Shares of

Aptinyx Inc.

APTX

were down 49.2% on Thursday after the company announced data from a phase IIb study evaluating its novel, oral NMDA receptor modulator candidate, NYX-2925, for treating patients with painful diabetic peripheral neuropathy (“DPN”).

In the study, NYX-2925 failed to achieve statistically significant separation versus placebo – the primary endpoint. Though treatment with NYX-2925 led to an improvement in average daily pain scores, separation from placebo was not observed.

The above-mentioned study evaluated the safety and efficacy of NYX-2925 in patients with advanced painful DPN, one of the largest neuropathic pain conditions. The primary endpoint of the study was to see the change from baseline in average daily pain as reported on the zero-to-ten numeric rating scale during week 12.

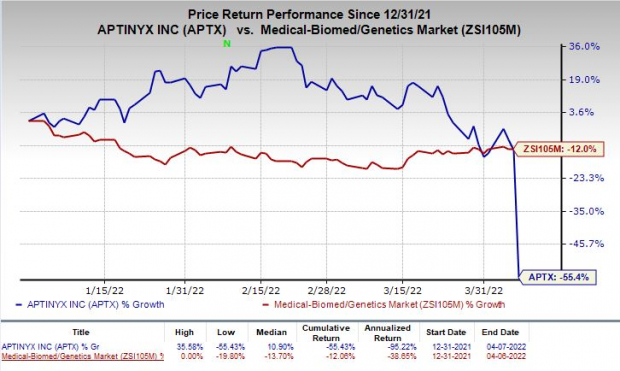

Shares of Aptinyx have plunged 55.4% so far this year compared with the

industry

’s decline of 12%.

Image Source: Zacks Investment Research

NYX-2925 is also being evaluated in another phase IIb study for the treatment of fibromyalgia. Data from this study is expected in early to mid third-quarter 2022.

Apart from NYX-2925, Aptinyx is also developing two other NMDA receptor-targeted candidates — NYX-783 and NYX-458 — in mid-stage studies. NYX-783 is being developed for the treatment of post-traumatic stress disorder. The company is evaluating NYX-458 as a potential treatment for cognitive impairment associated with Parkinson’s disease and dementia with Lewy bodies.

APTX currently has no approved product in its portfolio. Therefore, the successful development of NYX-2925, along with other pipeline candidates, remains in key focus for the company.

Zacks Rank & Stocks to Consider

Aptinyx currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Galera Therapeutics, Inc.

GRTX

,

Applied Therapeutics, Inc.

APLT

and

Voyager Therapeutics, Inc.

VYGR

, all sporting a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Galera Therapeutics’ loss per share has narrowed 30.6% for 2022 over the past 60 days.

Earnings of GRTX surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions.

Applied Therapeutics’ loss per share estimates have narrowed 11.9% for 2022 over the past 60 days.

Earnings of Applied Therapeutics have surpassed estimates in two of the trailing four quarters, met the same once and missed the same on the other occasion.

Voyager Therapeutics’ loss per share estimates have narrowed 38.6% for 2022 over the past 60 days. The VYGR stock has skyrocketed 233.2% year to date.

Earnings of Voyager Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report