Aeglea BioTherapeutics, Inc.

AGLE

announced that it has received a Refusal to File (“RTF”) letter from the FDA regarding the biologics license application (“BLA”) for its lead product candidate, pegzilarginase, for the treatment of arginase 1 deficiency (ARG1-D), a devastating rare disease. Currently, there is no approved therapy for the given indication.

The FDA had requested additional data to support effectiveness of pegzilarginase in the RTF letter. The regulatory body has also requested additional information relating to Chemistry Manufacturing and Controls. However, no issue related to safety was raised in the RTF letter.

Aeglea is considering requesting a Type A meeting with the FDA to clarify and respond to the items mentioned in the letter.

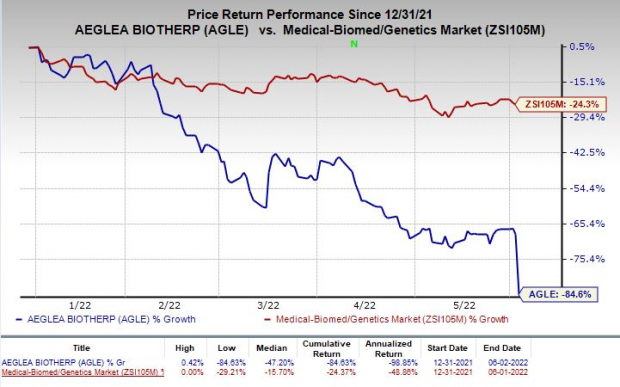

Shares of Aeglea were down 51.3% on Thursday following the announcement of the news. The stock has plunged 84.6% so far this year compared with the

industry

’s decrease of 24.3%.

Image Source: Zacks Investment Research

In April 2022, Aeglea submitted the BLA to the FDA, seeking approval of pegzilarginase for the treatment of ARG1-D. The company had requested the FDA to grant priority review to the BLA.

The BLA filling was based on data from several clinical studies, including the phase III PEACE study, an ongoing long-term extension study, a phase I/II study, as well as an open-label extension study that evaluated pegzilarginase for treating ARG1-D.

Back then, the FDA had already given a feedback to Aeglea, conveying its disagreement with the substantial evidence regarding the effectiveness of pegzilarginase.

Aeglea’s commercialization partner in Europe and the Middle East, Immedica Pharma AB, plans to submit marketing authorization application for pegzilarginase to the European Medicines Agency later in 2022.

Aeglea has no approved product in its portfolio at the moment. Therefore, the successful development of pegzilarginase, along with other pipeline candidates, remains a key focus for the company.

Zacks Rank & Stocks to Consider

Aeglea currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Anavex Life Sciences Corp.

AVXL

and

Precision BioSciences, Inc.

DTIL

, all carrying the same Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Anavex Life Sciences’ loss per share estimates narrowed 6.6% for 2022 and 4.3% for 2023 in the past 60 days.

Earnings of Anavex Life Sciences have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AVXL delivered an earnings surprise of 0.48%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report