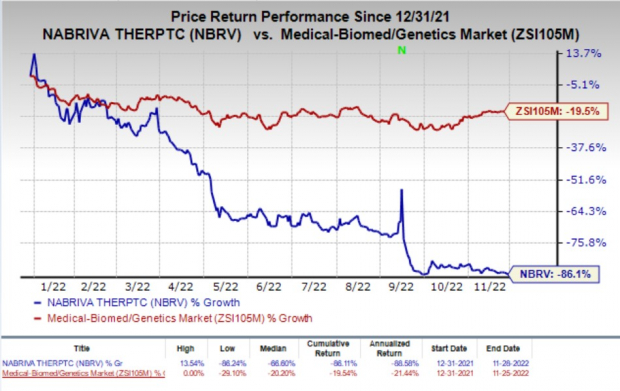

Despite the positive update, shares of Nabriva were down 4.2% on Monday following the announcement of the news. The stock has plunged 86.1% so far this year compared with the

industry

’s decline of 19.5%.

Image Source: Zacks Investment Research

In August 2022, Nabriva completed enrollment in a phase I study on Xenleta as a potential treatment of resistant bacterial infections in patients with CF.

We remind investors that the FDA approved both IV and oral formulations of Xenleta (lefamulin) to treat adult patients with CABP in August 2019.

In July 2020, the European Commission issued a legally binding decision for the approval of the marketing authorization application for Xenleta for the treatment of community-acquired pneumonia in adults, following a review by the European Medicines Agency.

Nabvira has another candidate in its portfolio called Contepo (fosfomycin), which is a potentially first-in-class epoxide intravenous antibiotic developed for treating adult patients with complicated urinary tract infections (cUTI), including acute pyelonephritis.

A potential label expansion for Xenleta and approval for other candidates are likely to boost Nabriva’s growth prospects in the days ahead.

Zacks Rank & Stocks to Consider

Nabriva currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

ASLAN Pharmaceuticals Limited

ASLN

,

Immunocore Holdings plc

IMCR

and

Angion Biomedica Corp.

ANGN

, all carrying a Zacks Rank #2 (Buy) at present.You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Immunocore have narrowed 39.7% for 2022 and 39.4% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Loss per share estimates for Angion Biomedica have narrowed 6.1% for 2022 and 3.9% for 2023 in the past 60 days.

Earnings of Angion Biomedica surpassed estimates in three of the trailing four quarters and missed the mark on the other occasion. ANGN witnessed an earnings surprise of 66.42% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report