We expect investors to focus on

Anavex Life Sciences

’

AVXL

development efforts for its pipeline candidates, when it reports third-quarter fiscal 2021 earnings results.

The company has a mixed surprise history with its earnings having surpassed expectations in two of the trailing four quarters, missing the mark in one and meeting the same in another. The average earnings surprise was 8.86%. In the last reported quarter, Anavex reported breakeven earnings.

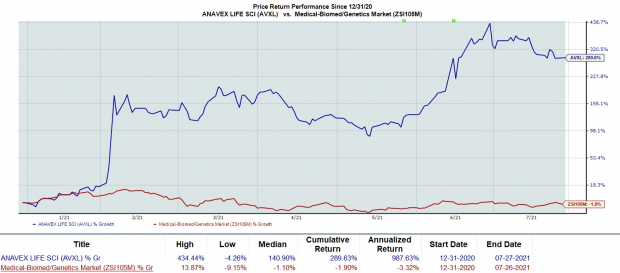

Anavex’s stock has rallied 289.6% this year so far against the

industry

’s decline of 1.9%.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for this announcement.

Factors to Consider

With no approved products in its portfolio, Avanex does not generate any revenues.

Hence, pipeline development should remain the key focus for investors during its upcoming quarterly release, especially updates on its lead investigational compound ANAVEX2-73 (blarcamesine). The candidate is being evaluated for the treatment of Alzheimer’s disease (AD).

Recently, ANAVEX2-73 successfully completed a phase II study for Alzheimer’s disease, a phase II proof-of-concept study on Parkinson’s disease dementia and a phase II study in adult patients with Rett syndrome.

Earlier, management announced that the Independent Data Safety Monitoring Board (DSMB) completed the pre-planned review of the interim safety data for the company’s above-mentioned ongoing studies on the lead drug. Upon review, the DSMB recommended to continue the studies without modification.

In June 2021, the company announced that it exceeded its enrollment target for the ANAVEX2-73 phase IIb/III study on Alzheimer’s disease. It expects to announce top-line results from the same by mid-2022.

Management also announced ANAVEX2-73’s label expansion by a US patent to treat a range of cardiac dysfunctions.

The company recently reported that treatment with ANAVEX2-73 resulted in a significant increase in the expression of the SIGMAR1 mRNA biomarker that substantially correlated with improvements in the primary and secondary clinical efficacy endpoints CoA and MDS-UPDRS Part III and MDS-UPDRS Total.

Another investigational drug ANAVEX3-71 is in phase I study for frontotemporal dementia. The candidate also exhibited disease-modifying activity against the major hallmarks of AD in pre-clinical studies.

An update on all these evaluations is expected on the third-quarter conference call. R&D costs of the company are expected to have risen in the quarter to be reported.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Anavex this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below.

Earnings ESP:

Anavex has an Earnings ESP is 0.00%. Both the Zacks Consensus Estimate and the Most Accurate Estimate stand at a loss of 13 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Anavex currently carries a Zacks Rank #3.

Stocks to Consider

Here are some biotech stocks that have the right combination of elements to beat on earnings this season:

Corvus Pharmaceuticals

CRVS

has an Earnings ESP of +14.29% and a Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

CytomX Therapeutics

CTMX

has an Earnings ESP of +12.66% and a Zacks Rank #2, currently.

Evelo Biosciences

EVLO

has an Earnings ESP of +16.15% and a Zacks Rank of 2, presently

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report