The European Automobile Manufacturers Association (“ACEA”) released data for passenger car registrations made in February 2022. New car registrations in Europe witnessed a year-over-year decline of 6.7%, as carmakers continue to battle supply chain woes. Sales in four key markets — namely France, Spain, Italy and Germany — witnessed mixed results. While Italy and France saw a double-digit decline of 22.6% and 13%, Germany and Spain recorded year-over-year growth of 3.2% and 6.6%, respectively.

Russia’s attack on Ukraine has compounded supply chain issues and resulted in the shortage of parts and components sourced from Ukraine. Germany-based auto biggie

Volkswagen

’s

VWAGY

2022 prospects appear muted amid the crisis. Meanwhile, a surge in COVID-19 infections in China prompted Japan’s auto giant

Toyota

TM

to suspend operations in the country.

Auto equipment supplier

Westport Fuel Systems

WPRT

released fourth-quarter 2021 results, with earnings beating the Zacks Consensus Estimate. Auto replacements parts company

LKQ Corp

LKQ

entered into an agreement to divest the PGW business in a bid to streamline its portfolio.

Sonic Automotive

SAH

also made it to the headlines as the auto retailer remains committed to expand the used vehicle business, EchoPark.

Recap of the Week’s Important News

Volkswagen

’s CEO Herbert Diess expects the company’s 2022 prospects to be hit by the Russia-Ukraine war in unforeseen ways. Diess notified that the lack of wire harness, which plays a key role in connecting a variety of vehicle components, has now overtaken microchips shortfall and has become a major supply concern.

Diess is of the view that aggravating logistical challenges and the shortage of key parts — especially wire harnesses — might force Volkswagen to cut its 2022 guidance if the company is unable to procure wiring harnesses from alternative sources in a month or so. Diess also anticipates the commodity markets to remain volatile until 2026. VWAGY’s CFO Arno Antlitz has already warned that high commodity costs will drive the prices of both ICE and electric vehicles.

Toyota

temporarily suspended operations at a joint venture plant with FAW group in Changchun in China after a lockdown was imposed in the city last week in view of a surge in COVID-19 infections. Considering the restrictions on travel and movement, supplier status, and the safety of employees, the company arrived at this decision. The Changchun facility produces the RAV4 sports utility vehicle.

In January, TM halted activities at a joint venture plant in Tianjin, China, following the onslaught of the Omicron variant of coronavirus in the city. The hiatus resulted in a drop in its sales by about 20% in January from the year before. There has been an uptick in the sales figure by about 10% since then, but it is likely to be dented once more if operations at the Changchun plant remain suspended for a prolonged period.

Westport

posted fourth-quarter 2021 earnings per share of 3 cents, unchanged from the year-ago period. The Zacks Consensus Estimate was pegged at break-even. Westport registered consolidated revenues of $82.7 million for the fourth quarter, on par with the Zacks Consensus Estimate and the year-ago level.

Westport had cash and cash equivalents of $124.8 million as of Dec 31, 2021, up from $64.3 million at 2020-end. Long-term debt decreased to $45.1 million at the end of fourth-quarter 2021 from $45.7 million on Dec 30, 2020. Amid supply chain snarls and the recent volatility in fuel prices, WPRT has refrained from providing any quantitative guidance for 2022 sales or earnings.

LKQ

inked a deal to divest the PGW Auto Glass (“PGW”) business to One Equity Partners. PGW is a distributor of aftermarket glass to the auto industry in North America. The business added $400 million to LKQ’s 2021 annual revenues and generated an EBITDA margin of 10%.

The financial terms of the deal are still kept under wraps. Subject to satisfactory closing conditions and regulatory approvals, the deal is scheduled for completion during second-quarter 2022. LKQ’s strategic acquisitions and divestment of non-core businesses are boosting its prospects.

Sonic

opened a new EchoPark store in Johnson City, TN. This marks the auto retailer’s fourth store in Tennessee. In December 2021, SAH opened a store in Chattanooga. The other two EchoPark stores in Tennessee are located in Nashville and Knoxville.

The latest store in Johnson City brings the total EchoPark store count to 36. This excludes the 11 Northwest Motorsport pre-owned vehicle stores acquired through the RFJ Auto Partners buyout in December 2021. The EchoPark brand reached more than 30% of the U.S. population at 2021-end and aims for 90% U.S. population coverage by 2025. Sonic currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

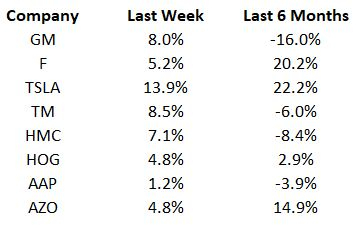

Price Performance

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on February commercial vehicle registrations to be released by the ACEA this week. Also, stay tuned for how automakers make changes in operations in the light of increasing supply chain snarls amid geopolitical conflict and rising coronavirus cases. Watch out for usual news releases and updates from the auto industry.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report