Alnylam Pharmaceuticals, Inc.

ALNY

announced that it has submitted a marketing authorization application (“MAA”) to the European Medicines Agency (“EMA”), seeking approval of its investigational RNAi therapeutic, vutrisiran, for the treatment of adult patients with polyneuropathy of hereditary transthyretin-mediated (hATTR) amyloidosis.

If approved in the European Union, vutrisiran might become a new, subcutaneously administered, once-quarterly treatment option for the given patient population.

Alnylam also plans to submit regulatory filings for vutrisiran in Brazil and Japan, later in 2021.

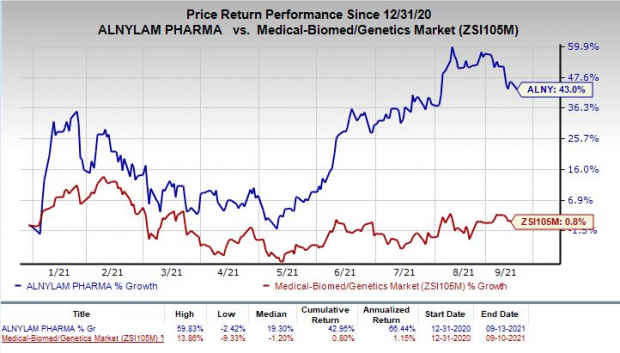

Shares of Alnylam have rallied 43% so far this year compared with the

industry

’s rise of 0.8%.

Image Source: Zacks Investment Research

In June 2021, the FDA accepted the new drug application for vutrisiran to treat adult patients with polyneuropathy of hATTR amyloidosis. A decision from the regulatory body is expected on Apr 14, 2022.

Both the FDA and the EMA have granted Orphan Drug designation to vutrisiran for the treatment of ATTR amyloidosis.

We remind investors that Alnylam’s Onpattro is already approved for the treatment of polyneuropathy of hATTR amyloidosis. The injection recorded sales of $215.8 million in the first six months of 2021, up 62% year over year, driven by new patient demand.

Hence, the potential approval of vutrisiran should help Alnylam strengthen its portfolio and drive growth further in the days ahead.

Zacks Rank & Stocks to Consider

Alnylam currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector include

Spero Therapeutics, Inc.

SPRO

,

Vertex Pharmaceuticals Incorporated

VRTX

and

Corvus Pharmaceuticals, Inc.

CRVS

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Spero Therapeutics’ loss per share estimates have narrowed 8.2% for 2021 and 10.6% for 2022 over the past 60 days.

Vertex’s earnings estimates have been revised 10.2% upward for 2021 and 7.1% upward for 2022 over the past 60 days.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 24.4% for 2021 and 21.4% for 2022 over the past 60 days.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report