Avantor, Inc.

AVTR

recently opened a new single-use logistics hub in Westminster, MA, to help bolster the company’s global biopharma supply chain. The new facility, situated near the company’s manufacturing site in Devens, acts as a center for raw material storage, quality control and distribution.

The novel Westminster facility simplifies Avantor’s supply chain to support the double-digit growth of single-use solutions. Interestingly, this site is the company’s sixth location in the United States, intended to support single-use solutions. It is worth noting that Avantor has single-use sites in California, Illinois, Massachusetts, New Jersey and North Carolina.

More on the News

Avantor has made significant investments in its single-use capabilities during 2021 to meet the rising global demand for single-use equipment and dependable supply. The acquisitions of RIM Bio and Masterflex were amongst the notable strategic investments.

Image Source: Zacks Investment Research

Per Avantor management, the company’s single-use business delivers design and manufacturing support for their customers’ bioproduction processes to help them bring new therapies to market. The newly-opened Westminster site offers distribution and logistics management, while allowing Avantor to better utilize its existing North American sites, resulting in enhanced reliability and efficiencies for customers.

Industry Prospects

Per a report

published in Mordor Intelligence, the biopharmaceutical logistics market is expected to see a CAGR of 8% during 2016-2026. Factors such as the growing trade of conventional and over-the-counter drugs owing to the COVID-19 pandemic and a surge in demand for cellular therapies, vaccines, and blood products in the biopharmaceutical industry are driving the market.

Given the market prospects, Avantor’s new single-use logistics hub in Westminster seems strategic.

Notable Developments

In November 2021, Avantor closed its previously announced buyout of Antylia Scientific’s Masterflex bioprocessing business and related assets (collectively “Masterflex”). This buyout fortifies Avantor’s offering across all bioproduction platforms, including monoclonal antibodies, cell and gene therapy and mRNA. The Masterflex acquisition also supports both therapy and vaccine manufacturing, including COVID-19.

In October 2021, the company built a new single-use facility in Hillegom, Netherlands — the company’s second single-use location in Europe after its Tilburg site. This site is a significant addition to Avantor’s overall cleanroom capacity in the region, servicing both regional and global customers. The Hillegom facility allows the company to manufacture, package and deliver single-use solutions that provide support to each stage of biologics manufacturing.

Share Price Performance

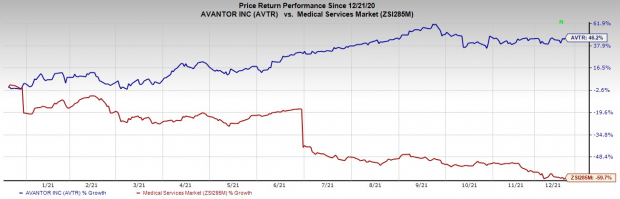

The stock has outperformed its

industry

over the past year. It has gained 46.2% compared with the industry’s 59.7% fall.

Zacks Rank and Key Picks

Currently, Avantor carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are

Apollo Endosurgery, Inc.

APEN

,

Varex Imaging Corporation

VREX

and

Thermo Fisher Scientific Inc.

TMO

, each sporting a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apollo Endosurgery has a long-term earnings growth rate of 7%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed its industry over the past year. APEN has gained 131.2% versus the 7.7% industry growth.

Varex has a long-term earnings growth rate of 5%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 115.3%.

Varex has outperformed the industry it belongs to in the past year. VREX has gained 79.4% versus the industry’s 6.2% fall.

Thermo Fisher has a long-term earnings growth rate of 14%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 9%.

Thermo Fisher has outperformed its industry over the past year. TMO has rallied 40.7% versus the industry’s 7.7% rise.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report