Advanced Micro Devices (NASDAQ:AMD) is poised to reveal substantial growth in its Client segment during the upcoming fourth-quarter 2023 earnings announcement on January 30. The projections indicate positive year-over-year and sequential advancements, driven by a thriving PC market.

The buoyancy in AMD’s fourth-quarter top-line figures is attributed to the resurgence of the PC market, with global shipments reaching 63.3 million units, marking a modest 0.3% increase year over year, as reported by Gartner.

An instrumental highlight is the reintroduction of the Ryzen Threadripper 7000 Series processors designed for high-end desktop users. Additionally, AMD has unveiled its flagship laptop graphics processor, the Radeon RX 7900M, recognized as the fastest AMD Radeon GPU developed specifically for laptops.

Revenue expectations for the Client segment indicate a substantial 19.4% year-over-year surge, reaching $1.18 billion, according to our model.

AMD’s promising prospects are further fueled by a diverse product portfolio and an expanding partner base. The company’s stronghold in the enterprise data center arena is bolstered by the prowess of fourth-generation EPYC CPUs.

Collaborations with industry leaders such as Dell Technologies, Microsoft, Amazon’s cloud arm (Amazon Web Services), Alibaba, and Oracle have played a pivotal role in AMD’s journey. The partnerships facilitate innovative solutions that support enhanced data center consolidation.

Major cloud providers, including Microsoft, Amazon, Alibaba, and Oracle, have already integrated Genoa. Notably, Microsoft Azure has introduced the first Genoa-X HPC instances, offering over five times higher performance in technical computing workloads compared to the previous generation.

Dell is leveraging AMD EPYC fourth-generation CPUs in its latest PowerEdge C6615 server, coupled with OpenManage Enterprise software. This synergy empowers cloud service providers to intelligently monitor systems, delivering more efficient computing services.

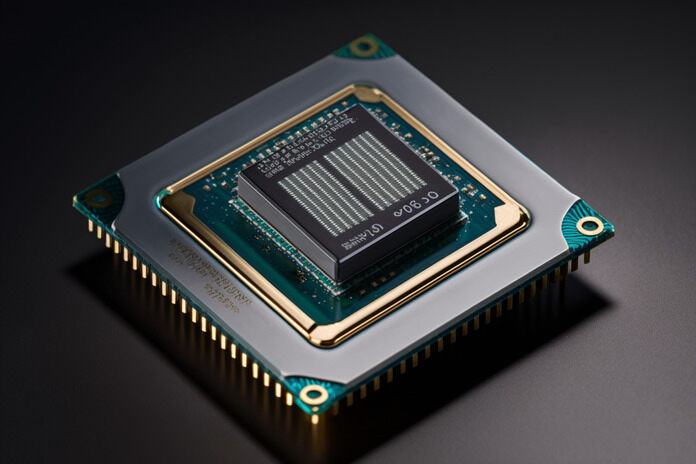

AMD’s data center footprint continues to expand with the introduction of the new Instinct MI300X accelerator. This innovative solution, combining CDNA 3 architecture and Zen 4 CPUs, is tailored for robust performance in High-Performance Computing (HPC) and Artificial Intelligence (AI) workloads.

Microsoft is also incorporating AMD’s Instinct accelerator portfolio in its Azure ND MI300x v5 virtual machine series, optimized for AI workloads.

Projections for Data Center revenues stand at $2.27 billion in our model, indicating a significant year-over-year increase of 37.3%. As AMD gears up for the earnings announcement, its solid performance in both the Client and Datacenter segments positions the company for notable success in the fourth quarter of 2023.

Featured Image: Freepik