Acer Therapeutics

ACER

announced that the FDA has issued a complete response letter (“CRL”) to its new drug application (“NDA”), which seeks approval for ACER-001 (sodium phenylbutyrate) for oral suspension for the treatment of patients with urea cycle disorders (UCDs).

Per the FDA, the CRL was issued as Acer Therapeutics’ third-party contract packaging manufacturer facility was not ready for inspection. Hence, the regulatory body’s field investigator was unable to complete the inspection of this facility. A satisfactory inspection is required to be carried out by the regulatory body before approving the drug in its current form, cited the CRL.

Though the FDA did not raise any approvability concerns related to the efficacy, safety or pharmacokinetics of ACER-001, it did request ACER to provide additional existing non-clinical information in the resubmission of the NDA. This information, requested by the FDA, was identified in the CRL as “not an approvability issue.”

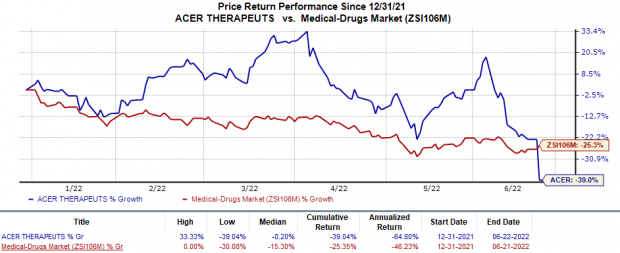

Shares of Acer Therapeutics fell 21% on Jun 21, following the above announcement. The stock has declined 39% so far this year compared with the

industry

’s 25.4% fall.

Image Source: Zacks Investment Research

Based on the response received in the CRL, Acer Therapeutics is currently collaborating with its third-party contract packaging manufacturer to ensure that the FDA’s queries are resolved. ACER plans to resubmit the NDA during early-to-mid of third-quarter 2022.

Apart from UCD, Acer Therapeutics is also developing ACER-001 to treat various other inborn errors of metabolism, including maple syrup urine disease. The drug is yet to be approved by any regulatory authority worldwide for any indication.

With no marketed drugs in its portfolio, ACER is highly dependent on its pipeline candidates for growth. Other than ACER-001, the company currently has two other candidates in clinical development. One of them is Edsivo (celiprolol), which is expected to enter a pivotal phase III study by the end of second-quarter 2022 to treat patients with COL3A1-positivevascular Ehlers-Danlos Syndrome (vEDS). Another candidate is ACER-801 (osanetant), which is being evaluated in an ongoing phase IIa study for the treatment of moderate-to-severe Vasomotor symptoms in post-menopausal women. Data from this mid-stage study is expected later this year.

Zacks Rank & Stocks to Consider

Acer Therapeutics currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Sesen Bio

SESN

. While Alkermes and Sesen Bio each sport a Zacks Rank #1 (Strong Buy) at present, Abeona Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Estimates for Sesen Bio’s 2022 bottom line have declined from a loss of 33 cents to 32 cents in the past 60 days. Shares of Sesen Bio have risen 8.8% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark once, with the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

Estimates for Alkermes’ 2022 bottom line have narrowed from a loss of 10 cents to 3 cents in the past 60 days. Shares of Alkermes have risen 18.9% year to date.

Earnings of Alkermes beat estimates in each of the trailing four quarters, with the average surprise being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Estimates for Abeona Therapeutics’ 2022 bottom line have narrowed from a loss of 33 cents to 31 cents in the past 30 days. Shares of Abeona Therapeutics have plunged 50.3% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and matched the same twice, with the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 25%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report