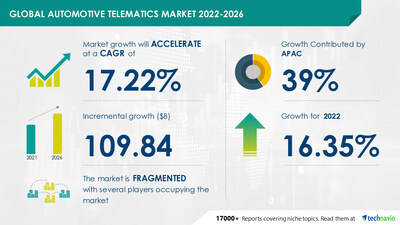

NEW YORK, Aug. 18, 2023 /PRNewswire/ — The automotive telematics market size is estimated to increase by USD 109.84 billion from 2021 to 2026, at a CAGR of 17.22%, according to a recent market study by Technavio. This report also offers a 5-year historical (2017-2021) data projection of market size, segmentation, and region. Discover some insights on market size before buying the full report –Request a sample report

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak. The Bargaining Power of Buyers & Suppliers and the Threat of New Entrants, Rivalry, and Substitutes have also been analyzed and rated between LOW-HIGH to provide a holistic view of market favorability.

Find Technavio’s Exclusive Analysis of Price Sensitivity, Adoption Lifecycle, Customer Purchase Basket, Adoption Rates, and Purchase Criteria

- One of the core components of the customer landscape is price sensitivity, an analysis of which will help companies refine marketing strategies to gain a competitive advantage.

- Another key aspect is price sensitivity drivers (purchases are undifferentiated, the purchase is a key cost to buyers, and quality is not important), which range between LOW and HIGH.

- Furthermore, market adoption rates for all regions have been covered.

The Automotive telematics market also offers information on the criticality of inputs, R&D, CAPEX, technology, and products of 15 vendors listed below –

Agero Inc., Airbiquity Inc., Continental AG, Delphi Technologies Plc, Garmin Ltd., General Motors Co, LG Corp., Masternaut Ltd., MiX Telematics Ltd., Octo Group S.p.A, Omnitracs LLC, Panasonic Corp, Qualcomm Inc., Robert Bosch GmbH, Teletrac Navman US Ltd, TomTom International BV, Trimble Inc., Verizon Communications Inc., Visteon Corp., and Volkswagen AG. Download Sample

Chart & Data Table on 5-Year Historic (2017-2021) Market Size, Comparative Analysis of Segments, and Y-O-Y Growth of Automotive telematics market

The market is segmented by Application (commercial vehicles and passenger cars), Type (embedded, smartphone integration, and tethered), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

- The automotive telematics market share growth in the commercial vehicles segment will be significant during the forecast period. The CVs segment is undergoing rapid technological advancements, driven by the integration of intelligent vehicle systems. The surging need for enhanced fuel efficiency and safety stands out as a key factor propelling the widespread adoption of telematics solutions within the CVs sector. In-vehicle telematics solutions play a pivotal role in monitoring driver behaviour, curbing fuel consumption, enhancing driver safety, and facilitating cost reduction. Original Equipment Manufacturers (OEMs) are offering a variety of connectivity choices, including embedded telematics devices, tethered handsets, and smartphone-integrated systems, to cater to the demands of connected vehicles.

To procure the data – Buy report!

Significant Driver

The growing popularity of EVs is notably driving the market growth. Governments worldwide are spearheading various initiatives to encourage the widespread adoption of electric vehicles (EVs). Unlike traditional internal combustion engine (ICE) vehicles, EVs offer a substantial reduction in air pollution by eliminating the emission of harmful pollutants like particulates, carbon monoxide, hydrocarbons, and volatile organic compounds. Notably, in China, manufacturers involved in EV production can avail themselves of government subsidies. Similarly, emerging economies like India are adopting incentivization strategies to accelerate the adoption of EVs, demonstrating their aggressive approach toward EV adoption. Consequently, the growing adoption of EVs stands as a driving force behind the expansion of the automotive telematics market.

Key Trends – The growing popularity of API is an emerging trend shaping market growth.

Major Challenges- The high cost associated with telematics services will be a major challenge hindering market growth.

Chart & Data Table on Historical Market Size (2017-2021, Historic Industry Size & Analysis of 15 Vendors and 7 Countries

The market is segmented by region North America, APAC, Europe, South America, and Middle East and Africa. An analysis of key leading countries has been included.

- The US and Canada are the major contributors to the global automotive telematics market.

- The ongoing economic revival from the recession is likely to contribute to the demand for automobiles in North America.

- The region is the hub of automobile manufacturers.

- The market in the region is developing rapidly, and automobile manufacturers are installing telematics systems as essential accessories.

- This is positive for the automotive telematics market in North America.

For Insights on the market dynamics & segmentations VIEW PDF SAMPLE!

What are the key data covered in this Automotive Telematics Market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the Automotive Telematics Market between 2022 and 2026

- Precise estimation of the size of the Automotive Telematics Market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the Automotive Telematics Market industry across North America, APAC, Europe, South America, and the Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of Automotive Telematics Market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

The automotive aftermarket telematics market share is expected to increase by USD 36.07 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 24.59%. This report extensively covers automotive aftermarket telematics market segmentation by application (passenger cars and commercial vehicles) and geography (APAC, North America, Europe, South America, and MEA). The rise in in-vehicle communication options is one of the key drivers supporting the automotive aftermarket telematics market growth.

The commercial vehicle telematics market share in the Americas is expected to increase to USD 7.97 billion from 2021 to 2026, at a CAGR of 16.6%. This report extensively covers commercial vehicle telematics market in the Americas segmentations by type (embedded telematics, smartphone-based telematics, and portable telematics) and application (LCV and M and HCVs). The cost savings options due to the adoption of telematics-enabled UBI is one of the key drivers supporting the Americas commercial vehicle telematics market growth.

|

Automotive Telematics Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2021 |

|

Historic period |

2017-2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.22% |

|

Market growth 2022-2026 |

USD 109.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

16.35 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 39% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agero Inc., Airbiquity Inc., Continental AG, Delphi Technologies Plc, Garmin Ltd., General Motors Co, LG Corp., Masternaut Ltd., MiX Telematics Ltd., Octo Group S.p.A, Omnitracs LLC, Panasonic Corp, Qualcomm Inc., Robert Bosch GmbH, Teletrac Navman US Ltd, TomTom International BV, Trimble Inc., Verizon Communications Inc., Visteon Corp., and Volkswagen AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of contents

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation by Application

Market Segmentation by Type

Market Segmentation by Geography

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Vendor Landscape

Vendor Analysis

Appendix

About US

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/automotive-telematics-market-size-to-grow-by-usd-109-84-billion-from-2021-to-2026–the-growing-popularity-of-evs-drives-the-market—technavio-301904141.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/automotive-telematics-market-size-to-grow-by-usd-109-84-billion-from-2021-to-2026–the-growing-popularity-of-evs-drives-the-market—technavio-301904141.html

SOURCE Technavio

Featured image: Pexels © Akil Mazumder