AbbVie, Inc.

ABBV

announced top-line data from the phase III maintenance study, U-ENDURE, which evaluated its JAK inhibitor drug Rinvoq (upadacitinib) for moderate-to-severe Crohn’s disease (CD).

This study achieved its co-primary endpoints of clinical remission and endoscopic response at week 52. The study also achieved its secondary endpoint of endoscopic remission at week 52.

The U-ENDURE study evaluated the safety and efficacy of two doses of upadacitinib (15 mg and 30mg) against placebo in adult participants with moderate-to-severe CD, who resposnded to indiction treatment with the drug in the phase III U-EXCEED and U-EXCEL induction studies.

The co-primary endpoint of clinical remission was defined by the Crohn’s Disease Activity Index (CDAI) or by stool frequency and abdominal pain score (SF/AP). Both CDAI and SF/AP were used to accommodate the regulatory differences in the United States and Europe. The FDA considers CDAI while the EMA considers SF/AP.

Per CDAI, patients in the U-ENDURE study who received upadacitinib, achieved a clinical remission of 37% and 48% with the 15 mg and 30 mg dose, respectively. Patients administered with placebo only achieved a 15% clinical remission based on CDAI. Per the SF/AP score, patients having received 15mg dose of the drug achieved a clinical remission of 36% while those who received 30mg dose achieved 46% clinical remission. Patients in the placebo group achieved clinical remission of 14% based on the SF/AP score.

Patients administered with upadacitinib achieved an endoscopic response of 28% for the 15mg dose of the drug and 40% for the 30mg dose. Participants in the placebo group achieved a response of 7%.

Participants administered with the 15 mg and 30mg doses of the drug achieved 19% and 29% endoscopic remission, respectively, while those in the placebo group achieved only 5% remission. The safety results of the drug in the maintenance study were also consistent with the safety profile observed in the induction studies.

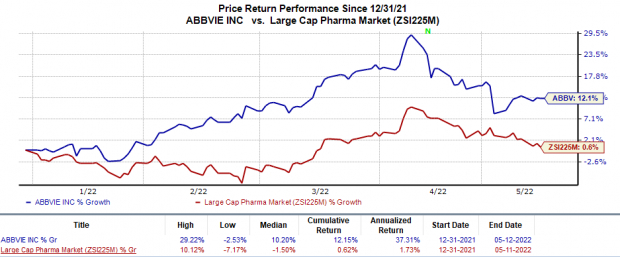

Shares of AbbVie have gained 12.2% so far this year compared with the

industry

’s 0.6% rise.

Image Source: Zacks Investment Research

Rinvoq is already approved by the FDA for five indications, namely rheumatoid arthritis, active psoriatic arthritis (PsA), ulcerative colitis (UC), ankylosing spondylitis and atopic dermatitis.

ABBV also markets another blockbuster drug Skyrizi, an IL-23 inhibitor currently approved for two indications in the United States, which are plaque psoriasis and PsA. An FDA filing seeking label expansion for the CD indication is currently under review.

AbbVie is alert about strengthening its focus on Rinvoq and Skyrizi to gradually lower its dependence on Humira, ABBV’s blockbuster drug, sales of which are declining due to biosimilars eroding its yearly international sales. Humira biosimilars are expected to be launched in the United States in 2023.

Both Skyrizi and Rinvoq demonstrated differentiated clinical profiles compared to Humira. With many new indications coming in the next couple of years, AbbVie expects combined sales of these two drugs to be more than $15 billion by 2025.

Skyrizi generated sales worth $940 million in the first three months of 2022, while Rinvoq generated sales worth $465 million during the same period.

The targeted CD market is highly competitive. ABBV faces stiff competition from

Johnson & Johnson

JNJ

, which markets its own drug Stelara that utilizes a different mechanism of action to treat the CD indication.

A blockbuster drug, J&J’s Stelara is a human IL-12 and IL-23 antagonist approved by the FDA for treating moderately-to-severely active CD. The drug is also approved for other indications, including UC and PsA. Evidently, Stelara is one of JNJ’s top-line drivers. During first-quarter 2022, J&J recorded revenues worth $2.3 billion from Stelara sales.

Zacks Rank & Stocks to Consider

AbbVie currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the overall healthcare sector include

Abeona Therapeutics

ABEO

and

Alkermes

ALKS

. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, Abeona Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have rallied 13.5% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 33 cents in the past 30 days. Shares of ABEO have declined 59.5% in the year-to-date period.

Abeona Therapeutics has a mixed surprise history, with its earnings having surpassed expectations in one of the trailing four quarters, missing the mark in another and meeting the same on the remaining two occasions, the average surprise being 0.7%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 7.7%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report