Shares of

Actinium Pharmaceuticals

ATNM

were up 24% on Tuesday after management announced that ATNM has entered into a license and supply agreement with Sweden-based Immedica BioPharma for its most advanced pipeline candidate.

Per the terms of the agreement, Actinium granted exclusive rights for Iomab-B, its investigational antibody radiation conjugate (ARC), to Immedica in Europe, the Middle East and North Africa. In return, ATNM will receive an upfront payment of $35 million from Immedica. In addition, ATNM is eligible to receive milestone payments up to $417 million as well as future royalties on the product’s net sales in the above-mentioned markets. However, ATNM will remain responsible for certain clinical and regulatory activities as well as manufacturing Iomab-B in the aforementioned regions.

Actinium developed Iomab-B for targeted conditioning to facilitate bone marrow transplant (BMT). ATNM is currently evaluating this candidate in the pivotal phase III SIERRA study against physician’s choice of salvage therapy in elderly patients (aged 55 years and older) with relapsed or refractory (r/r) acute myeloid leukemia (AML). Topline data from the SIERRA study is anticipated in third-quarter 2022.

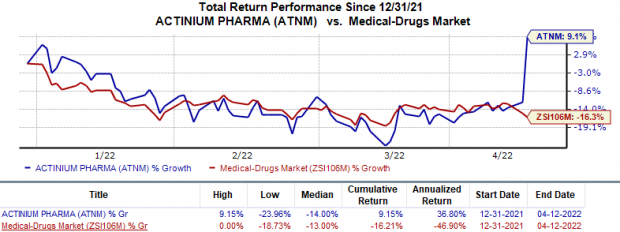

Shares of Actinium have gained 9.2% so far this year against the

industry

’s 16.2% decrease.

Image Source: Zacks Investment Research

Currently, BMT is the only potentially curative treatment option to certain blood-borne cancers including r/r AML. Per management, Iomab-B provides a safer treatment option to patients preparing for BMT conditioning by avoiding the side-effects of non-targeted intensive chemotherapy, the current standard of care for conditioning BMT, on healthy tissues and at the same time, effectively killing a patient’s cancer cells. Notably, Iomab-B is already granted orphan drug designations in the United States and the European Union (EU).

With no marketed products in its portfolio, ATNM is highly dependent on its ARC pipeline for growth. Although Actinium has multiple candidates in its pipeline, most are in early-stage development and still years away from a potential approval and commercialization. Positive data from the SIERRA study will enable ATNM to proceed for a potential approval of Iomab-B for BMT conditioning in AML patients.

Zacks Rank & Key Picks

Actinium presently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Angion Biomedica

ANGN

,

Assertio Holdings

ASRT

and

Collegium Pharmaceutical

COLL

, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Angion Biomedica’s loss per share estimates for 2022 have narrowed from $2.52 to $1.92 in the past 60 days. The same for 2023 has narrowed from $3.11 to $2.19 in the past 60 days.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark once, the average surprise being 47.5%.

Assertio Holdings’ earnings per share estimates for 2022 have increased from 20 cents to 35 cents in the past 60 days. Shares of ASRT have rallied 40.4% in the year-to-date period.

Earnings of Assertio Holdings beat estimates in two of the last four quarters and missed the mark in the other two, the average surprise being 20.8%.

Collegium Pharmaceutical’s earnings per share estimates for 2022 have increased from $3.79 to $5.59 in the past 60 days. The same for 2023 has increased from $4.79 to $7.44 in the past 60 days. Shares of COLL have risen 3.1% year to date.

Earnings of Collegium Pharmaceutical missed estimates in three of the last four quarters and beat the mark on one occasion, the negative surprise being 57.6%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report