Agios Pharmaceuticals, Inc.

AGIO

reported a loss of $1.81 per share from continued operations for the fourth quarter of 2021, wider than the Zacks Consensus Estimate of a loss of $1.71 as well as the year-ago quarter’s loss of $1.22.

Following the

sale of its oncology portfolio

to France-based pharmaceutical company Servier, AGIO recorded zero revenues for the fourth quarter. The Zacks Consensus Estimate for the metric was $2.1 million. In the year-ago quarter, Agios recorded $44 million of total revenues.

Last week, the FDA

approved

its lead pipeline candidate mitapivat for hemolytic anemia in adults with pyruvate kinase (PK) deficiency. The drug to be marketed by the trade name of Pyrukynd is the first disease-modifying therapy approved to treat this rare and debilitating blood disorder. A regulatory application for the drug for a similar indication is pending in the European Union and a decision is expected by this year-end.

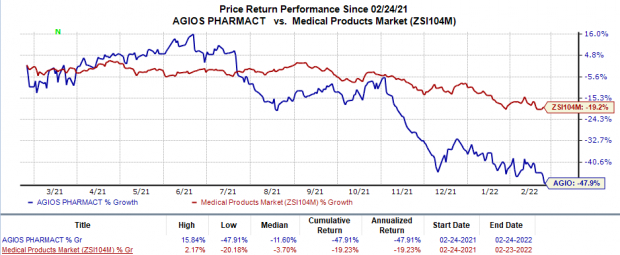

Shares of Agios were down 2.5% in pre-market trading on Feb 24 following the above announcement. In fact, the stock has declined 47.9% in the trailing 12 months compared with the

industry

’s 19.2% decrease.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development expenses increased 23.4% year over year to $73.3 million due to a rise in cost related to the planned initiation of late-stage studies of Pyrukynd for thalassemia and sickle cell disease (SCD), a blood disorder.

Selling, general and administrative expenses were up 21.7% year over year to $31.5 million, primarily due to launch preparations for Pyrukynd as well as expenses incurred to educate consumers about the PK deficiency disease

At the end of December 2021, cash, cash equivalents and marketable securities were $1.3 billion compared with $1.4 billion at the end of September 2021.

Pipeline Updates

Apart from PK deficiency, Agios is evaluating Pyrukynd for SCD and thalassemia indications.

AGIO initiated two phase III studies, namely ENERGIZE and ENERGIZE-T, to evaluate Pyrukynd for thalassemia in adults, with one segment being not regularly transfused while the other being regularly transfused. Agios plans to complete enrolment in both studies by 2022-end. Agios also plans to initiate two phase III studies that evaluate Pyrukynd in pediatric patients who are not regularly transfused and are regularly transfused, respectively, by mid-2022.

AGIO also initiated the phase II/III RISE UP study evaluating Pyrukynd for SCD. It plans to complete enrolling patients in the study by 2022-end.

Apart from Pyrukynd, Agios is evaluating AG-946, its next-generation pyruvate kinase-R activator. AGIO is currently evaluating the candidate in a phase I study for the treatment of hemolytic anemia.

Agios also intends to evaluate AG-946 for other indications. While a phase I study to evaluate the candidate for SCD is expected to begin in first-half 2022, a phase IIa study on the candidate for low- to intermediate-risk myelodysplastic syndrome (MDS) is planned to start by 2022-end.

Zacks Rank & Stocks to Consider

Currently, Agios has a Zacks Rank #3 (Hold). Better-ranked stocks in the overall healthcare sector include

Adaptimmune Therapeutics

ADAP

,

Arbutus Biopharma

ABUS

and

Vertex Pharmaceuticals

VRTX

, each carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Adaptimmune Therapeutics’ loss per share estimates for 2022 have narrowed from 99 cents to 91 cents in the past 30 days. Earnings of ADAP beat estimates in three of the last four quarters and missed the mark on a single occasion, the average surprise being 0.9%.

Arbutus Biopharma’s loss per share estimates for 2022 have narrowed from 63 cents to 61 cents in the past 30 days. Earnings of ABUS beat estimates in one of the last four quarters, met the mark once and missed the same on the other two occasions. ABUS delivered a negative surprise of 3.6%, on average.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $13.35 to $14.33 in the past 30 days. The same for 2023 has risen from $14.12 to $15.31 in the past 30 days. Shares of VRTX have risen 6.3% in the past year.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report