Alnylam Pharmaceuticals, Inc.

ALNY

announced that the FDA has accepted its new drug application (“NDA”) for its investigational RNAi therapeutic, vutrisiran, being developed for the treatment of adult patients with polyneuropathy of hereditary transthyretin-mediated (hATTR) amyloidosis.

A decision from the regulatory body is expected on Apr 14, 2022. The FDA is currently not planning to hold an advisory committee meeting as part of the NDA review.

If approved, vutrisiran might become a new treatment option for the given patient population.

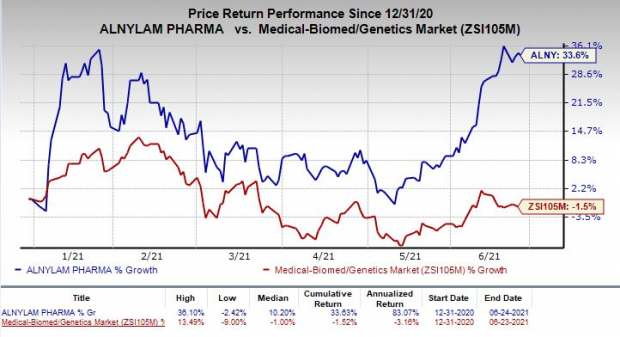

Shares of Alnylam have rallied 33.6% so far this year against the

industry’s

decline of 1.5%.

Image Source: Zacks Investment Research

The FDA’s acceptance of the above-mentioned NDA was based on data from the HELIOS-A study. In January 2021, the company

announced

positive top-line results from the study, which evaluated vutrisiran for the treatment of transthyretin-mediated (ATTR) amyloidosis with polyneuropathy.

The study met both its primary and secondary endpoints at nine months in patients with hATTR amyloidosis with polyneuropathy. hATTR is an inherited, often fatal disease caused by mutations in the TTR gene.

Based on results from the HELIOS-A study, Alnylam plans to submit regulatory filings for vutrisiran in the EU, Brazil, and Japan, later in 2021.

Please note that Alnylam’s Onpattro is already approved for the treatment of polyneuropathy of hereditary transthyretin-mediated (hATTR) amyloidosis. The injection recorded sales of $102 million in the first quarter of 2021, up 52.9% year over year, driven by new patient demand.

Hence, the potential approval of vutrisiran should help Alnylam diversify its portfolio and drive growth in the days ahead.

Zacks Rank & Stocks to Consider

Alnylam currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

Repligen Corporation

RGEN

,

Trevena, Inc.

TRVN

and

Bio-Techne Corporation

TECH

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Repligen’s earnings estimates have been revised 18.3% and 14.7% upward for 2021 and 2022, respectively, over the past 60 days. The stock has risen0.7% year to date.

Trevena’s loss per share estimates have narrowed 6.4% for 2021 and 3.7% for 2022 over the past 60 days.

Bio-Techne’s earnings estimates have been revised upward by 8.8% and 9.1% for 2021 and 2022, respectively, over the past 60 days. The stock has surged 38.4% year to date.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report