Shares of

aTyr Pharma, Inc

.

LIFE

surged 66.97% after the company announced positive results from its phase Ib/IIa double-blind, placebo-controlled study of its lead candidate, ATYR1923.

The study was a randomized, double-blind, placebo-controlled, multiple-ascending dose clinical study in 37 patients with pulmonary sarcoidosis.

aTyr is developing ATYR1923 as a potential therapeutic for patients with severe inflammatory lung diseases. The lead indication for ATYR1923 is pulmonary sarcoidosis.

Pulmonary sarcoidosis is an inflammatory disease characterized by the formulation of granulomas, clumps of inflammatory cells, in one or more organs of the body.

The study consisted of three cohorts testing doses of 1.0 mg/kg, 3.0 mg/kg, and 5.0 mg/kg of ATYR1923 or placebo, dosed intravenously every month for six months. The primary objective of the study was to evaluate the safety, tolerability, immunogenicity, and pharmacokinetic profile of multiple doses of ATYR1923 compared to placebo. Secondary objectives included the potential steroid-sparing effects of ATYR1923 in addition to other exploratory assessments of efficacy.

Results showed that ATYR1923 was safe and well-tolerated at all doses without any drug-related serious adverse events or signal of immunogenicity. Additionally, the study demonstrated consistent dose response for ATYR1923 on key efficacy endpoints and improvements compared to placebo, including measures of steroid reduction, lung function, sarcoidosis symptom measures, and inflammatory biomarkers.

The study was conducted along with the company’s Hong Kong subsidiary, Pangu BioPharma Limited, which supports basic and translational research in tRNA synthetase biology in collaboration with the Hong Kong University of Science and Technology.

aTyr Pharma intends to present these data to the FDA. It plans for subsequent clinical development and path to registration for ATYR1923 for pulmonary sarcoidosis and expects to initiate a registrational trial next year.

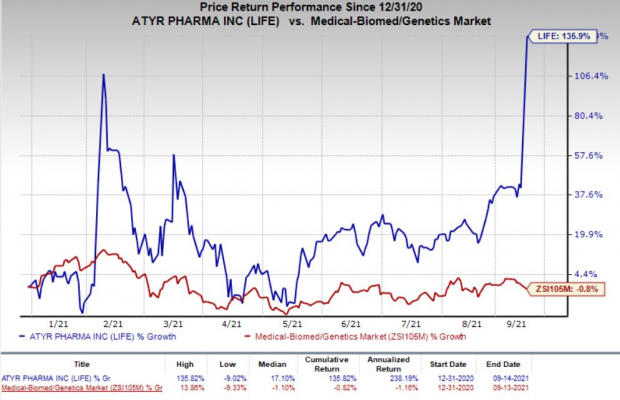

Shares of the company have rallied 135.9% in the year so far against the

industry

’s 0.8% decline.

Image Source: Zacks Investment Research

We note that aTyr Pharma has collaborated with Kyorin Pharmaceutical Co., Ltd., a wholly owned subsidiary of Kyorin Holdings, Inc for the development and commercialization of ATYR1923 for interstitial lung diseases in Japan.

The successful development of the candidate will be a significant boost for the company.

Zacks Rank & Stocks to Consider

aTyr currently carries a Zacks Rank #3 (Hold). A few better-ranked companies in the sector are

Regeneron Pharmaceuticals

REGN

,

Repligen

RGEN

, and

Moderna

MRNA

. While Regeneron and Repligen sport a Zacks Rank #1 (Strong Buy), Moderna carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Earnings estimates for Regeneron have moved up $3.79 for 2021 in the past 60 days. The stock is up 34.1% year to date.

Earnings estimates for Repligen have moved up 50 cents for 2021 in the past 30 days. The stock is up 53% year to date.

Earnings estimates for Moderna have moved up 13 cents for 2021 in the past 30 days. The stock is up 316.1% year to date.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report