Aclaris Therapeutics, Inc.

ACRS

announced positive preliminary top-line data from the first in-human phase IIa study evaluating its JAK 1/3 inhibitor, ATI-1777, for the treatment of moderate-to-severe atopic dermatitis (“AD”).

The multicenter, double-blind, parallel-group study evaluated the efficacy, safety, tolerability and pharmacokinetics of ATI-1777 in patients with moderate or severe AD. Data from the study showed that treatment with ATI-1777 led to statistically significant results in the primary efficacy endpoint at week four.

The primary endpoint of the study was the percentage change from baseline in the Eczema Area and Severity Index (“EASI”) score at week four. The study met its primary endpoint by demonstrating statistical significance, with a 74.4% reduction in mEASI score from baseline in the ATI-1777 arm versus 41.4% reduction in the vehicle arm.

Notably, ATI-1777 was generally well tolerated, with no serious adverse side effect being reported. If successfully developed and upon potential approval, ATI-1777 will be able to safely and effectively treat AD while limiting systemic exposure.

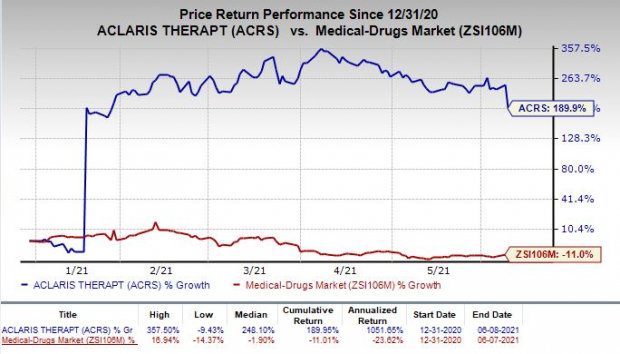

Shares of Aclaris have skyrocketed 189.9% so far this year against the

industry’s

decline of 11%.

Image Source: Zacks Investment Research

ATI-1777 is an investigational topical “soft” janus kinase (JAK) 1/3 inhibitor. It has been developed internally utilizing Aclaris’ proprietary KINect drug discovery platform.

AD, also called eczema, is a chronic inflammatory disease of the skin. Several companies are developing medicines to treat AD.

Sanofi

(

SNY

)/

Regeneron Pharmaceuticals

’

REGN

Dupixent is approved for treating AD.

Zacks Rank & Stock to Consider

Aclaris currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the healthcare sector is

Catalent, Inc.

CTLT

, which sports a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Catalent’s earnings estimates have been revised 2.4% upward for 2021 and 3.3% upward for 2022 over the past 60 days.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report