Amicus Therapeutics

FOLD

reported a loss of 30 cents per share for first-quarter 2022, wider than the Zacks Consensus Estimate of a loss of 24 cents as well as the year-ago loss of 25 cents.

Revenues increased 18.5% year over year to $78.7 million for the first quarter, beating the Zacks Consensus Estimate of $77 million. Revenues were entirely derived from the sales of Galafold (migalastat), approved for Fabry disease.

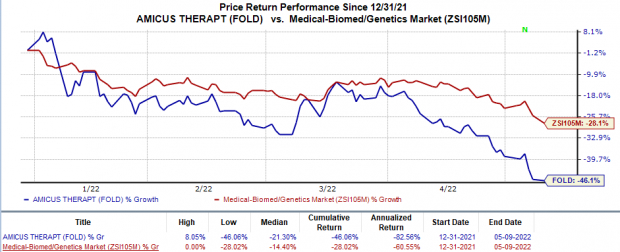

Shares of Amicus Therapeutics have slumped 46.1% in the year so far compared with the

industry

’s 28% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Revenues for the first quarter were driven by strong new patient accruals, continued sustained patient compliance and adherence rates. While Amicus Therapeutics generated 31% of total revenues from within the United States, the remaining 69% was generated from the ex-U.S. sales of Galafold.

Operating expenses (adjusted basis) were $109 million, up 20.4% year over year.

As of Mar 31, 2022, Amicus Therapeutics had cash, cash equivalents and marketable securities of $411.2 million compared with $482.5 million on Dec 31, 2021.

Amicus Therapeutics expects cash resources and revenues to be enough to support operations and the ongoing research programs through self-sustainability.FOLD anticipates achieving profitability by 2023.

Maintains 2022 Guidance

For the full year, Amicus Therapeutics expects total Galafold revenues of at least $350-$365 million, driven by continued patient demand and commercial execution across all major markets, including the United States, the EU, the U.K. and Japan.

Adjusted operating expenses for the year are estimated in the range of $470-$485 million, driven by continued investments for the global Galafold launch, AT-GAA clinical studies and pre-launch activities.

Other Updates

The lead pipeline candidate in Amicus Therapeutics’ portfolio is AT-GAA, developed as a potential treatment of Pompe disease. The FDA accepted FOLD’s biologics license application (BLA) and the new drug application (NDA) for AT-GAA to treat Pompe disease. The FDA set PDUFA action dates of May 29, 2022, for the NDA and Jul 29, 2022, for the BLA.

In the EU, Amicus Therapeutics completed the marketing authorization application (MAA) submissions for AT-GAA in fourth-quarter 2021. A positive opinion on the MAA by the EMA’s Committee for Medicinal Products for Human Use (CHMP) is expected later this year.

The submissions in both the United States and the EU are based on data from the phase I/II and phase III PROPEL studies as well as the long-term open-label extension study evaluating AT-GAA for Pompe disease.

During the first quarter, Amicus Therapeutics decided to discontinue the CLN6 Batten Disease gene-therapy program development. The decision was based on the review of a long-term extension study data, which determined that any initial stabilization of disease progression at the two-year time point was not maintained.

Zacks Rank & Other Stocks to Consider

Amicus Therapeutics currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Vertex Pharmaceuticals

VRTX

. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, both Abeona Therapeutics and Vertex Pharmaceuticals carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have risen 14.4% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 33 cents in the past 30 days. Shares of ABEO have declined 54.2% in the year-to-date period.

Abeona Therapeutics has a mixed surprise history, with its earnings having surpassed expectations in one of the trailing four quarters, missing the mark in another and meeting the same on the remaining two occasions, the average surprise being 0.7%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 7.7%.

Vertex Pharmaceuticals’ earnings per share estimates for 2023 have increased from $15.31 to $15.33 in the past 30 days. VRTX has rallied 7% in the year so far.

Earnings of Vertex Pharmaceuticals beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 7.6%. In the last reported quarter, Vertex Pharmaceuticals missed earnings estimates by 2.2%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report