Alpine Immune Sciences, Inc.

ALPN

announced that it has entered into a collaboration and supply agreement with pharma giant

Merck

MRK

for conducting an immuno-oncology study. The study – NEON-2 – began dosing participants last month.

With this deal, the companies are looking to evaluate the safety and efficacy of Alpine’s ALPN-202 in combination with Merck’s anti PD-1 therapy, Keytruda (pembrolizumab), for treating a broad range of cancer indications.

ALPN-202, a conditional CD28 co-stimulator and dual checkpoint inhibitor, has demonstrated superior efficacy in tumor models compared with checkpoint inhibition alone, in preclinical studies.

In June 2020, Alpine dosed the first patient in the phase I NEON-1 study on ALPN-202 for the treatment of patients with advanced malignancies.

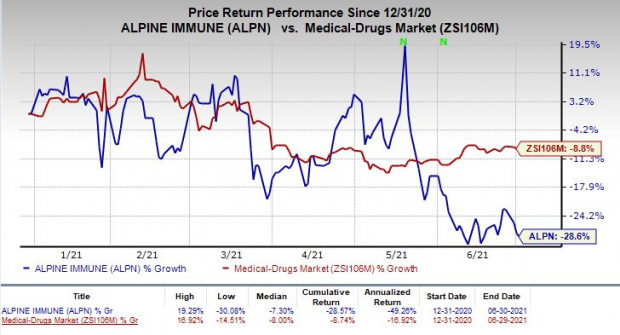

Shares of Alpine have plunged 28.6% so far this year compared with the

industry

’s decrease of 8.8%.

Image Source: Zacks Investment Research

We remind investors that Alpine is an immunotherapy company engaged in leading a new wave of immune therapeutics. Apart from ALPN-202, the company has another candidate, ALPN-101, which is being developed for autoimmune diseases.

In June 2021, Alpine dosed the first patient in the phase II Synergy study evaluating ALPN-101 for treating patients with systemic lupus erythematosus. Following this, the company received $45 million as pre-option exercise development milestone payment from

AbbVie

ABBV

.

Last June, Alpine signed an agreement with AbbVie, granting the latter an exclusive option to license worldwide rights to ALPN-101.

We note that Alpine currently has no approved product in its commercial portfolio, thus lacking a source of regular income. Successful development of the two pipeline candidates is key to the company’s growth in the long run as they might become revenue drivers upon potential approval.

Zacks Rank & Stock to Consider

Alpine currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the healthcare sector is

Zoetis Inc.

ZTS

, which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zoetis’ earnings estimates have been revised 1.8% and 1.8% upward for 2021 and 2022, respectively, over the past 60 days. The stock has rallied 12.6% year to date.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research SherazMian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report