Acer Therapeutics Inc.

ACER

, along with its partner Relief Therapeutics Holding AG, announced that the FDA has approved Olpruva, a formulation of sodium phenylbutyrate for oral suspension for the treatment of patients with urea cycle disorders (“UCDs”). The drug is approved for patients with UCDs involving deficiencies of carbamylphosphate synthetase (“CPS”), ornithine transcarbamylase (“OTC”), or argininosuccinic acid synthetase (“AS”).

The approval marks the first FDA nod to the company for any of its pipeline candidates.

Per the company, UCDs are a group of rare, genetic disorders that can cause harmful ammonia to build up in the blood, which may lead to brain damage and neurocognitive impairments if not controlled.

The FDA approved Olpruva under section 505(b)(2) of the Federal Food, Drug and Cosmetic Act (FDCA), a regulatory pathway that allows applicants to rely, at least in part, on third-party data for approval. Acer mentioned preclinical and clinical safety and efficacy data from the reference listed drug, Buphenyl powder, in its new drug application or NDA for Olpruva.

Buphenyl powder is also approved as adjunctive therapy in the chronic management of patients with UCDs involving deficiencies of CPS, OTC or AS.

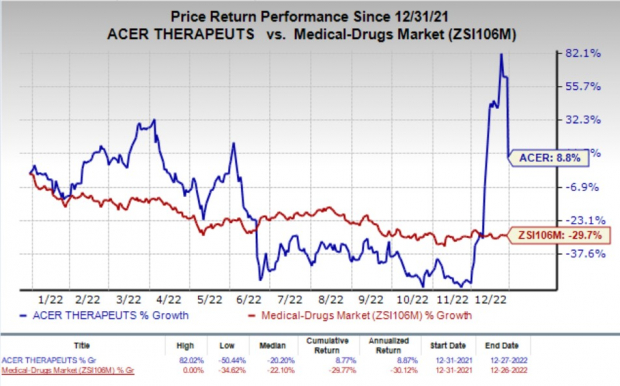

Shares of Acer were down 33.3% on Tuesday following the announcement of the news. The stock has gained 8.8% in the year-to-date period against the

industry

’s decline of 29.7%.

Image Source: Zacks Investment Research

We remind investors that in June 2022, the FDA issued a complete response letter (“CRL”) to Acer’s NDA for Olpruva to treat patients with UCDs.

The CRL was issued as Acer’s third-party contract packaging manufacturer facility was not ready for inspection. Hence, the FDA’s field investigator was unable to complete the inspection of this facility. The CRL cited that a satisfactory inspection was required to be carried out by the regulatory body before approving the drug in its current form.

The resubmitted NDA for Olpruva was accepted by the FDA in July. The regulatory body set had set an action date of Jan 15, 2023, but the decision has now come much earlier

Apart from UCD, Acer is also developing Olpruva to treat various other inborn errors of metabolism, including maple syrup urine disease.

Other than Olpruva, the company currently has other candidates in clinical development.

Edsivo (celiprolol) is being developed for vascular Ehlers-Danlos syndrome (“vEDS”) in patients with a confirmed type III collagen (COL3A1) mutation, while ACER-801 (osanetant) is being developed for the treatment of induced vasomotor symptoms (“iVMS”) and post-traumatic stress disorder (“PTSD”). Acer’s other candidate, ACER-2820 (emetine) is a host-directed therapy against a variety of viruses, including cytomegalovirus, Zika, dengue, Ebola and COVID-19.

Successful development of the pipeline candidates will be a big boost for the company.

Zacks Rank & Other Stocks to Consider

Acer currently carries a Zacks Rank #1 (Strong Buy). Other top-ranked stocks in the biotech sector are

Syndax Pharmaceuticals, Inc.

SNDX

,

Celularity Inc.

CELU

and

Immunocore Holdings plc

IMCR

, all carrying the same Zacks Rank #1 at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Loss per share estimates for Syndax Pharmaceuticals have narrowed 5.9% for 2022 and 14.5% for 2023 in the past 60 days.

Earnings of Syndax Pharmaceuticals surpassed estimates in three of the trailing four quarters and met the same on the other occasion. SNDX witnessed an earnings surprise of 95.39% on average.

Loss per share estimates for Celularity have narrowed 57.1% for 2022 and 7.7% for 2023 in the past 60 days.

Earnings of Celularity surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. CELU witnessed an earnings surprise of 51.01% on average.

Loss per share estimates for Immunocore have narrowed 56.1% for 2022 and 56.8% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report