Apellis Pharmaceuticals, Inc.

APLS

announced that it has expanded its existing research and development (R&D) collaboration agreement with France-based privately held company, Affilogic, to develop and deliver targeted complement therapies into the brain.

Affilogic specializes in the discovery, development and combinations of affinity proteins named Nanofitins.

The companies expanded their deal to include the development of Nanofitins targeting the transferrin receptor (TfR), which helps carry drugs across the blood-brain barrier and the central nervous system.

Apellis entered into a collaboration agreement with Affilogic in 2018.

Per the expanded agreement, Apellis will have exclusive, worldwide patent rights for all development projects, while Affilogic will be entitled to receive development milestone payments as well as royalties on net sales if a product is commercialized from the collaboration.

The latest deal looks a good fit for Apellis as it extends the company’s efforts to develop brain-active C3 inhibitors and deliver targeted complement therapies into the brain.

Apellis plans to file an investigational new drug (“IND”) application for APL-1030, a potential first-in-class brain-active C3 inhibitor, for treating neurodegenerative and other complement-driven diseases. The company also expects to file an IND application for ophthalmological candidate, APL-2006, to treat both wet age-related macular degeneration and geographic atrophy. The INDs are expected to be filed over the next 12 months.

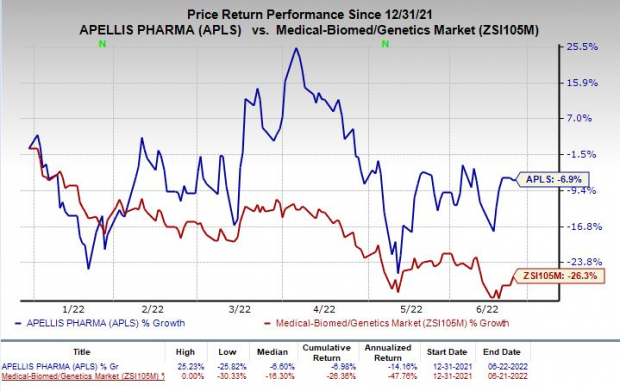

Shares of Apellis have lost 6.9% so far this year compared with the

industry

’s decline of 26.3%.

Image Source: Zacks Investment Research

Earlier this month, Apellis submitted a new drug application (“NDA”) to the FDA seeking approval of pegcetacoplan for the treatment of geographic atrophy secondary to age-related macular degeneration. The regulatory body’s decision on the NDA filing acceptance is expected in August 2022.

In May 2021, the FDA

approved

pegcetacoplan (marketed as Empaveli) as a monotherapy treatment for adult patients suffering from paroxysmal nocturnal hemoglobinuria (“PNH”).

Empaveli is approved for treatment-naïve patients and for those switching from Alexion’s (now part of AstraZeneca) C5 inhibitor therapies for PNH, namely, Soliris and Ultomiris.

Last December, the European Commission

approved

Aspaveli to treat adult patients with PNH who are anemic after treatment with a C5 inhibitor for at least three months. The drug is marketed under the trade name Empaveli in the United States.

Several label studies on pegcetacoplan are currently underway. A potential approval of pegcetacoplan for additional indications will boost sales and drive growth for the company.

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed has 19.4% for 2022 and 37.5% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report